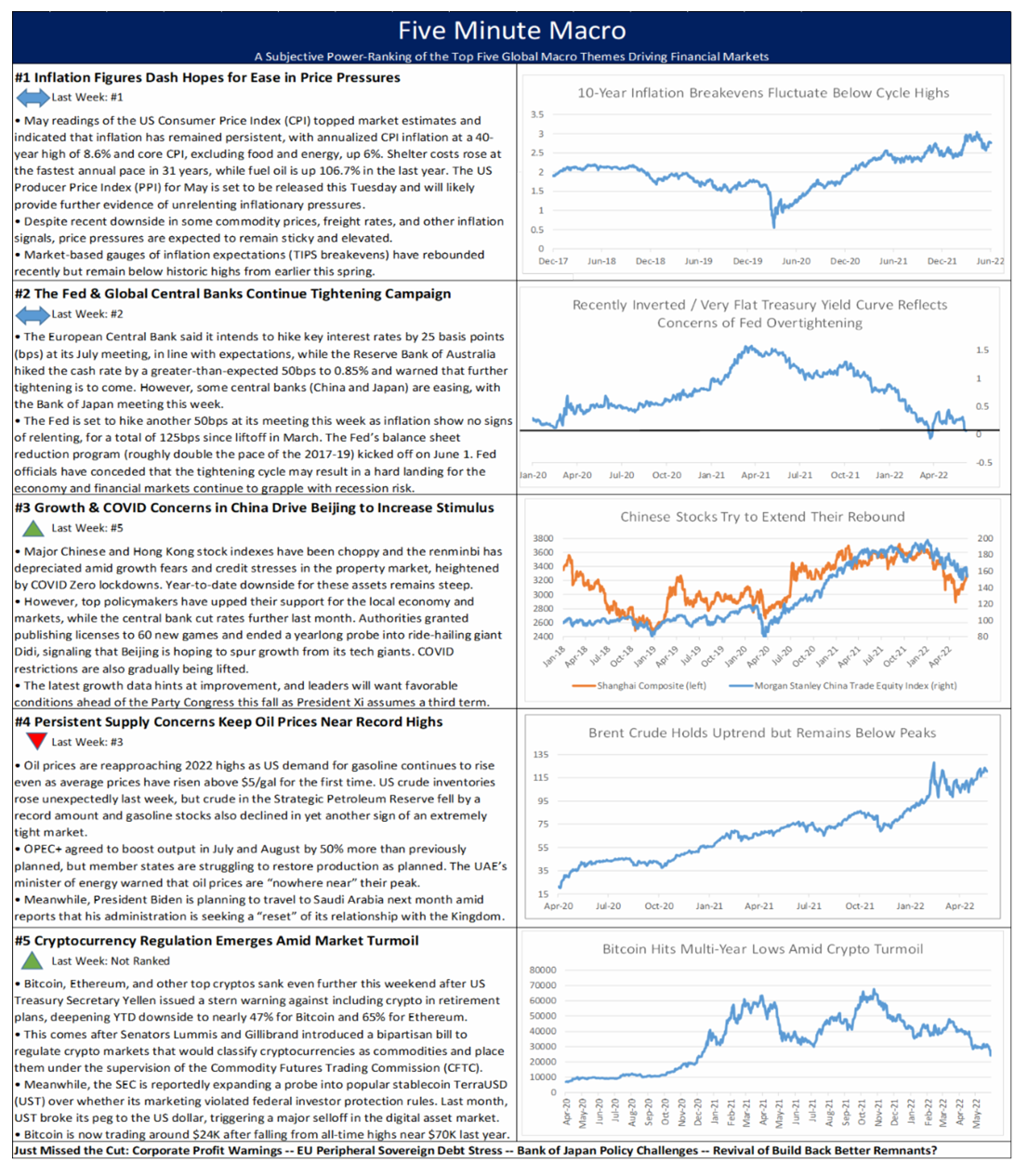

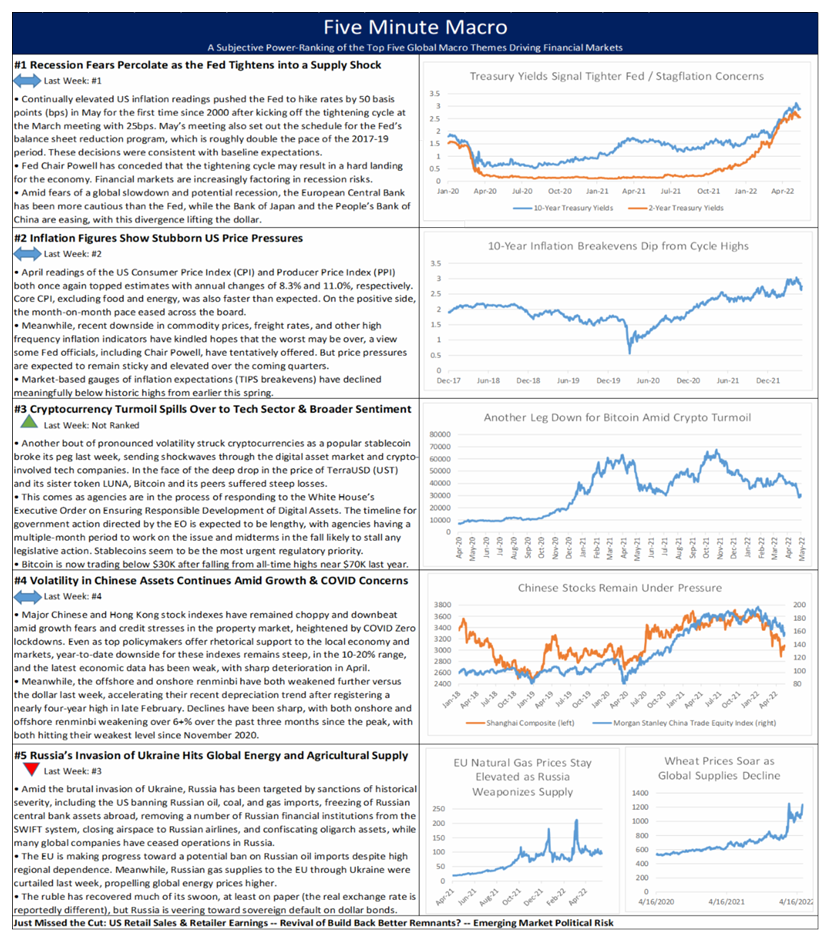

Continued high inflation and hawkish central banks continue to roil markets. Growth concerns moves up the list while high oil prices and lack of supply move down a spot. Finally, crypto markets are plummeting as regulation ramps up.

