Summary and Price Action Rundown

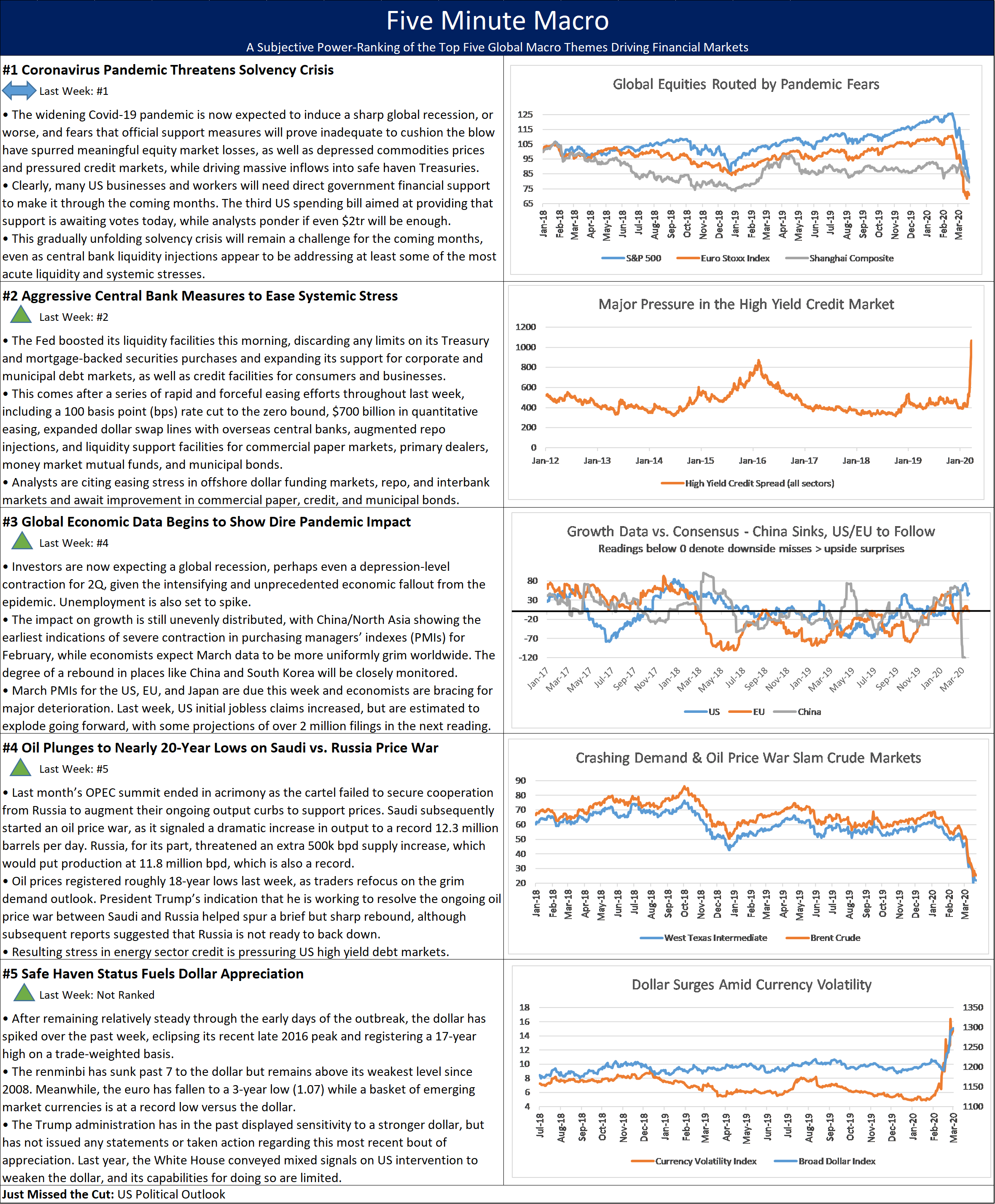

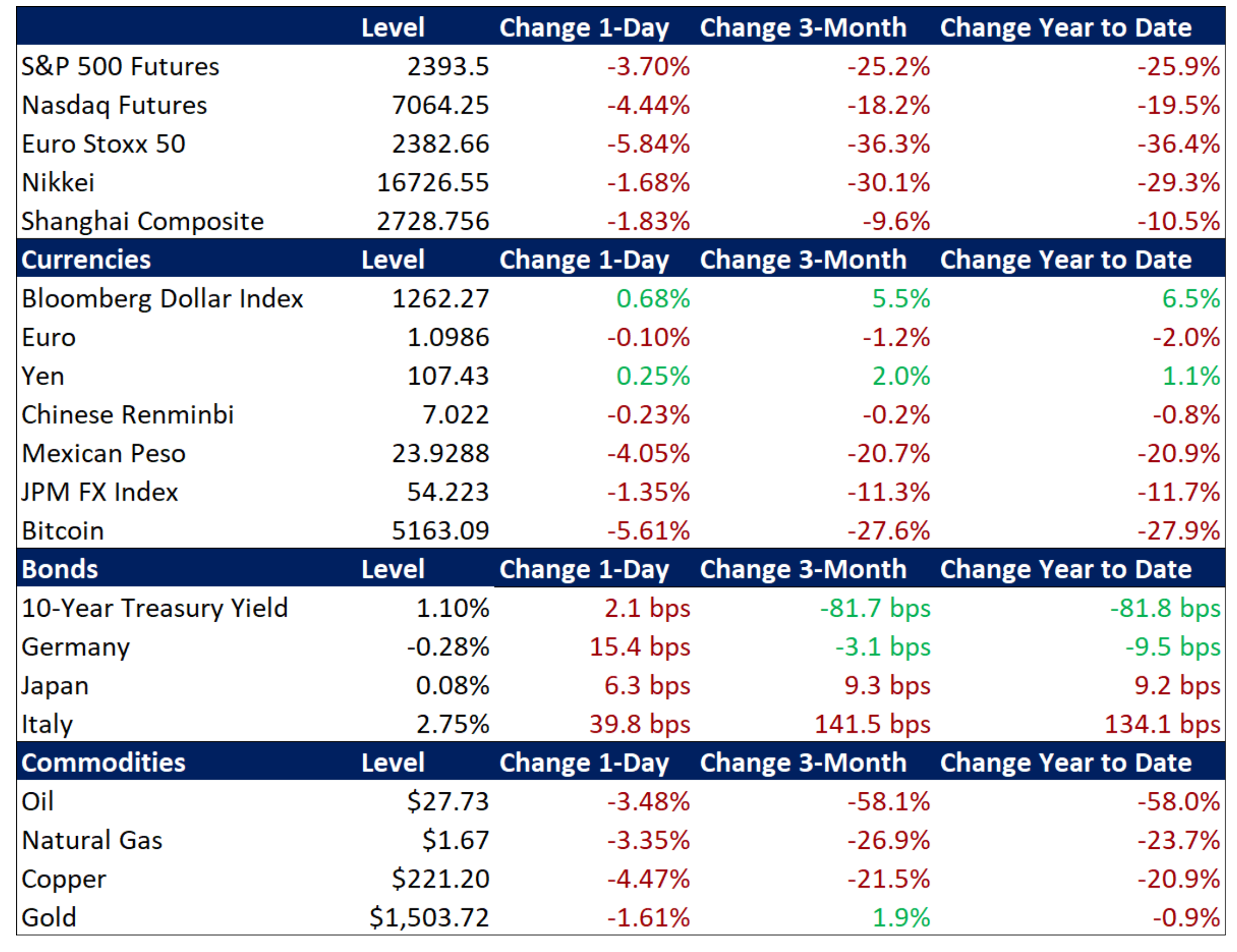

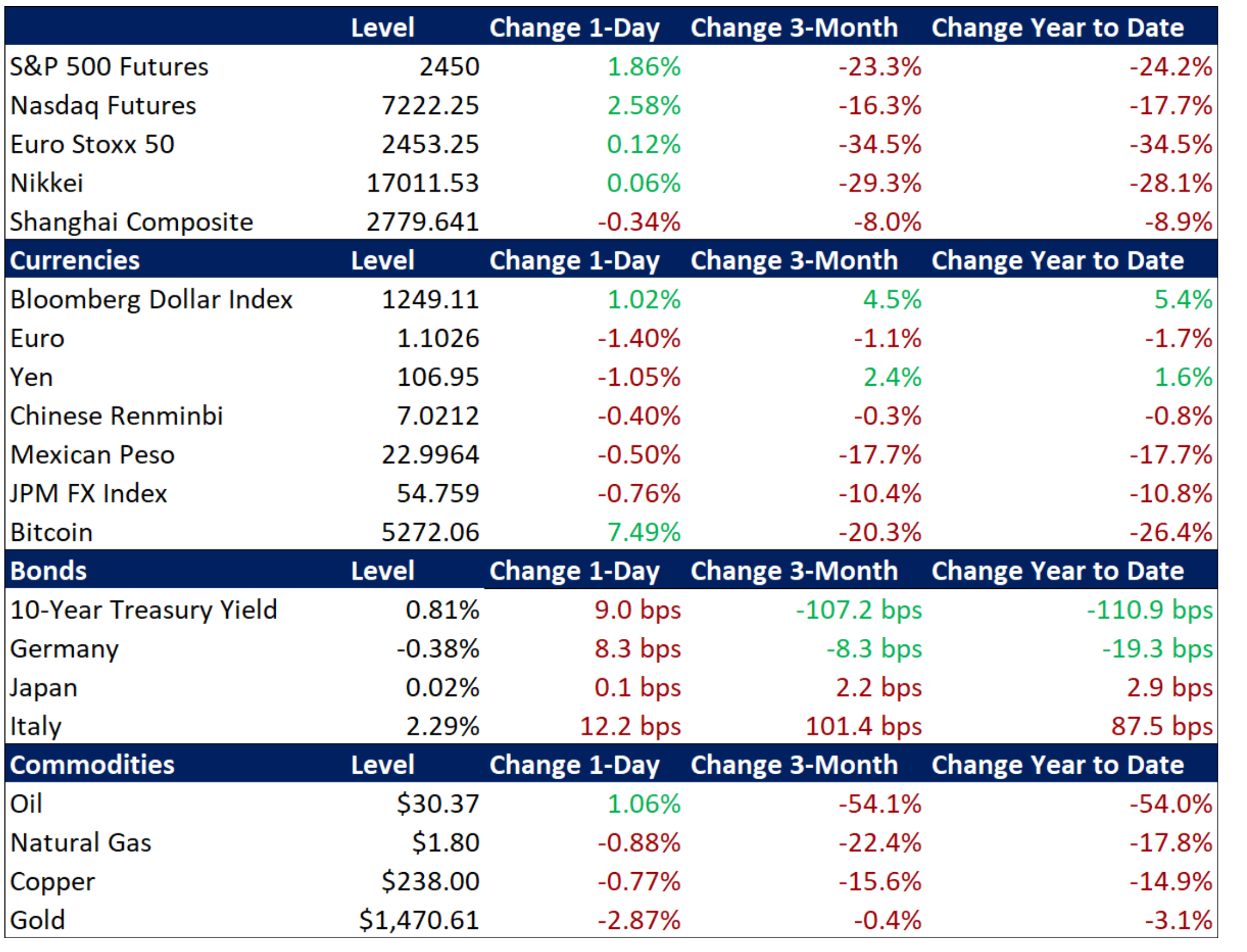

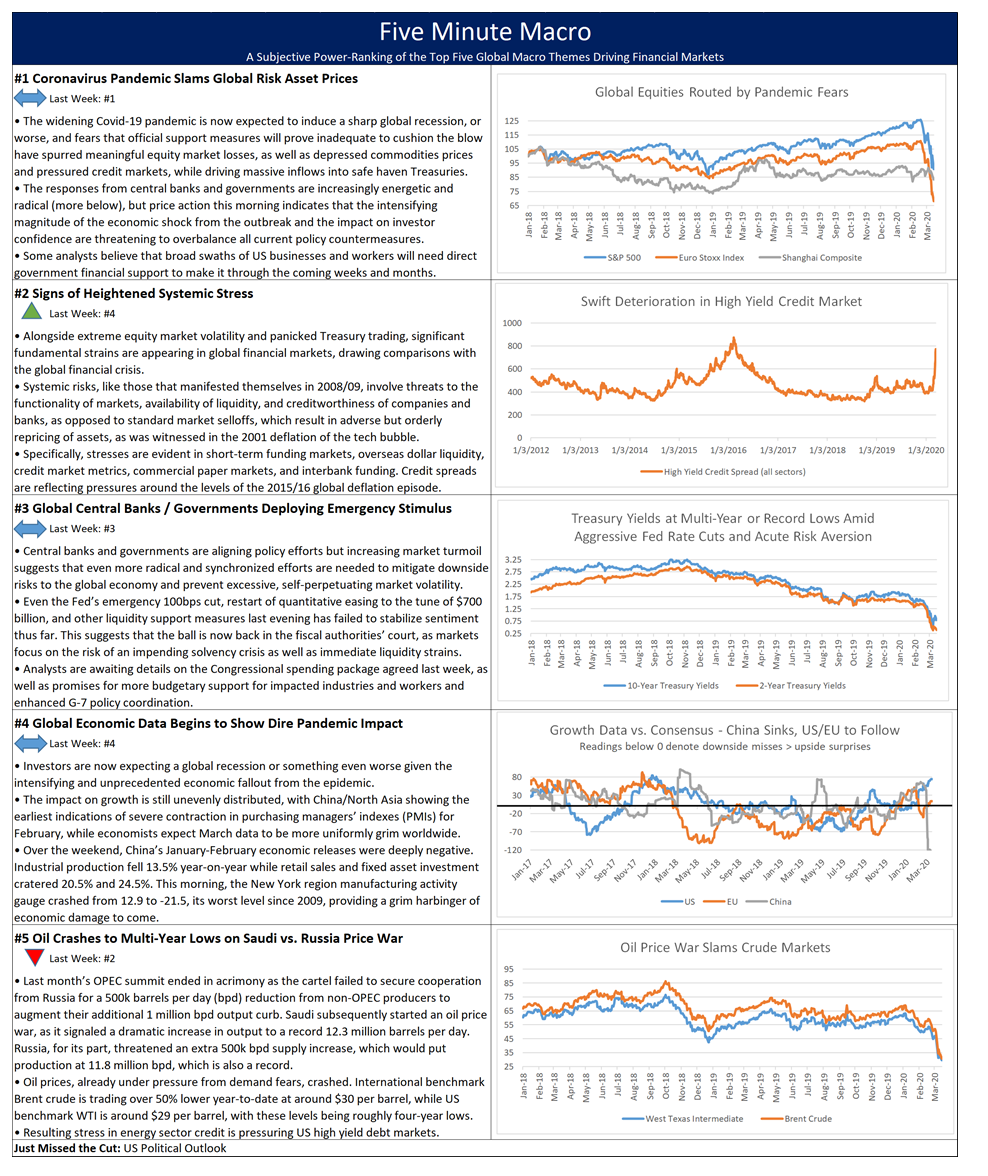

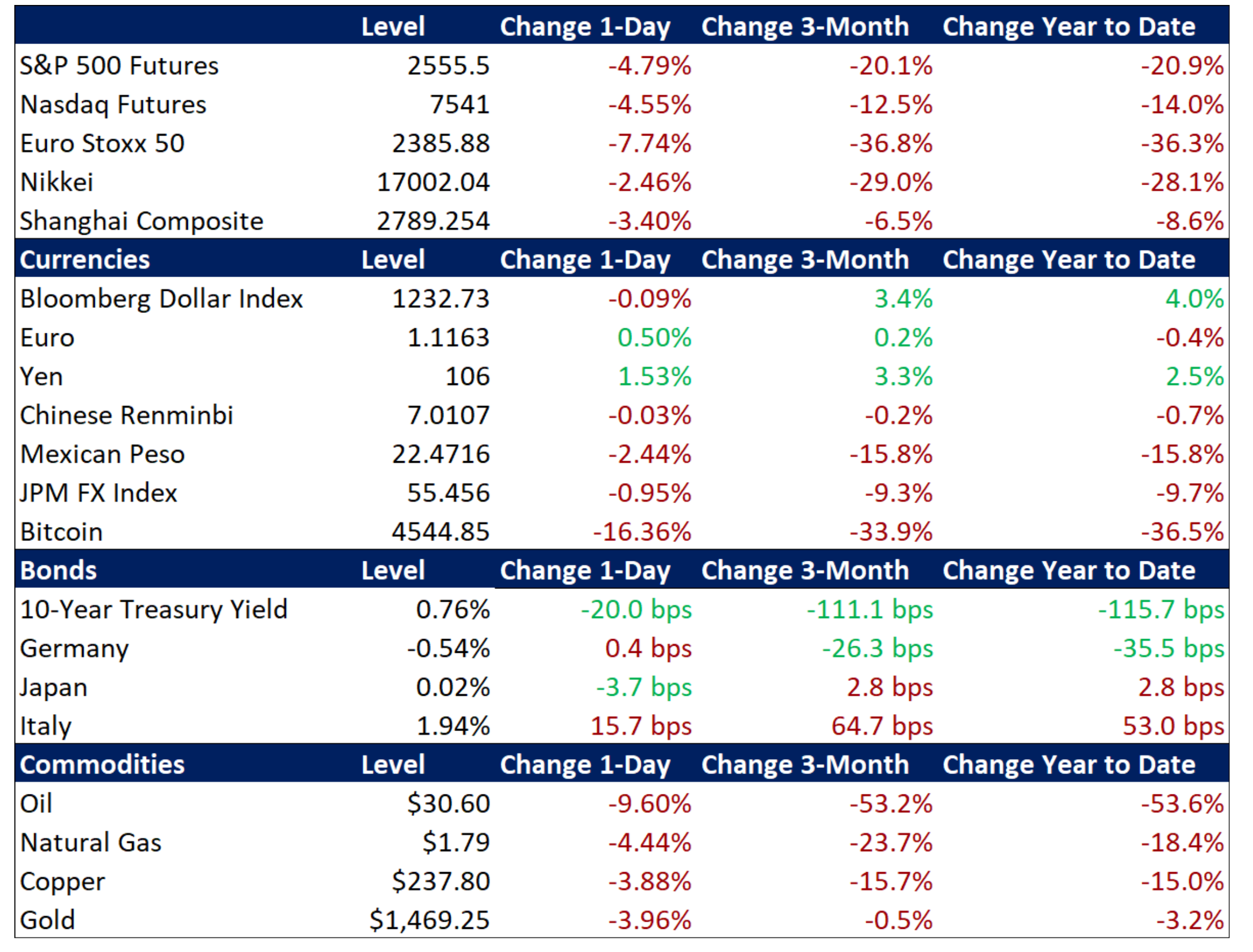

Global financial markets are staging a recovery this morning as investors anticipate forceful fiscal measures aimed at cushioning the unprecedented economic impact from the pandemic and note easing signs of systemic stress following strong monetary policy action. S&P 500 futures