Looking Ahead – Two Minute Drill

The NFL season began last evening with an entertaining if uneven Thursday Night Football game between the Texans and the Super Bowl champion Chiefs in a partly filled Arrowhead Stadium, which provided sports fans with another encouraging step toward a semblance of normalcy. It may not have been anything close to top form, with limited practices and no pre-season, but it was a pleasure to witness, and just getting the teams out on the field at this point seems like a victory in itself.

With the Washington Football Team tipped to win maybe five games this season, the DC denizens are probably more focused on this town’s other favorite contact sport – politics. And this was a bruising week, with Senate Majority Leader McConnell’s so-called “skinny” stimulus bill, weighing in at a featherweight $500 billion versus the Democrats’ hulking $3 trillion HEROES Act, getting sacked in a procedural vote before it ever made it to the Senate floor.

Now, Congress looks set to run out the clock until their pre-election recess with no points on the board for the latest round of pandemic stimulus. The only remaining play they have to run is punting the government funding issue until after the upcoming election with what is expected to be a clean Continuing Resolution (CR), in accordance with the commitment made by Speaker Pelosi and Treasury Secretary Mnuchin. Since the appetite to append spending measures to the CR appears to be low on both sides, pundits are increasingly despairing of any path to victory for a pandemic relief bill at least until polling is over and the presidential election is decided (hopefully not after months of recounts and lawsuits, but that is a distinct possibility). However, economists warn that the withdrawal of stimulus would be premature and damaging to the recovery, falling hardest on those least able to bear the added burden. Fed officials have been voluble and unanimous on the need for more fiscal support as well.

Congressional Republicans and Democrats are understandably at odds over the bill, but by allowing the White House to take the lead in negotiations, until recently, Senate Leader McConnell implied that he would probably be able to get enough of his caucus to go along with whatever they negotiated. But the White House pivoted away from the more deal-friendly approach of prior negotiations spearheaded by Treasury Secretary Mnuchin, inserting former Tea Partier and current White House Chief of Staff Meadows into the proceedings, which Capitol Hill insiders suggested was a signal of a much tougher line by the administration. And that is how the negotiation has played out, with each successive drive toward a deal bogging down, which ultimately brought the Senate Republicans back onto the field.

Now that the Senate Republicans’ skinny version has been batted down, the ball is firmly back in President Trump’s hands. But so far, the lack of action has left many questions as to his motivations with regard to this bill.

- Did he really begin to worry about the deficit? Unlikely, we think, as his past record and statements show great comfort with taking on debt, particularly at low interest rates.

- Does he think he needs to appeal to the fiscal conservative wing of the party to nail down their support in November? Doubtful, it seems – deficit reduction is not currently a big swing voter issue nor a prominent feature of his policy platform now or ever.

- Is he concerned that agreeing to a large pandemic stimulus bill now will undermine his claim that Covid-19 is basically a thing of the past? Possibly, but President Trump has not often been constrained by a need for exact logical consistency in his policy choices.

- Is he worried about appearing to cave to the Democrats? Probably, but is this genuinely a deal breaker? It would not be the first time he has done so, and in the other cases he has just spun it as a victory and moved on.

- Could he be convinced that more pandemic relief is not economically necessary? Of course President Trump is going to laud the economic rebound as the greatest thing ever, but we assume that the White House is well aware of the fragile and tentative nature of the recovery, even if they are encouraged by progress so far.