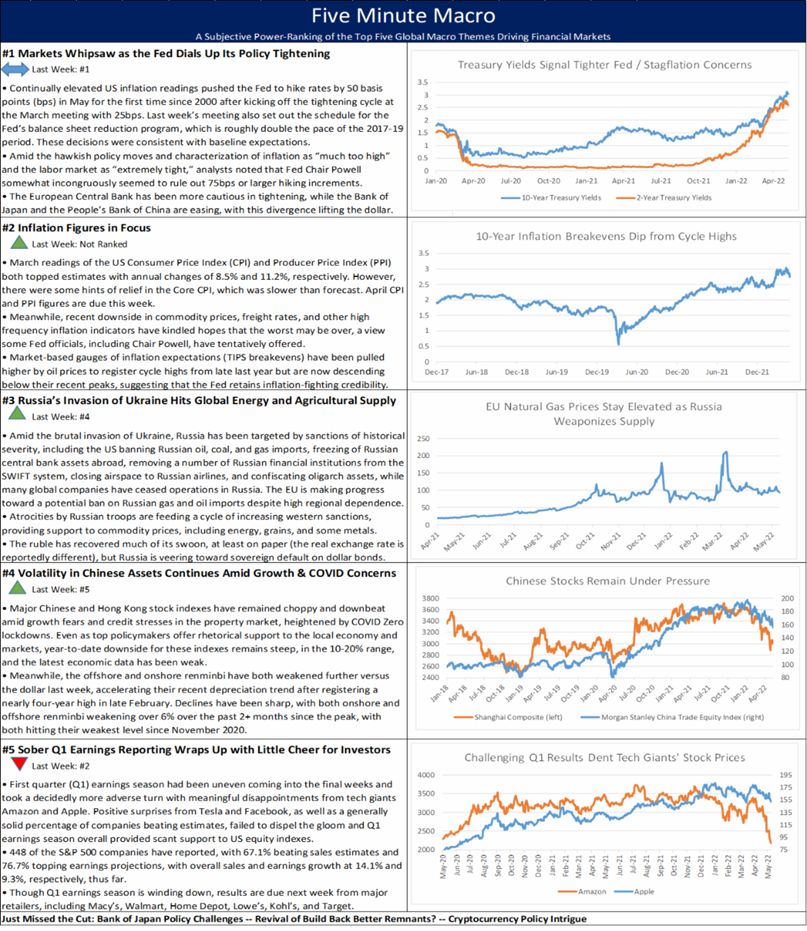

Continued high inflation and hawkish central banks continue to roil markets. Growth concerns moves up the list while high oil prices and lack of supply move down a spot. Finally, crypto markets are plummeting as regulation ramps up.

