Summary and Price Action Rundown

Global risk assets are continuing their recent downtrend this morning, as investors cite concerns over a Covid-19 resurgence and deepening US political frictions among the headwinds on sentiment. S&P 500 futures point to a 1.6% lower open after the index slid 1.1% on Friday, paring its year-to-date gain to 2.8%, which is over 7% below early September’s record high. The tech-heavy Nasdaq is set to decline over 1% for a fourth consecutive session today, which would cut its robust year-to-date gains to below 20%. Equities in the EU are underperforming amid uncertainty over central bank policy (more below) and Asian stocks declined as well overnight. A broad dollar index is finding support from safe haven demand near its recent 28-month low, while longer-dated Treasury yields are moving lower, with the 10-year yield at 0.66%. Brent crude prices are sinking back below $43 per barrel.

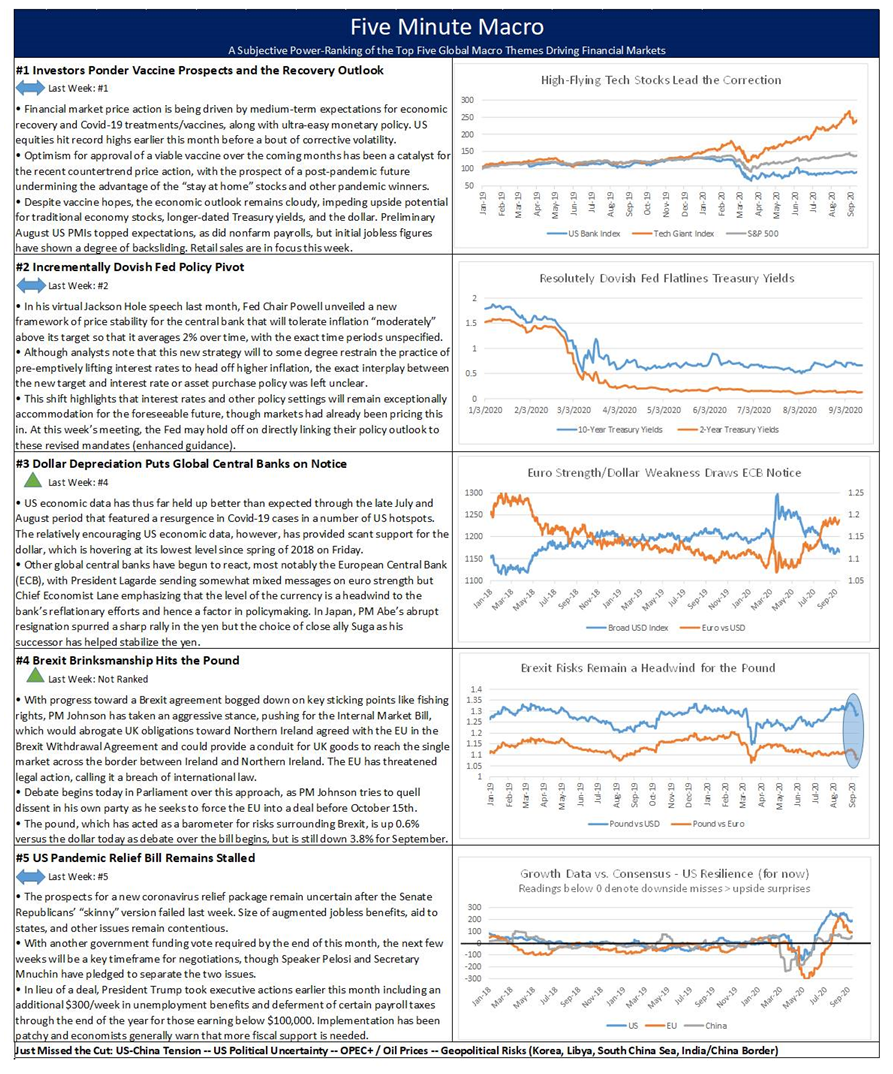

Equity Selloff Deepens

The return of elevated stock market volatility after a placid summer of seemingly inexorable upside is being attributed to an array of catalysts rather than a single trigger. US stocks are set to extend their recent downside, which is taking them roughly 10% below the recent peaks, a magnitude of decline that fits the classic definition of a correction. High-flying tech stocks, which had been among the winners of the pandemic, are leading the declines but nevertheless generally retain significant year-to-date gains. Analysts have generally characterized this correction as healthy and overdue following the gaudy gains over the past few months, though more fundamental downside catalysts are also in play. First, the upside of the “stay-at-home” stocks is challenged by the potential for a vaccine announcement over the coming months, which might serve to undermine their advantage. But the rotational dynamic by which investors might reallocate their investments from the over-extended tech and other pandemic winners into more traditional economy sectors, like banks and industrials, is being impeded by concerns about the growth outlook. With the risk of a Covid-19 resurgence in the fall coming into focus, highlighted by the accelerating second wave outbreaks in the EU and UK, doubts about the sustainability of the uneven economic recovery are deepening. Recent US economic data has been muddled, with weekly jobless remaining elevated and retail sales showing signs of backsliding, and the next round of US fiscal stimulus remains deadlocked on Capitol Hill. With the death of Supreme Court Justice Ginsburg deepening the partisan rancor and further raising the stakes in an already fraught political environment, prospects for a deal on the pandemic relief bill have fallen and the odds of a disorderly and drawn-out election outcome have risen.