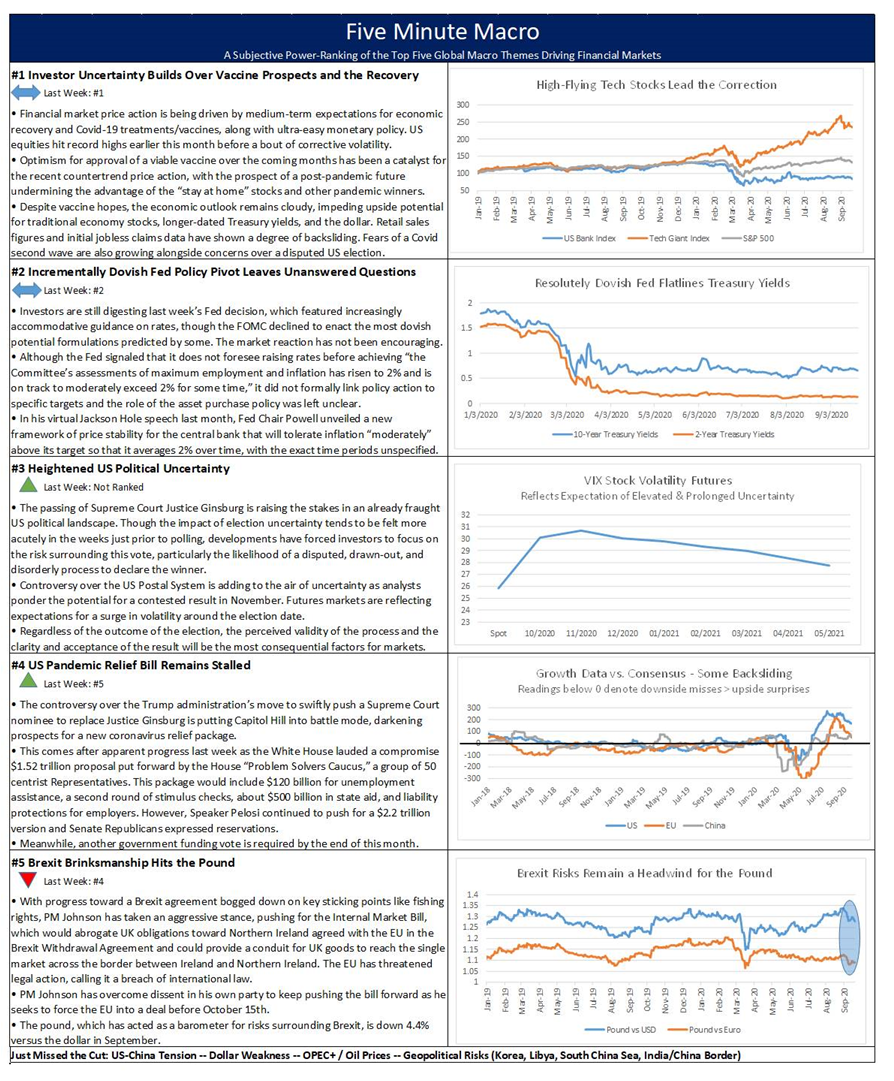

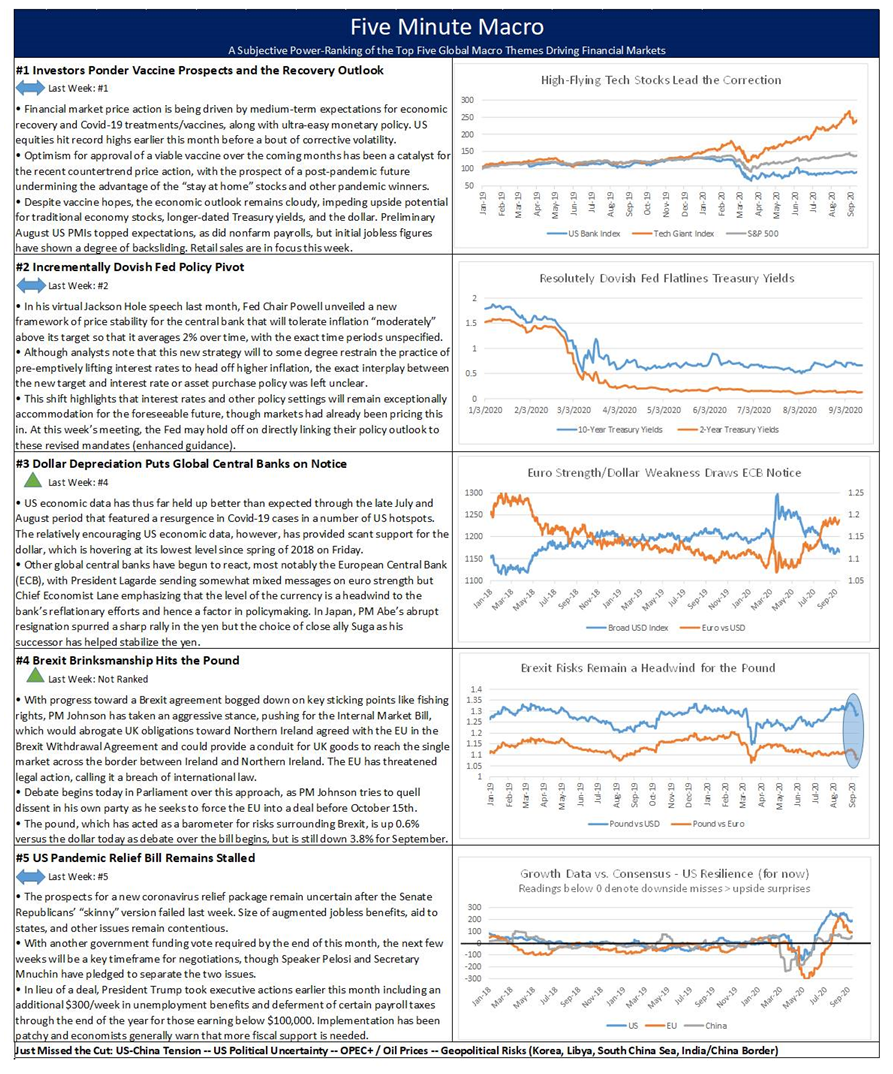

In fact, most standard US economic readings for the past few months have looked pretty solid and consistent with ongoing recovery, but there is a significant degree of noise in the data, the pace of improvement seems to be softening, and now fiscal support is being withdrawn. Notably, the headline figures for the most recent labor market data series have been better than expected, but the underlying details have shown clear signs of backsliding. Meanwhile, Fed officials continue to fret that high-frequency economic data shows growth leveling off.

Weighing the considerations above, and looking at the waning time on the clock, it seems like the right call for the White House is to put its hurry-up offense on the field for this negotiation. Mnuchin would be back under center (and Meadows on the bench), wrangling with Congressional Democrats and dragging enough Senate Republicans along to get a not-quite $2 trillion stimulus package across the goal line in time for relief checks to be rolling out to Americans in need during the height of campaign season. And the crowd goes wild.

Or the Trump administration can just take a knee on this pandemic relief bill and head to the locker room, adding another one to the Loss column when they, and the country, can perhaps least afford it.

Looking ahead, next week’s calendar features a Fed meeting, as well as decisions from the Bank of England and Bank of Japan. Japan’s ruling party will also vote on the successor to outgoing Prime Minister Abe. US retail sales and industrial production data for August will be in the spotlight, alongside another weekly initial jobless claims tally, while China and the EU will also be issuing key industrial and consumer data for last month.

- Federal Reserve Meeting

- Bank of England

- Bank of Japan

- US Retail Sales, Industrial Production, & Initial Jobless Claims

- Chinese Data for August

- EU Data for August

Global Economic Calendar: Back to school

Monday