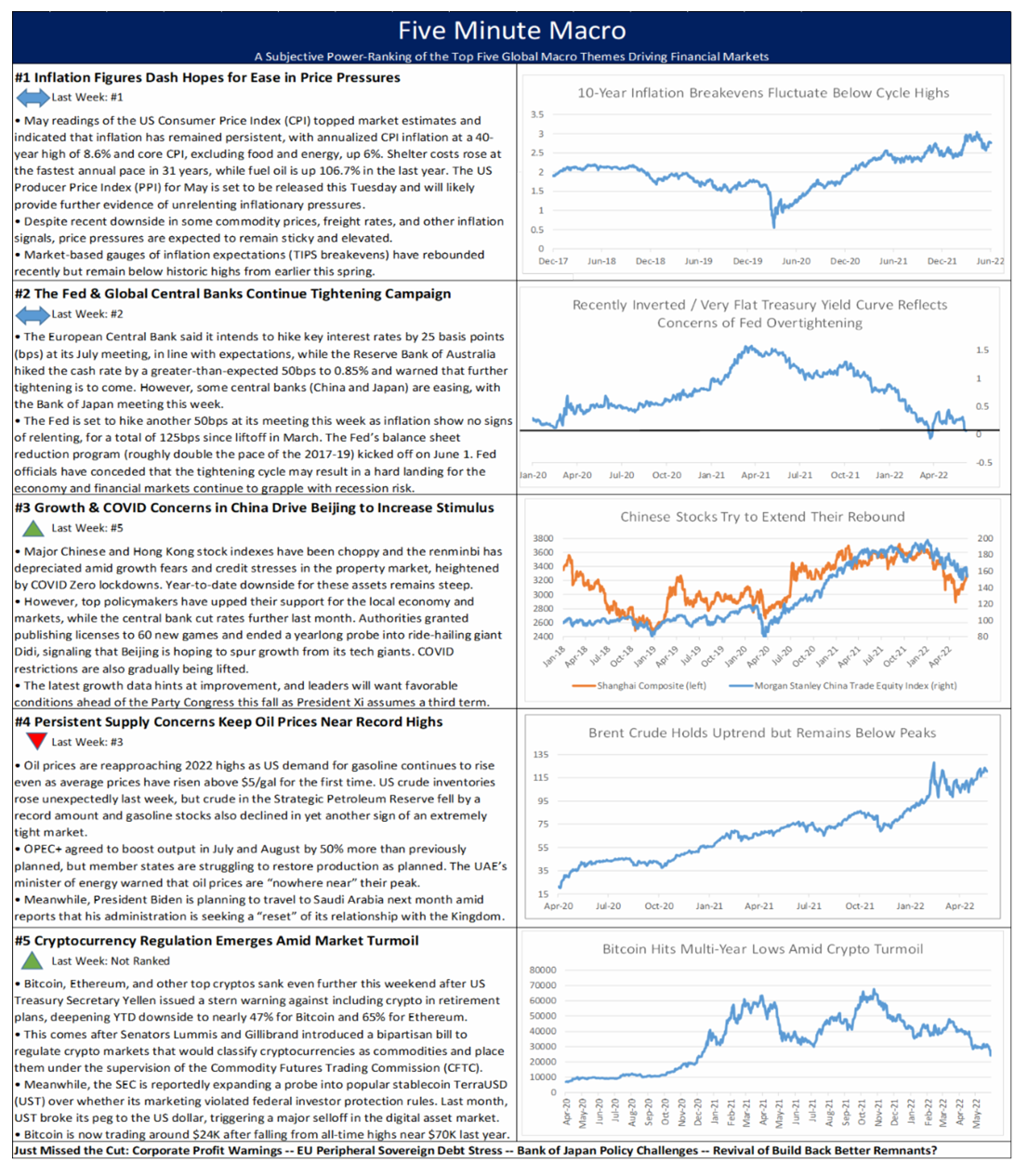

Markets wait for the May CPI report on Friday as global central banks talk tough on inflation and supply concerns keeps oil well above $100 a barrel. While recent data has been strong, forecasts are getting darker, and finally China rapidly reopens from Covid lockdowns.

