Looking Ahead – A Lack of Discipline

Take it from us, Wall Street is not the only place where complacency can set in during a big rally in the S&P 500. US equities can seem to policymakers like a tick-by-tick opinion poll, particularly at a time like this when the fiscal and monetary might of the government is playing such a central role in driving risk asset prices. Plus, the Trump administration has more expressly tethered their fortunes to the stock market than any other in recent memory and under that formulation, buoyant equity prices can easily be taken as a validation of whatever policy prescriptions are currently being administered.

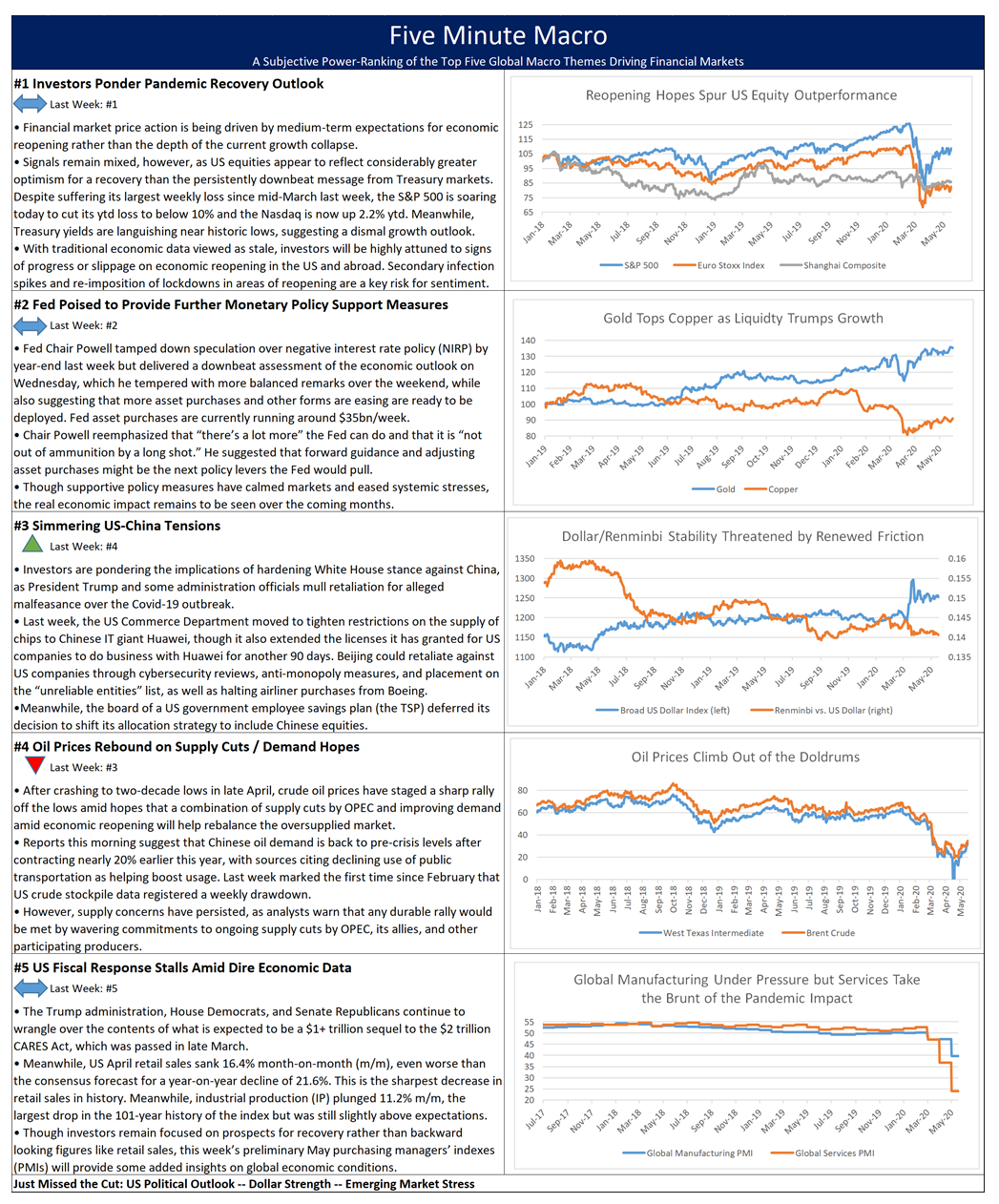

In short, policymakers can easily read too much into a stock market rally, as equities are a fickle friend. Though the S&P 500 might appear to “like” accelerated efforts to reopen segments of the US economy, that does not mean that it would not turn on a dime and head southward again if infection rates shoot up, threatening a re-imposition of lockdowns. The staunchest defender of the efficient market hypothesis still cannot claim that stocks are a crystal ball.