The week begins Monday with Japan’s Industrial Production Final Estimate and Capacity Utilization for July. Industrial production in Japan rose by 8% month-on-month (m/m) in July, compared with market consensus of a 5.8% advance and after a 1.9% gain in June, a preliminary estimate showed. This was the strongest monthly rise on record in industrial output, largely contributed by motor vehicles. On a yearly basis (y/y), industrial output shrank by 16.1% in July, after a 18.2% plunge in June. Capacity Utilization in Japan increased to 75 points in June from the 10-year low of 70.60 points in May.

On Monday in Europe we’ll get the Euro Area Industrial Production for July. Industrial Production in the Euro Area increased 9.1% m/m in June, still a decrease of 12.30% y/y, missing market expectations for a second consecutive month and easing from a revised 12.3% m/m jump in May. Output increased for all segments: durable consumer goods (20.2% vs 53.7% in May); capital goods (14.2% vs 26.0%); intermediate goods (6.7% vs 9.7%); non-durable consumer goods (4.8% vs 3.3%); and energy (2.6% vs 3.0%).

Monday wraps with a Chinese focus, specifically, China’s Fixed Asset Investment, Industrial Production, Retail Sales, and Unemployment changes in the month of August. China’s fixed-asset investment dropped 1.6% y/y to CNY 32.92 trillion in the first seven months of, compared to a 3.1% fall in January-June and in line with market consensus, after the economy began to open up and authorities loosened coronavirus-related restriction measures. Private investment decreased 5.7% (vs -7.3% in January-June) while public investment rose at a faster 3.8% (vs 2.1%). Next, China’s Industrial Production Growth stood at 4.8% y/y in July, short of market expectations of 5.1%. Manufacturing and utilities output continued to increase, while mining fell back into contraction territory. For the first seven months of the year, output shrank 0.4%. China’s Retail Trade declined by 1.1% y/y, missing market expectations of a 0.1% rise. This was the seventh straight month of contraction in retail trade, with people continuing to avoid crowded places, including shops, restaurants, and cinemas amid the COVID-19 crisis. From the January to July period, retail trade tumbled 9.9%. Finally, the Unemployment Rate in China remained unchanged at 5.70% in July.