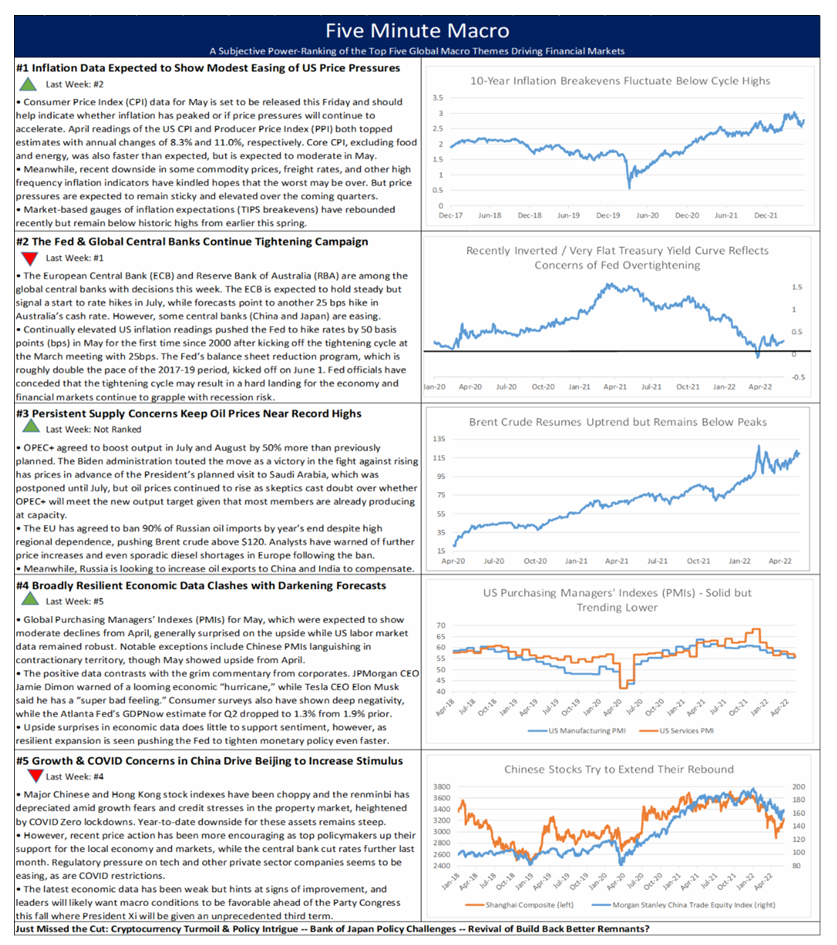

Recession fears remain as the Fed continues its tightening path as inflation figures remain elevated. Russia’s invasion continues to hit global energy and agriculture supply. Finally, Chinese Covid lockdowns persist, and this week brings a host of global PMI data.