Even if policymakers take price action with the appropriate grain of salt, it remains the case that rising US stocks inevitably drain some of the urgency out of the proceedings in Washington DC. Market price action, particularly high profile, headline grabbing, 401K bashing stock market declines, can be very effective at focusing the minds of Congress, the Federal Reserve, and the administration on attempting to address the problems at hand. When a warning siren is blaring on Wall Street with equities in freefall, officials scurry around trying to figure how to silence it. Now, the S&P 500 is not even down 10% year-to-date and the Nasdaq is already back in positive territory for the year, so if stocks are telling everyone the coast is clear, why do we need another $1 trillion plus stimulus package?

A former Treasury official once recounted a story – during one of the later repetitions of the tedious debt ceiling showdowns, Wall Street had completely tuned out and stocks were rallying steadily even as Tea Party rabble rousers threatened a sovereign US default. A concerned member of Congress asked why stocks were so upbeat in the face of this significant threat, and the Treasury official explained that investors had seen this movie before a few times and figured they knew how it would end. The response was “don’t investors know that the less they worry about a debt ceiling accident, the more likely it becomes?” In other words, without the market performing a disciplinary function, policymakers are more apt to misbehave.

There seems to be a similar dynamic developing with regard to the next version of a pandemic relief bill (the latest CARES Act sequel). One of the key pillars of the turnaround in market sentiment is the massive fiscal response from Congress, but the very existence of the rally makes additional follow-through on the fiscal response less likely. Without conspicuous stock market losses to hold Congress’ collective feet to the fire, the less likely anything further gets done. The partisan armistice that was achieved during the torrid weeks of March and April looks like it may not hold as the House Democrats, Senate Republicans, and Trump administration officials head back to their entrenched positions and prepare for battle over policy turf while unemployment is at Depression levels. Earlier today, National Economic Council Director Kudlow said that negotiations are officially on pause for this month.

For policymakers looking for a more accurate market-based gauge of economic expectations, we would suggest focusing on the prescient Treasury market, which is signaling deep and persistent US economic doldrums, rather than on flighty and emotional equities, which are notorious for overshooting at inopportune times.

Looking ahead to next week, market participants will attempt to look past more horrendous economic data amid an overriding focus on the prospects for recovery.

- US Retail Sales, Industrial Production & Consumer Confidence

- US Initial Jobless Claims

- China’s April Economic Readings

- UK Q1 GDP

Global Economic Calendar

Monday

The week begins in Australia with the National Australia Bank’s Business Confidence Index. In March the index crashed to a record low of -66 from -4 in February. The index of business conditions plummeted to -21 from 0 the prior month, dragged down by sharp declines in sales, profits and employment. April is expected to be -70.

Tuesday

Tuesday’s focus will be on the Consumer Price Index for April. In March Headline CPI fell 0.4% m/m to 1.5% y/y. This is the lowest level since February 2019 and the largest monthly drop since January 2015, driven by a 10.2% slump in gasoline and a 1.6% drop in apparel prices. Core CPI, which excludes the more volatile food and energy components, fell 0,1% m/m putting it up 2.1% y/y but below market consensus of a 2.3% advance. March marked the first monthly drop in Core CPI’s since January 2010.

In Australia on Tuesday the focus will be on the Melbourne Institute and Westpac Bank Consumer Sentiment Index. In April the index fell 17.7% to 75.6, the biggest monthly fall in survey history, taking the index to its lowest level since February 1991. Outlook on Economic conditions for the next 12 months dropped 31% to 53.7 points, the lowest since the Financial Crisis, and conditions for the next 5 years fell 3.8% to 87. In addition, time to buy a major household item tumbled 31.6 % to the lowest on record of 76.2.