are “limit up,” indicating a 5.1% rally at the open. Traders suggest that investor sentiment is finding support from more aggressive Fed accommodation, glimmers of hope from slightly decelerating Italian contagion figures, and expectations of a prompt resolution to the fiscal stimulus holdup on Capitol Hill. Coming off its worst week since 2008, the S&P 500’s year-to-date downside is now 30.8% and its decline from mid-February’s record high is 33.9%. EU and Asian equities also posted robust gains overnight. Amid the easing risk aversion, Treasury yields are ticking higher, with the 10-year yield at 0.80%, while EU sovereign bonds remain steady. Importantly, the dollar is falling back from multi-year highs. Lastly, oil prices are bouncing further above last week’s nearly multi-decade lows, with Brent crude up above $28.

Expectations of US Fiscal Support Help Steady Market Nerves

Investor sentiment remains fragile but tentatively more upbeat today as Congress and the White House work toward a third US spending bill aimed at providing government support to households and businesses during the pandemic, though analysts fret that even this massive package may prove to be too little, too late. Senate Democrats continue to hold out for amendments to the latest stimulus bill aimed at providing support to workers, companies, and the economy in general during the sharp contraction of activity amid the pandemic response. The latest reports indicate that House Speaker Pelosi would likely accept a version agreed between Senate Democrats and the White House, but that House Democrats have crafted their own version of the bill featuring $2.5 trillion in government support for workers and businesses. The House version features moratoriums for mortgage, car, and credit card payments, breaks for public housing rent, $10k in student loan forgiveness, and a freeze on foreclosures and evictions. This follows the rapid expansion of the size of the fiscal package last week from $1.3 trillion to roughly $2 trillion last week, as Congress and the Trump administration reacted to the soaring estimates of economic damage. Investors are struggling to comprehend how much fiscal firepower might be necessary to even partially cushion severe impact of the pandemic on the balance sheets of businesses and households, but more than $2 trillion represents a strong counterweight to this unfolding national solvency crisis. Meanwhile, President Trump’s latest remarks convey anxiousness to restart more normal economic activity, though most of the restrictions and lockdowns are mandated at the state level.

