Summary and Price Action Rundown

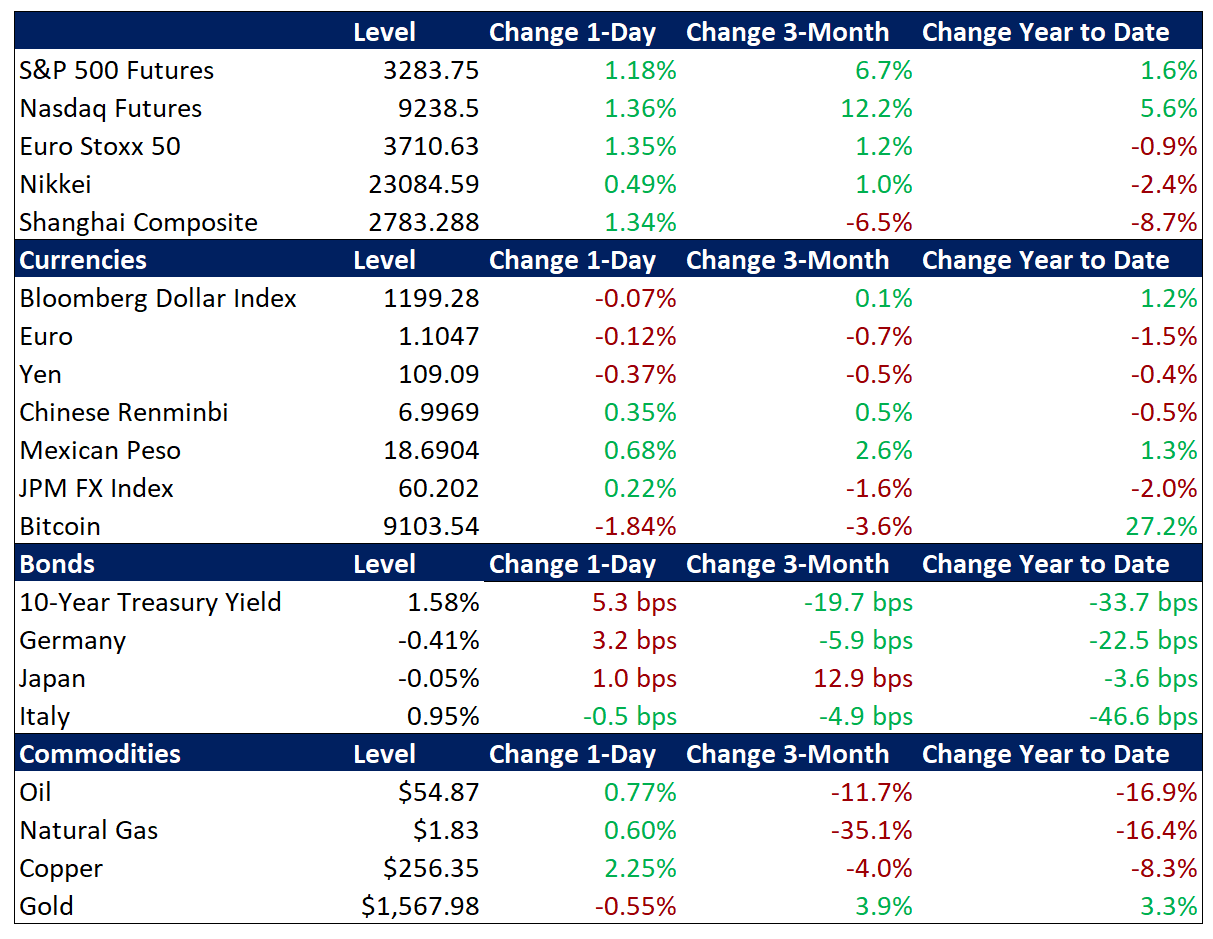

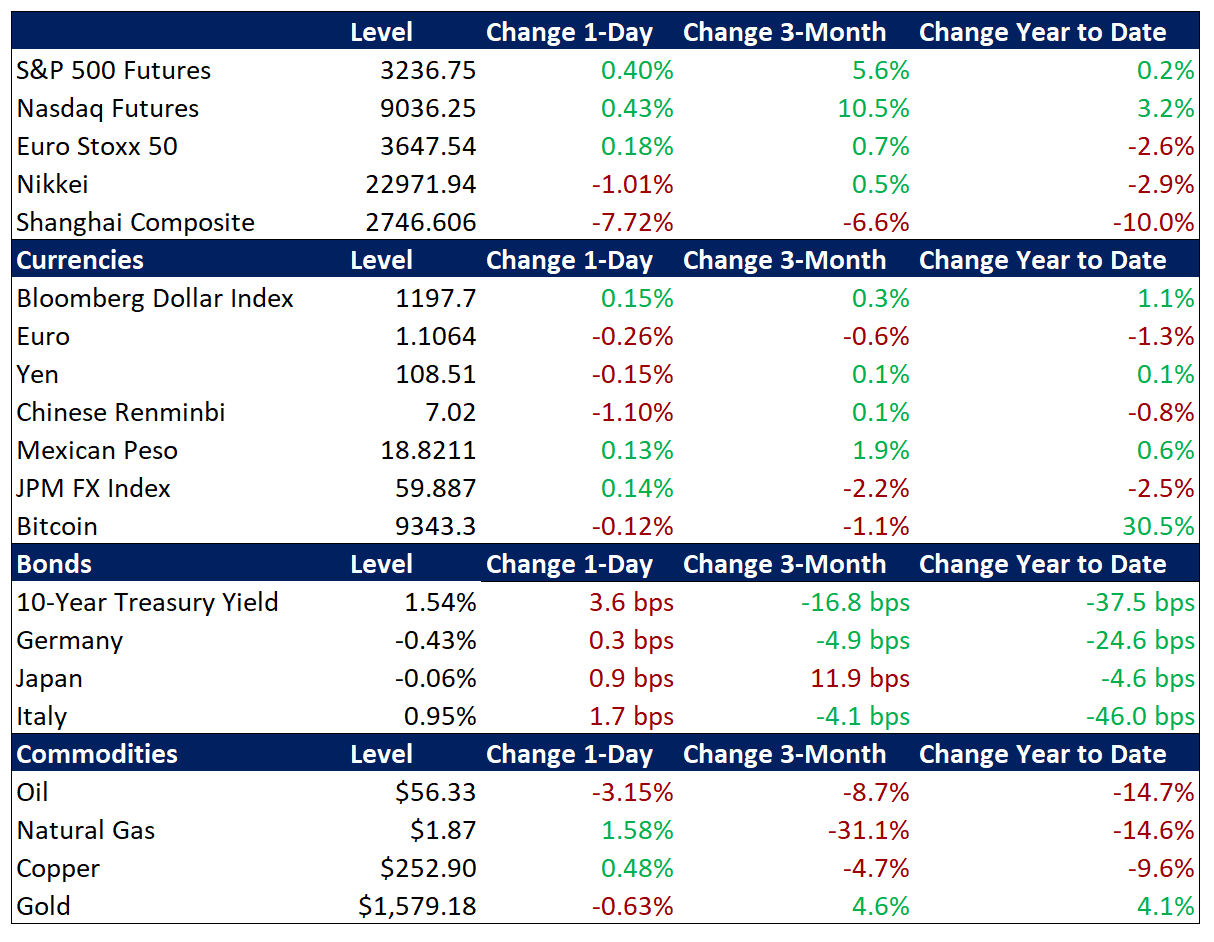

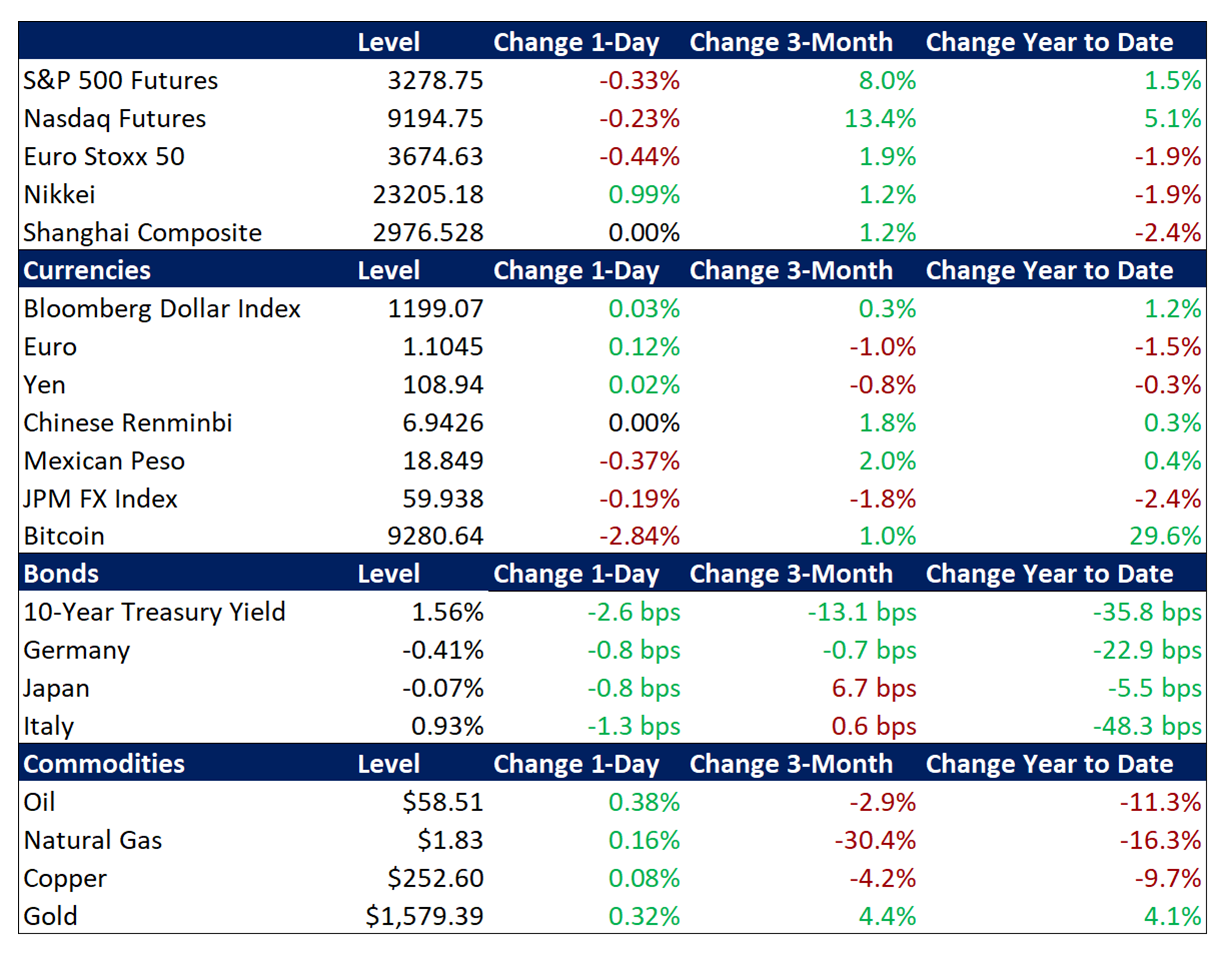

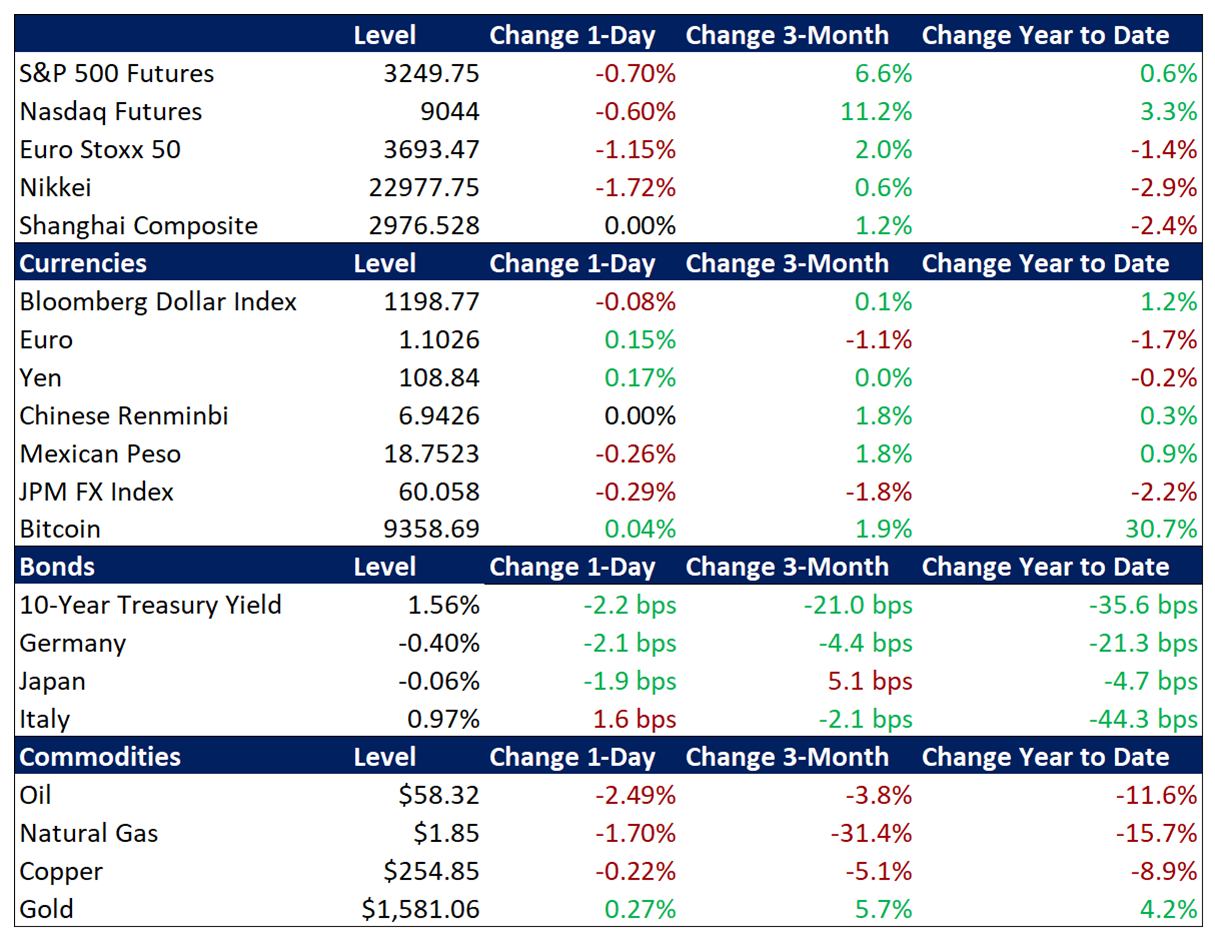