Wednesday

Wednesday brings the first estimate of First Quarter GDP in Great Britain. 4Q19 GDP was flat as household consumption was unchanged, marking the first period that it has not increased since the 4Q15, while gross fixed capital formation dropped the most in nearly two years, led by a contraction in business investment. Meanwhile, government consumption rebounded firmly, driven by education and health, and net trade contributed positively to the GDP as exports rose more than imports. On the production side, services activity grew at a softer pace, while production output fell due to declines in manufacturing, and mining and quarrying. In addition, construction output dropped into contraction territory. Expectations are for a 2% contraction in the first quarter as the UK implemented a lockdown to battle the virus.

In the US we will see Producer Price Index (PPI) for April. In March PPI fell 0.2% m/m but increased 0.7% y/y, after declining 0.6% m/m but increasing 1.3% y/y in February. March PPI was the lowest level since September 2016. Cost of goods fell 1%, mainly due to a 6.7% drop in energy costs. In contrast, prices of services increased 0.2%, mainly due to an 8.1% rise in margins for apparel, jewelry, footwear, and accessories retailing. Core PPI came in 0.2% m/m higher, after falling 0.3% in February, and above forecasts of a flat reading.

Wednesday also features the Australian Employment Report for April. In March the Australian economy added 5,900 jobs to 13,017,600, following a 25,600 gain in the previous month and easily beating market forecasts of a 40,000 fall. Australia’s seasonally adjusted unemployment rate edged up to 5.2% in March from 5.1% in February but less than market expectations of 5.5%. The number of unemployed people rose by 20,300 to 718,600. By the end of this quarter, the Employment Change in Australia is expected to be a loss of 65,000 persons and the Unemployment Rate in Australia is expected to be 9.00%.

Thursday

Thursday brings a host of data on the Chinese economy starting with Industrial Production for April. March production dropped by 1.1% y/y, after a 13.5% plunge in January-February, but far less dire than market expectations of a 7.3% fall. Output fell at a softer pace for both manufacturing and utilities, while a rebound was seen in mining.

We also will see Retail Sales for April. March sales declined 15.8% y/y in March, following a 20.5% slump in January-February, worse than market expectations of a 10% fall. Sales continued to decline for most categories, while sales rebounded for personal care, office supplies, and telecoms.

On Thursday in the US the focus will be on Initial Jobless Claims. Last week 3.169 mil Americans filled for initial unemployment benefits, compared to 3.846 mil in the prior week and above market expectations of 3.0 mil. Last week’s filings lifted the total reported since the beginning of the coronavirus crisis to 33.5 mil, equivalent to a 22% unemployment rate. The largest increases were seen in California, Texas, Georgia, and New York, while continuing jobless claims hit a new record of 22.647 mil. Tomorrow the BLS will release the April Employment Report where consensus expectations are for a loss of 22 mil jobs and a 20% unemployment rate.

Friday

Friday’s focus will be on US Retail Sales for April. March sales plunged 8.4% m/m and 5.8% y/y and was the largest monthly decline on record and the largest decline in trade since 2009. Excluding autos, retail sales fell 4.2% m/m. The biggest decreases were seen in clothing, furniture, restaurants & bars, motor vehicles & parts, sporting goods, hobby, musical instrument & books, and electronics & appliances. Receipts at gasoline stations also fell sharply as consumers cut back spending on fuel and as oil prices plunged. On the other hand, sales of food & beverages and health & personal care products rose.

We will also see Industrial Production for April. March production slumped 5.4% m/m and 5.5% y/y, the largest monthly drop since January 1946, and worse than market expectations of a 4% dive. Manufacturing output fell 6.3%, the most since February 1946. The declines were led by a 28.0% tumble in motor vehicles and parts output.

Finally, the week ends with the Michigan Consumer Expectations Index for May. In April the index fell to 71.8, the lowest reading since 2011. Surveys of Consumers chief economist, Richard Curtin stated that “In the weeks ahead, as several states reopen their economies, more information will reach consumers about how reopening could cause a resurgence in coronavirus infections. The necessity to reimpose restrictions could cause a deeper and more lasting pessimism across all consumers, even those in states that did not relax their restrictions.”