Looking Ahead – Do You Like Surprises?

This year has featured a jarring array of unexpected events, most of them decidedly unpleasant, and market participants are bracing for more to come. To borrow Donald Rumsfeld’s now-famous formulation, “unknown unknowns” are, by definition, impossible to predict, though nobody seems to be ruling anything out at this point given what 2020 has already thrown at us. Meanwhile, the “known unknowns” are certainly still capable of producing significant shocks.

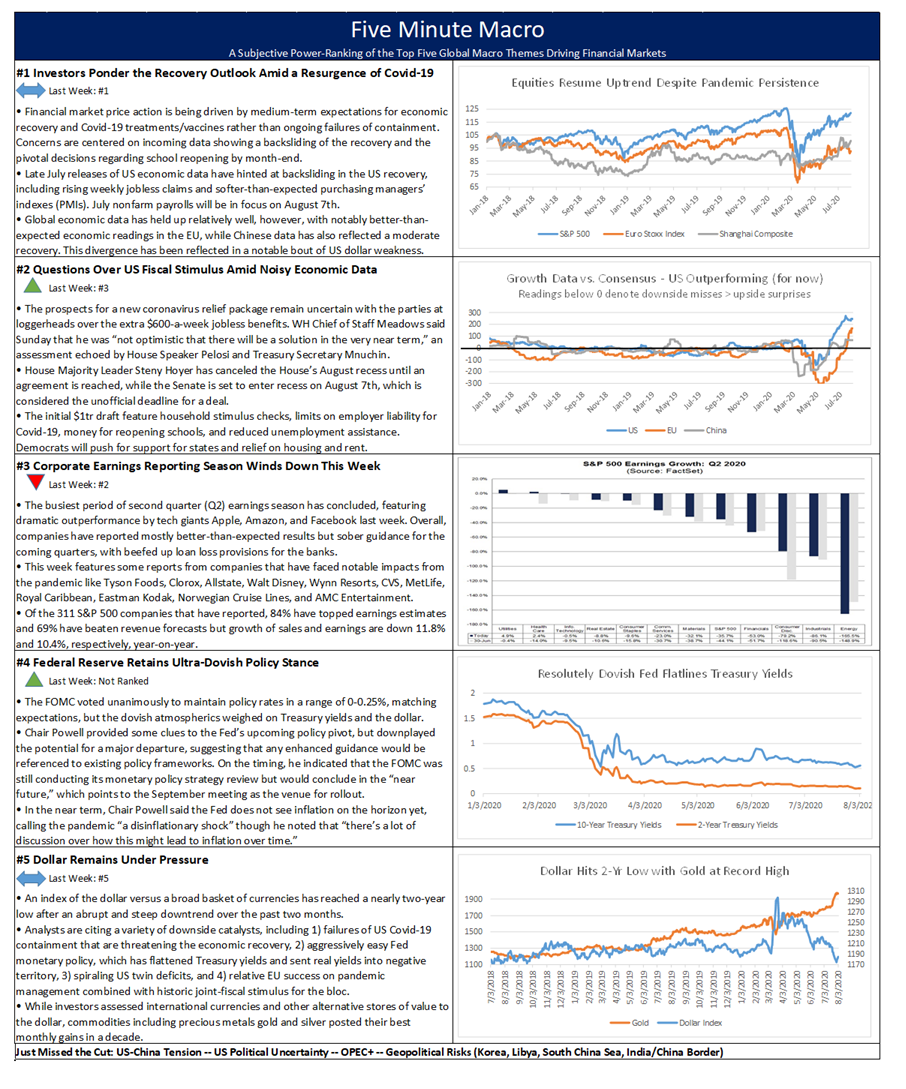

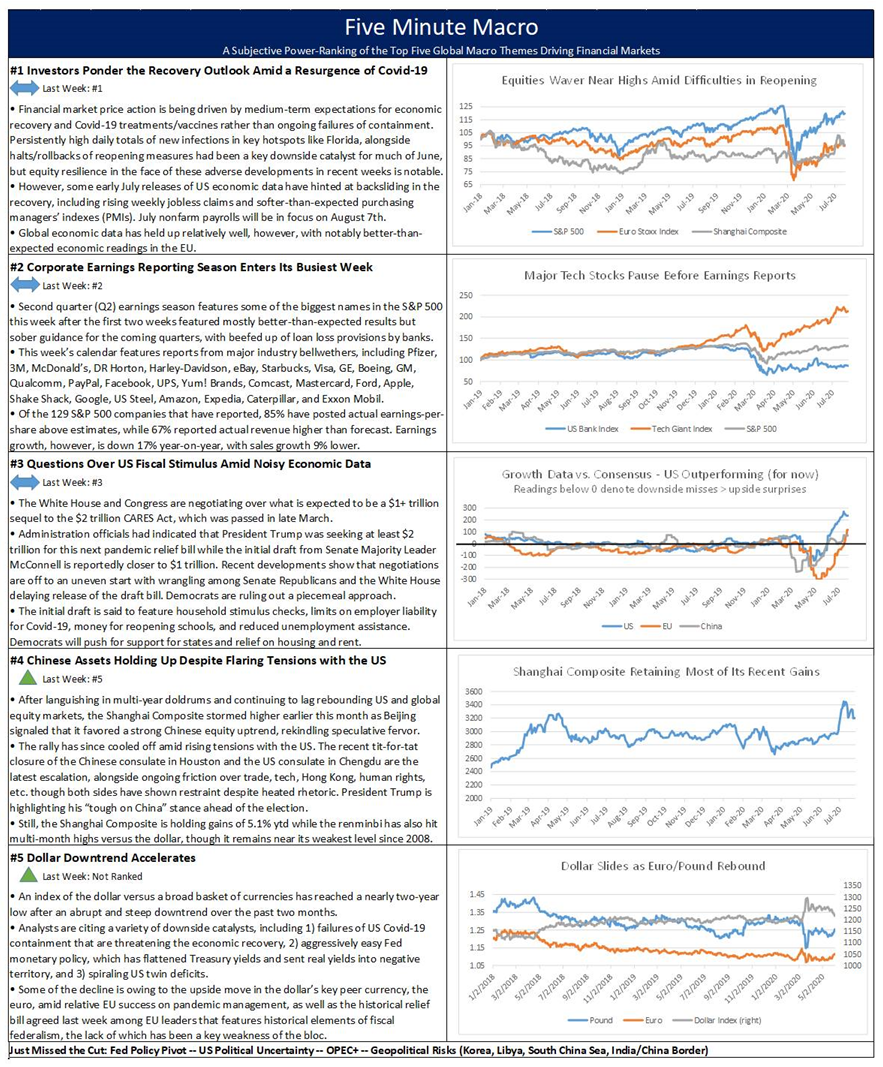

Corporate reporting for the second quarter was almost certain to produce surprises both the upside and downside given the dearth of management guidance due to impenetrable Covid-19 uncertainties. Although earnings season is still in its early stages, surprises have indeed been the norm, as US megabanks blew estimates out of the water on the trading and investment bank side, but also exceeded the expected levels of credit provisioning, highlighting downside risks to the economic outlook. This wide dispersion around estimates is expected to continue with next week’s dense calendar of earnings announcements.

Questions still surround the two high-profile fiscal packages that are in the process of being negotiated in the US and EU, with both generally expected to be finalized by the rapidly approaching month-end. The wrangling is expected to be intense on both of these pandemic relief bills, but the expectation is for eventual compromise and agreement on a significant figure for each that is capable of providing real support to both economies. The predominant risk in the EU negotiation is for disappointment if the so-called Frugal Four countries (Netherlands, Denmark, Sweden, and Austria) refuse to compromise. In the