Summary and Price Action Rundown

Global risk assets are mostly lower this morning as investors continue to ponder the outlook for economic reopening and the next round of policy support measures while awaiting US consumer data and monitoring the latest developments on the US-China front. S&P 500 futures point to a 0.4% lower open, which would deepen this week’s 2.6% loss for the index that has taken year-to-date downside to 11.7% and the decline from February’s record high to 15.8%. Equities in the EU are higher this morning while Asian stocks were mixed overnight. Longer-dated Treasury yields continue to fluctuate near recent lows amid the cautious tone in markets, with the 10-year yield at 0.60%. Meanwhile, the dollar is edging higher within its recent trading range. Crude oil is holding gains after registering a new high for the month.

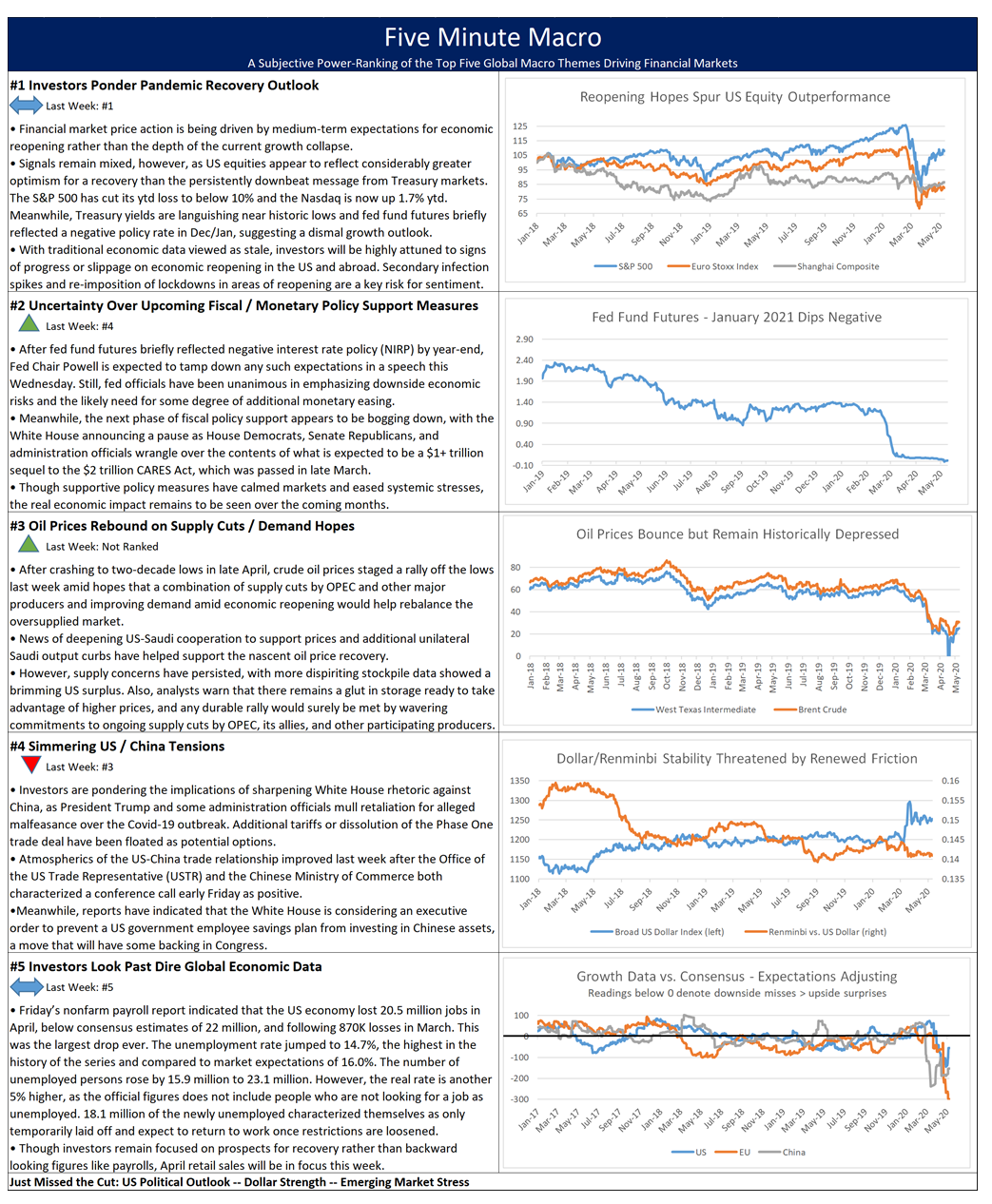

White House Pivoting on Fiscal Relief Efforts?