Signs of Easing Market Stress Amid Unprecedented Fed Support Measures

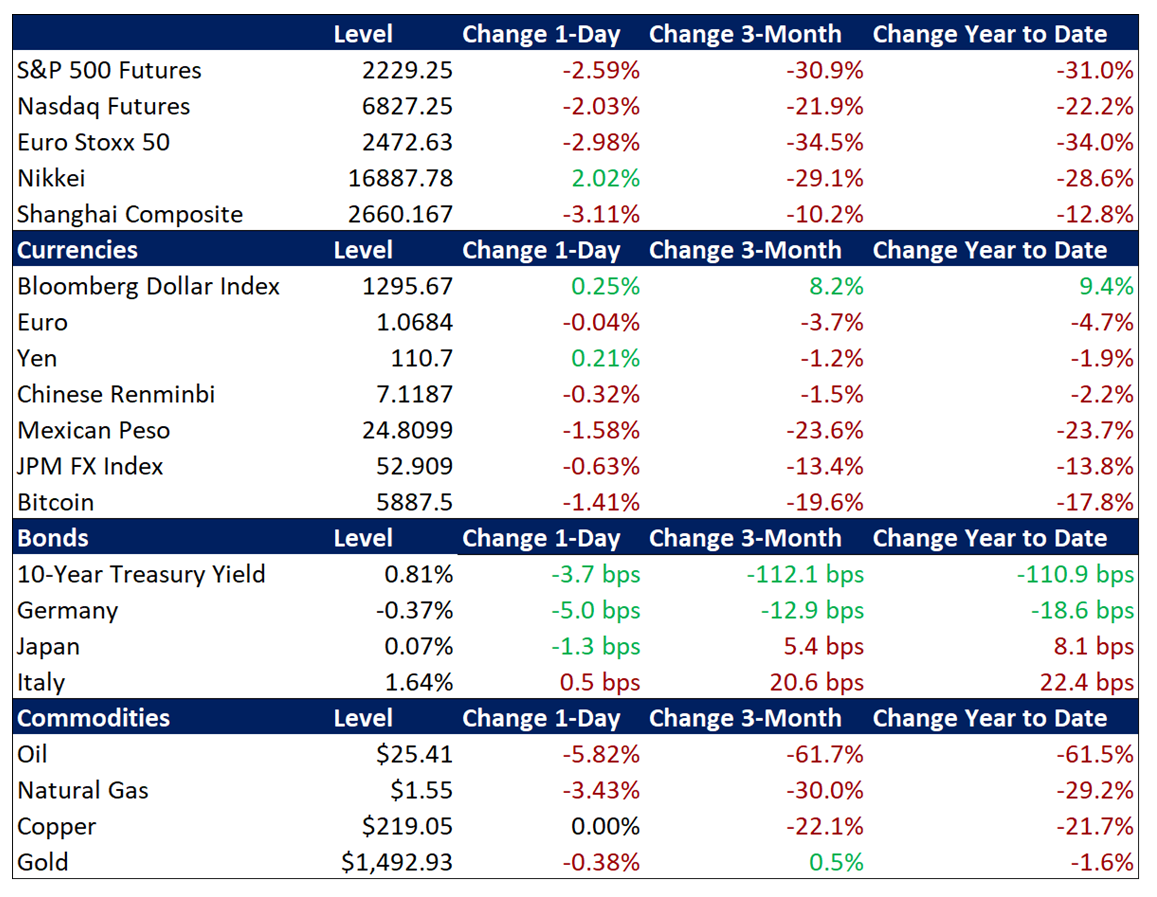

As the liquidity crisis that the Fed is attempting to quell remains intertwined with the slower-moving but intensifying solvency crisis brought on by the pandemic, the FOMC answered the call yesterday to more directly support credit markets and reinforce fiscal backstops to key sectors. Yesterday morning, the Fed announced extensive new measures to support the economy that will provide up to $300 billion in new financing for employers, consumers, and businesses. The Fed will also now be able to purchase Treasury securities and agency mortgage-backed securities in unlimited amounts in order to support smooth market functioning along with increasing buying of agency commercial mortgage-backed securities. They created two facilities to support credit to large employers and established a third facility to support the flow of funds to consumers and businesses, along with facilitating credit availability for municipalities. Investment grade credit rallied yesterday and traders noted some signs of better market functioning, although high yield debt remained under significant pressure. Meanwhile, analysts are citing diminished evidence of stress in offshore dollar funding markets (more below), while short-term funding (repo) and interbank markets similarly appear more orderly. Commercial paper and municipal bonds will be monitored for evidence of improvement.