US, there is upside and downside potential for the bill given the propensity for recent budget negotiations to expand the pie rather than make tough decisions, but there is certainly a meaningful risk of disappointment as well as the House Democrats, Senate Republicans, and Trump administration are finding less common ground than in the case of the CARES Act.

The Federal Reserve is working hard not to surprise the markets, with a veritable barrage of communications on a seemingly daily basis, but investor nonetheless remain wary of anticipated details of what seems to be an impending policy pivot. The constant din of fed speakers is not entirely unanimous but appears to be pointing broadly toward a shift in favor of enhanced forward guidance, predicated upon their traditional inflation target of 2%. It does seem unlikely, particularly ahead of an election when major monetary policy making tends to be inauspicious, that the Fed would make any sudden moves to startle investors, such as unexpectedly instituting yield curve control or taking interest rates into negative territory.

Last year featured a steady diet of nasty surprises on the US-China front, but ultimately with the Phase One trade deal being signed early this year, expectations for a tense equilibrium have settled in. Recent Trump administration actions to counter China on the tech and investment fronts, as well as retaliation for Beijing’s posture toward Hong Kong and repression in western China, have increased the degree of uncertainty among market participants regarding this key relationship. Speculation over a major White House policy escalation against China tend to be linked to the belief that President Trump may have to pull a spectacular October surprise in order to close the polling gap between himself and Joe Biden.