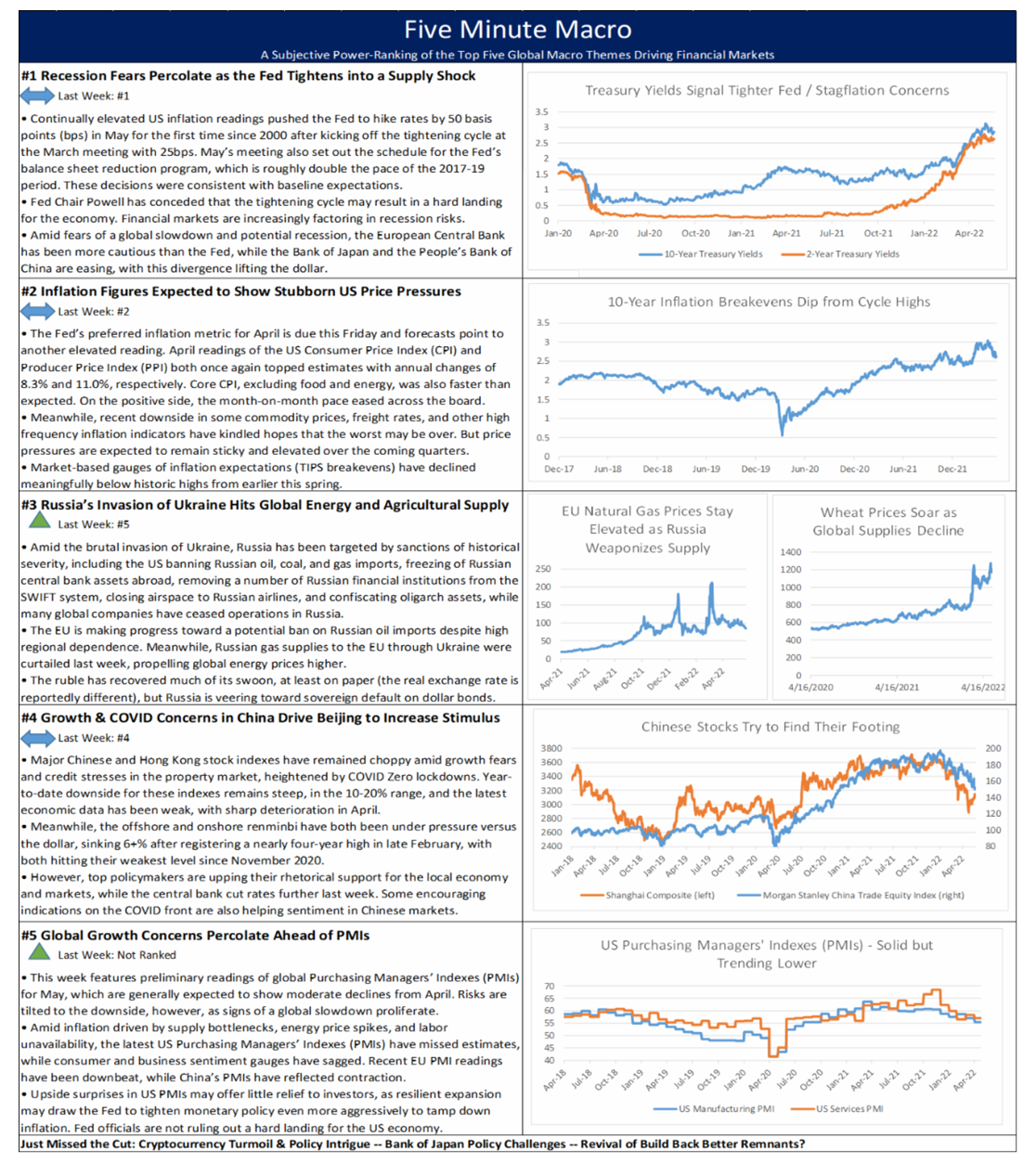

Fed tightening in the face of recession and inflation fears is keeping markets volatile as crypto remains in turmoil. China remains in lockdown and under pressure while the war in Ukraine keeps pressure on energy and agriculture markets.