Additional Themes

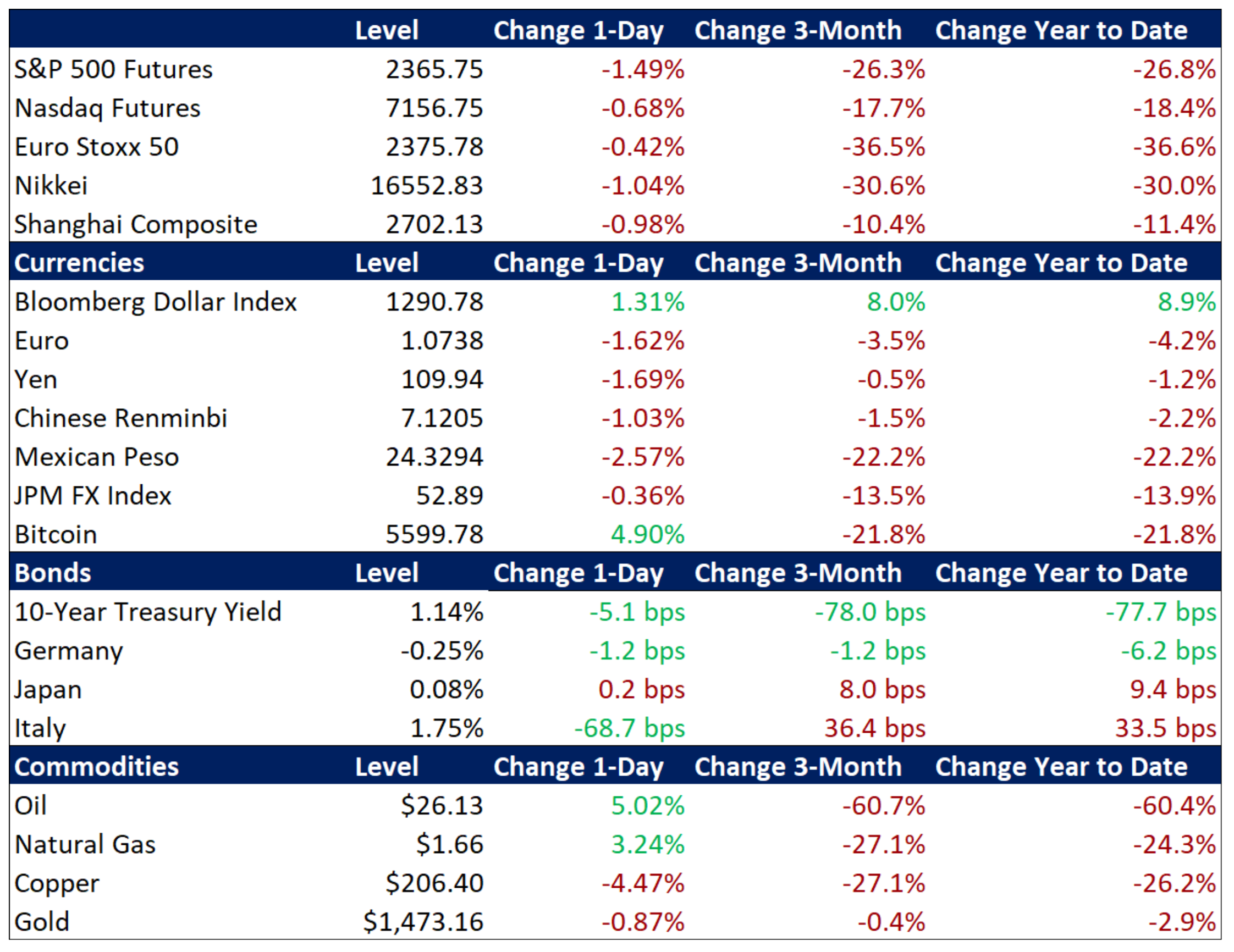

Data Shows Massive Economic Contraction – March purchasing managers’ indexes (PMIs) for the EU, Japan, and UK reflect unprecedented deterioration (readings below 50 denote contraction). The EU composite PMI plummeted to 31.4 after registering 51.6 in February, with the service sector showing the sharpest contraction at 28.4 versus 52.6 last month. Factory activity also saw a quickening decline, sinking from 49.2 in February to 44.8. Earlier, Japan’s March services PMI cratered to 32.7 from 46.8 and manufacturing slid to 44.8 from 47.8, putting the composite reading at 35.8. UK services slumped to 35.7, manufacturing was 48.0, and the composite crashed to 37.1 from 53.0 the prior month. US PMIs are due later today.

Dollar Depreciation Welcome – Analysts are crediting the Fed’s aggressive measures for taming the rampant dollar in overseas trading thus far today. The greenback is off its multi-year peak.