Polling data has been likened to intellectual junk food – quick and easy to digest, sometimes quite tasty, but ultimately unsatisfying and genuinely bad for you if you consume too much. Skepticism over the validity of political polls has increases significantly due to its notoriously spotty track record in recent years, with high-profile misfires over Brexit and the US election in 2016. On its face, President Trump’s current deficit to Joe Biden looks substantial enough to subsume any statistical oddities, but market participants are well aware that polls in swing states, which will decide the outcome, look meaningfully closer. They also note that Trump voters are thought to be quite shy with pollsters about their intentions, and that races traditionally tighten into the actual election day, which is still an eternity away in from a political standpoint. In short, this race is far from over.

Still, an October surprise by President Trump is seen as highly likely and the most common areas of speculation tend to be, as mentioned above, some kind of anti-China policy barrage, with some even floating the potential for outright geostrategic confrontation. More likely, we believe, is that Trump’s major moves in the fall designed to tip the political scales will be more targeted at Joe Biden in terms of alleged dirt or announced investigations. Unlike an offensive against China, this sort of approach has less likelihood of major market blowback.

Looking ahead to next week, the economic calendar is relatively light, with global PMIs for July featuring prominently, as Q2 earnings reporting season rolls on.

- Corporate Earnings Reports

- Global Purchasing Managers’ Indexes

- China Central Bank

- US Initial Jobless Claims & Housing Data

US Second Quarter Corporate Earnings:

Next week is dominated by ongoing US corporate earnings reporting, with the calendar featuring results from IBM, Halliburton, Coca-Cola, Lockheed Martin, Snap, Capital One, KeyCorp, Northern Trust, CSX, Tesla, Microsoft, Southwest Airlines, AT&T, Twitter, American Airlines, Honeywell, Verizon, Schlumberger, Royal Caribbean, and Intel.

Global Economic Calendar: Summer lull

Sunday

This upcoming weekend starts the weekend with the Loan Prime Rate Decision in China. The People’s Bank of China held its benchmark interest rates steady for the second straight month at its June fixing after the central bank maintained borrowing costs on medium-term loans last week, as policymakers adopted a wait-and-see approach amid tentative signs of economic recovery. The one-year loan prime rate was left unchanged at 3.85% from the previous monthly fixing while the five-year remained at 4.65%.

Monday

The focus on Monday will be Japanese Inflation Rate for June, which comes out after markets close that day. Japan’s consumer price inflation stood at a three-year low of 0.1% year-on-year (y/y) (flat, month-on-month (m/m)) in May, in line with market estimates, as the pandemic continued to hamper consumption. Prices fell further for transport & communication (-1.7% versus -1.2% in April), amid slumping oil prices. In contrast, inflation edged up for housing (0.8% vs 0.7%) while it remained unchanged for medical care (at 0.5%); clothing & footwear (at 1.4%) and food (at 2.1%). Core consumer prices, which exclude food and energy, dropped 0.2% y/y (the same pace as in April) and compared with market consensus of a 0.1% drop.

Tuesday

Tuesday morning, the focus will be on the Chicago Fed National Activity Index for June. The index rose to a record high of 2.61 in May from a downwardly revised record low of -17.89 in April as some lockdown restrictions caused by COVID-19 epidemic were lifted. All four sub-indexes made positive contributions in May with production and employment-related indicators leading the gains.

In the evening, Japanese manufacturing for this month will be the focus. The AU Jibun Bank Japan Manufacturing PMI was revised higher to 40.1 in June from a flash reading of 37.8, amid the prolonged impact of the COVID-19 pandemic on activity. The latest reading signaled a 14th consecutive month of contraction as new orders, output, employment and purchasing activity continued to fall at sharp rates. On the price front, selling prices dropped as businesses strived to stimulate sales, while input cost rose following a decline in May. On the other hand, sentiment jumped back into positive territory for the first time since February. Meanwhile, the Services PMI was revised higher to 45.0 compared to May’s 26.5. It was the highest reading since February as restrictions lifted.

Wednesday

The priority Wednesday will be the number of US Existing Home Sales last month. Sales of previously owned houses in the US dropped 9.7% m/m (26.6% y/y) from the previous month to a seasonally adjusted annual rate of 3.91 million units in May, below market expectations of 4.12 million. It is the lowest reading since 2010 and the steepest annual drop in nearly forty years. Declines were seen in all regions, although the Northeast experienced the greatest drop. The median existing-home price for all housing types in May was $284,600, up 2.3% from May 2019 ($278,200).