Central Banks in the Spotlight

The People’s Bank of China held its key policy rate steady, while the European Central Bank announces a review of its pandemic asset purchase program. As expected, the People’s Bank of China (PBoC) held its benchmark interest rates steady for the fifth straight month, amid signs that the economy is recovering from the pandemic shutdown. Specifically, the one-year loan prime rate (LPR) was left unchanged at 3.85% while the five-year remained at 4.65%. For context, the PBoC has maintained a relatively conservative monetary policy approach throughout the Covid-19 crisis and encouraging economic data, including an acceleration in previously lagging retail sales in August, suggests that it will remain in wait-and-see mode. The currency has responded to the widening divergence between steady monetary conditions in China and increasingly accommodative Fed policy. The renminbi has gained 5.7% versus the dollar since late May and is at its strongest level in roughly two and a half years. Meanwhile, the European Central Bank (ECB) has announced that it will be reviewing its Pandemic Emergency Purchase Program (PEPP). This follows some mixed messages from ECB officials regarding the €1.35 trillion program amid internal debate over the degree to which the program should be skewed in favor of countries like Italy with weaker sovereign creditworthiness and more significant impact from the pandemic, and whether the full €1.35 trillion should be deployed. EU stocks are selling off sharply while peripheral EU bonds are underperforming only slightly, while the euro is retreating 0.5% versus the dollar.

Additional Themes

Trump OK’s TikTok Deal – Over the weekend, President Trump announced that he had approved the Oracle deal with TikTok in concept and asserted that Oracle and Walmart, its junior partner in the deal, would be in total control of the new entity despite ownership stakes of 12.5% and 7.5%, respectively. ByteDance, the Chinese owner of TikTok, disputed President Trump’s characterization of corporate control, emphasizing its full control of the algorithms and continued majority stake, while describing the $5 billion payment as an advance tax payment rather than a deal fee to the US government. The Commerce Department deferred its threatened ban on the app. Meanwhile, the ban on Chinese social media app WeChat was put on hold by a federal judge over the weekend.

Trade Data Perks Up – South Korean export data for the first 20 days of September is showing a continued rebound, expanding 3.6% year-on-year (y/y) versus -7.0% for August. Meanwhile, Taiwan export orders outpaced expectations at 13.6% y/y, topping July’s 12.4% reading. Investors await this week’s releases of preliminary global purchasing managers’ indexes (PMIs) for September for further insights on the state of the global economic recovery.