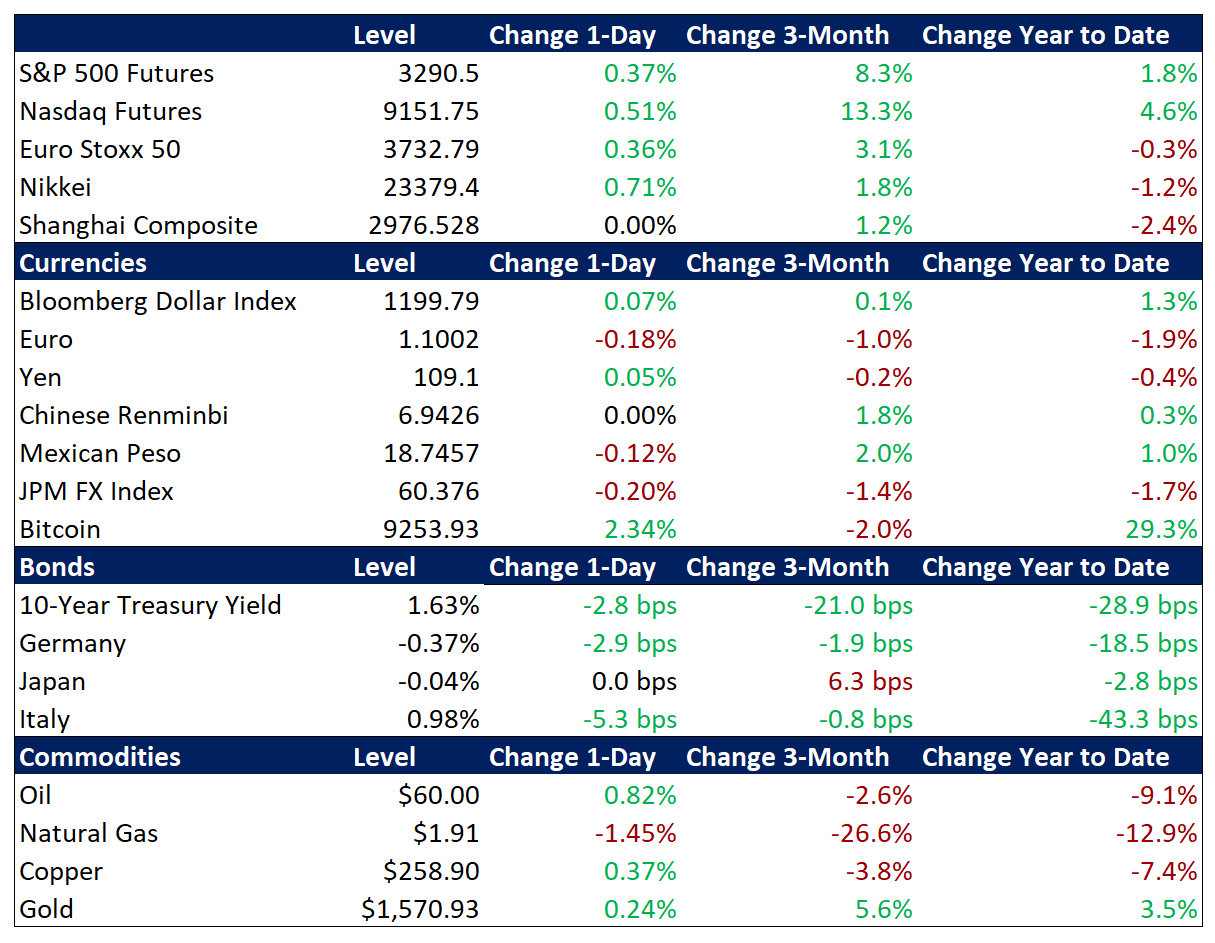

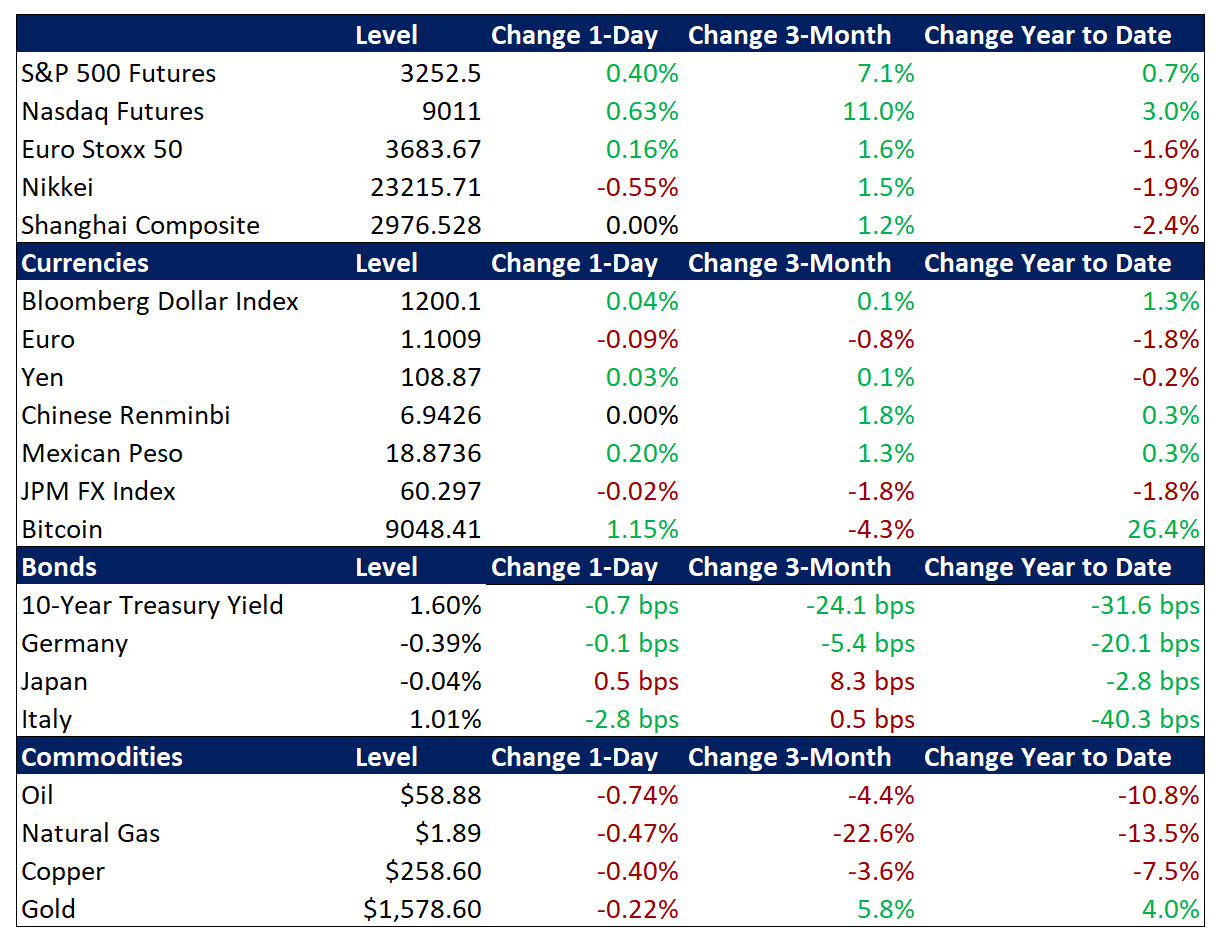

Global risk assets were mixed overnight as ongoing coronavirus outbreak concerns keep investors on edge ahead of this week’s key economic data and testimony by Fed Chair Powell. S&P 500 futures indicate a flat open, which would keep the index slightly below last Thursday’s record high. Friday’s moderate selloff followed a burst of optimism earlier in the week amid some encouraging news on slowing infection rates and potential treatment options, and volatility remains elevated. Overnight, equities in Asia were mostly lower, though mainland Chinese stocks extended their rebound, while EU stocks are posting modest losses. The cautious tone is supportive of Treasuries, which are holding recent gains with the 10-year yield at 1.57%, barely above multi-month lows after starting the year at 1.92%. The dollar is pausing its recent uptrend. Crude oil prices remain under pressure, with Brent crude sinking toward $54 per barrel as dissent from Russia is reportedly blocking OPEC efforts to further cut output.