Thursday

Early Thursday morning we’ll get a look at consumer confidence in Germany. The GfK Consumer Sentiment indicator for Germany rose to -9.6 heading into July from an upwardly revised -18.6 in the previous month and compared with market consensus -12.0. Both economic and income expectations improved, as well as propensity to buy, following the gradual lifting of restrictions imposed to contain the coronavirus. The gauge for business cycle expectations jumped 18.9 points to 8.5, the highest reading since January 2019 and far above its long-term average of zero.

Just before markets open, Initial Jobless Claims will be released. The number of Americans filling for unemployment benefits stood at 1.30 million in the week ended July 11th, little-changed from a revised 1.31 million claims in the prior week and above market expectations of 1.25 million. This was the smallest week-on-week decline since claims started to fall after peaking in March. The latest number lifted the total reported since March 21st to 51.3 million.

Shortly after, we will get a look at Consumer Confidence in the Eurozone. The consumer confidence indicator in the Eurozone was confirmed at -14.7 in June, compared with May’s -18.8, on the back of households’ much improved expectations in respect of their financial situation, their intentions to make major purchases and, particularly, the general economic situation. Same as in May, households’ assessments of their past financial situation deteriorated, but on a much smaller scale.

Friday

Friday starts with several Markit PMI datapoints, beginning with the Eurozone. The IHS Markit Eurozone Composite PMI was revised higher to 48.5 in June from a preliminary estimate of 47.5 and compared to 31.9 in May. The reading pointed to the softer contraction in private sector activity in four months, as restrictions related to the coronavirus pandemic eased. Both manufacturing output (PMI at 47.4 vs 39.4 in May) and services activities (48.3 vs 30.5 in May) shrank at the weakest pace in four months. Though the Manufacturing PMI was revised higher to a four-month high, the latest survey suggested the Eurozone manufacturing sector remained in contraction territory for the past 17 months. Output and new orders declined at a softer pace as more businesses restarted operations following weeks of closure due to the coronavirus pandemic. Backlogs of work outstanding fell for a twenty-second successive month and employment dropped for a fourteenth month in a row. Purchasing activity also remained depressed. On the price front, both input costs and output charges continued to decline. Finally, confidence about production in the year ahead returned to positive territory and services optimism hit a four-month high during June.

Not long after the Eurozone, we will get Markit PMI for the United Kingdom. The IHS Markit/CIPS UK Composite PMI came in at 47.7 in June, little-changed from a preliminary estimate of 47.6 and compared to the previous month’s 30.0. Manufacturing production rebounded 9.4 points to 50.1 and service activity contracted at a softer pace, 47.1 compared to the previous month’s 29.0, in June as the economy reopened following months of disruption caused by the coronavirus pandemic. Manufacturing production rose slightly for the first time in four months, while new order intakes and employment fell at softer rates. On the price front, input costs rose the most in a year, although at mild pace, while output charges also increased. Looking ahead, business sentiment rose to a 21-month high in June due to clients reopening, an expected further loosening of COVID-19 restrictions and hopes that markets would revive at home and overseas to help recover growth lost during the pandemic.

Coming back to an American focus, lastly, we’ll get US Markit PMI. The IHS Markit US Composite PMI was revised higher to 47.9 in June from a preliminary estimate of 46.8 and compared to the previous month’s 37.0. Much softer rates of contraction were reported across the manufacturing and service sectors as the economy began to reopen following the coronavirus-related restrictions. New order inflows stabilized, and employment fell at softer pace, while excess capacity remained as backlogs of work continued to decline. On the price front, cost burdens were up for the first time since February, with private sector firms partly passing on higher costs to clients. Finally, companies expressed optimism towards the outlook for output over the coming year for the first time since March.

Next week, our interest concludes with New Home Sales in the United States. Sales of new single-family homes in the United States jumped 16.6% m/m (12.7% y/y) to an annualized rate of 676 thousand in May, beating forecasts of a 2.9% rise. However, data for April was revised sharply lower to 580 thousand from 623 thousand. Still, May’s figure is the highest in three months. There were 318,000 new homes on the market, down 2.2% from April. At May’s sales pace it would take 5.6 months to clear the supply of houses on the market. The median new house price rose $5,200 from a year ago to $317,900.