Though House Democrats, Senate Republicans, and the White House appeared to be deadlocked over the size and composition of the next round of pandemic relief spending, a report yesterday indicated the Trump administration’s willingness to seek a deal. The Washington Post reported around midday yesterday that the White House was softening its opposition to state aid, which features prominently in the latest draft pandemic relief act drafted by House Democrats, in hopes of securing tax cuts and corporate liability limitations. This comes after President Trump called the $3 trillion HEROES Act crafted by House Democrats “dead on arrival” earlier this week and Treasury Secretary Mnuchin echoed this sentiment, indicating that the administration is intent on pausing for “the next 30 days and think carefully.” For context, the draft bill features $1 trillion in support for states and municipalities, money for Covid-19 testing, direct payments to households of up to $6000, and surpasses the size of its predecessor, the $2.2 trillion CARES Act, which was signed into law in March.

US Consumer in the Spotlight

US retail sales for April will provide a degree of insight on the efficacy of government support payments, while Chinese economic data overnight suggested a choppy recovery. Although most traditional economic datapoints over the last few months have been considered stale by investors who are increasingly focused on the prospects for recovery rather than the depths of the current economic trough, April’s US retail sales figures have a greater likelihood of moving markets given the primacy of the US consumer to any global rebound scenario. Headline expectations are for a 12.0% month-on-month (m/m) contraction, deepening from -8.4% in March. A reading of May consumer sentiment follows later this morning. Last month’s industrial production is also forecast at -12.0% m/m after a 5.4% retrenchment in March. This follows yesterday’s latest jobless figures, which showed that 2.981 million Americans filled for unemployment benefits over the week ending May 9th, down from 3.176 million the prior week and the lowest level since the coronavirus crisis began. However, filings came in well above market expectations of 2.5 million and lifted the total reported to 36.5 million, equivalent to nearly a quarter of the working age population. Furthermore, continuing jobless claims hit a new record of 22.833 million in the week ending May 2nd.

Additional Themes

Mixed Chinese Data as Tensions with the US Percolate – Overnight, Chinese economic figures for April suggested an uneven and tepid recovery. While industrial production topped estimates at 3.9% year-on-year (y/y), rising from 1.1% y/y in March, retail sales undershot expectations at -7.5% y/y, though this still represents an improvement from the prior month’s -15.8% y/y. Fixed asset investment growth, on a year-to-date basis, roughly matched estimates at -10.3% y/y. This comes amid a week of rising friction between the US and China. This morning, headlines indicate US moves to block Chinese IT giant Huawei from using US software. Yesterday in an interview, President Trump indicated that he is focused on Chinese companies that are listed on the NYSE and Nasdaq but have not been subjected to US-standard accounting rules. This comes after the US government retirement savings fund, the Thrift Savings Plan (TSP), suspended their upcoming move that would have allocated a portion of its holding to Chinese stocks in proportion to the weightings of the MSCI All Country World Index.

Germany Faces Deepening Recession – Germany’s first quarter (Q1) GDP contracted 2.2%, in line with expectations, which was the steepest decline since Q1 2009. Q2 is forecast to register -10%. This comes a day after the Finance Ministry reported that Germany’s overall tax income for 2020 is expected to be €98.6 billion ($106 billion) lower than an estimate six months ago, the first drop since the global financial crisis. The estimates assume a 6.3% GDP contraction this year, with the country facing its deepest recession since World War II. With investors braced for downbeat news, the euro is stable near three-year lows versus the dollar and German bund yields continue to languish in negative territory.