Coronavirus Concerns Remain in Focus for Investors

The lack of clarity on containment is continuing to dampen last week’s nascent optimism that the worst of the outbreak might be over. To better understand the key risk factors of the coronavirus, please listen to the podcast we produced in conjunction with our friends at RenMac, featuring virologist Dr. Christopher Mores.

Click here for RenMac Off-Script: Coronavirus Thru Dr. Chris Mores’ Eyes:

Reports over the weekend highlighted continued increases in infections and fatalities, with the totals rising to 40,573 and 910, respectively. Analysts noted that Chinese President Xi made a public appearance in Beijing for the first time since the start of the outbreak, with state media featuring a picture of him wearing a mask and having his temperature taken. Continued closures of many Chinese factories are also being monitored for impact on supply chains. The Shanghai Composite rallied for a fifth straight session, though, advancing 0.5% to further reduce post-Lunar New Year losses to 2.9%. Official and unofficial state support is being credited with helping the index rebound from last Monday’s plunge of nearly 8% upon reopening from the extended holiday closure. The renminbi also gained versus the dollar overnight, remaining on the strong side of the pivotal 7 to the dollar level.

Uncertain Virus Impact Clouds Economic Outlook

Strong US jobs data for January extended the trend of labor market strength, and this week’s retail sales and industrial production are expected to be steady, but virus-related growth concerns are dulling the market reaction. Friday’s release showed that nonfarm payrolls jumped by 225K in January, handily outpacing consensus expectations of 160K. Notable job gains occurred in construction due to unseasonably warm weather. November and December were revised up, putting the 2019 average at 175K jobs a month. The unemployment rate rose to 3.6%, slightly above expectations of 3.5%, and above last month’s 50-year low, but this was due to new entrants into the labor force. Average hourly earnings (AHE) for all employees on private nonfarm payrolls rose by 0.2% month-on-month (m/m) to $28.44 but missed market expectations of a 0.3%. Year-on-year, AHE have risen by 3.1%, following an upwardly revised 3.0% gain in December. The market reaction to these robust figures on Friday was negligible, however, as Treasuries rallied and stocks sold off due to rekindled coronavirus fears. US consumer inflation data, industrial production, and retail sales for January are all due this week, but the resulting price reaction could be similarly muted given expectations that incoming data points will increasingly feature downside risk due to the outbreak.

Additional Themes

Fed Testimony in Focus – Chair Powell will testify in front of both houses of Congress on Tuesday and Wednesday this week for his semiannual Humphrey-Hawkins testimony. The Fed’s written statement preceding the testimony identified the coronavirus outbreak as a “new risk” and Chair Powell is likely to face extensive questioning on his assessment of the potential impact and the Fed’s expected policy response. For context, futures markets reflect nearly 50% odds that the Fed will restart rate cuts by the June meeting. Another line of inquiry will surely be the unsettled situation in short duration funding markets and the Fed’s choice of balance sheet expansion as a primary means of addressing this issue. These renewed asset purchases, which the Fed characterizes as a technical adjustment, are being taken by many in financial markets as a stealth easing program akin to quantitative easing (or QE).

German Assets Steady Despite Political Upheaval – The German benchmark equity index is performing in-line with regional peers, bunds are rallying moderately, and the euro is little-changed as analysts note that Chancellor Merkel’s presumptive successor, Annegret Kramp-Karrenbauer, has stepped down from the leadership of the Christian Democratic Union.