Volatile markets on the back of Fed policy tightening continues this week as markets await tomorrow’s key CPI numbers. The Ukraine war and new oil restrictions continue to effect oil market and Chinese Covid lockdowns intensify. Finally, earnings season is coming to an end.

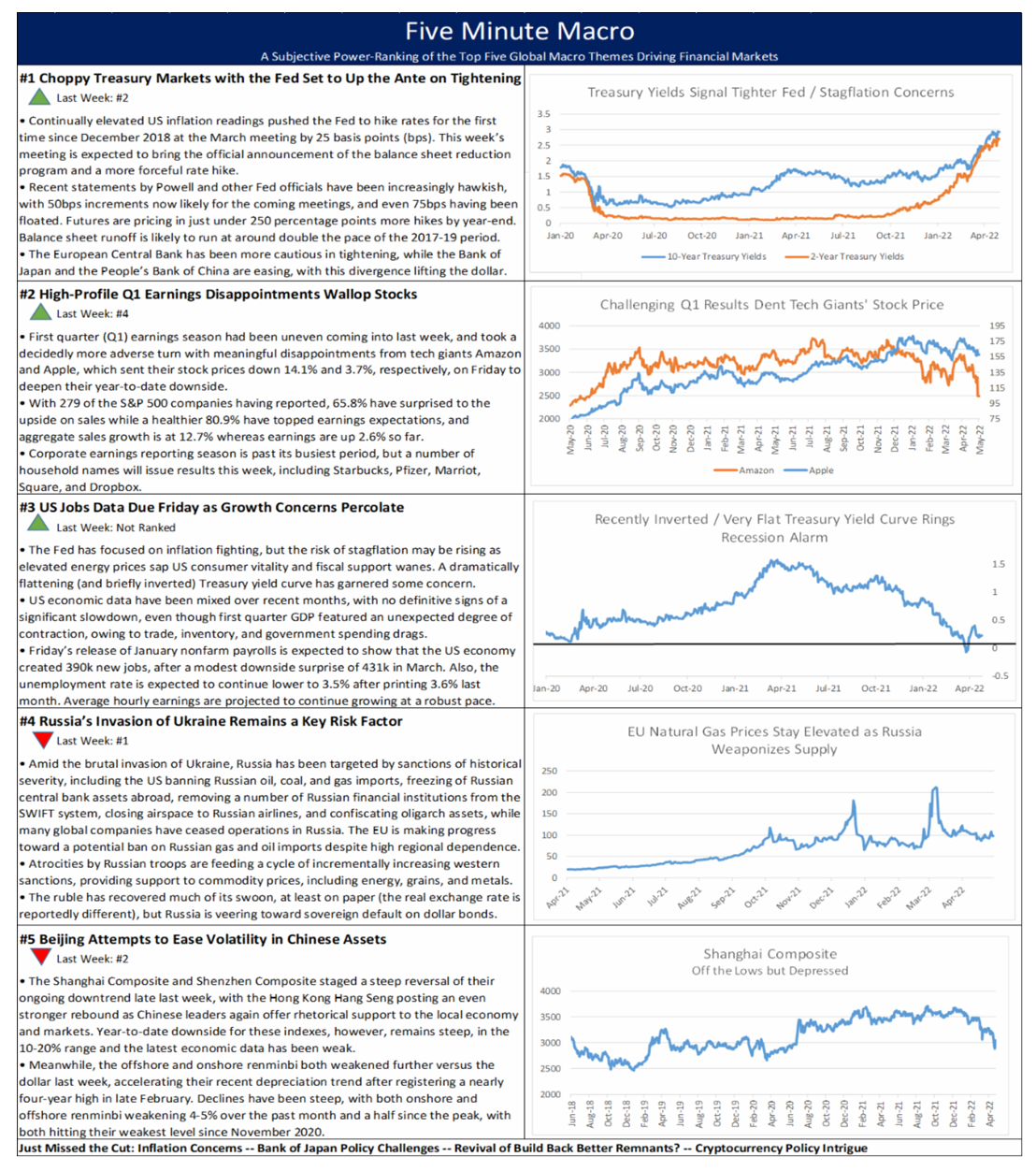

The FOMC meeting later this week is the main focus of markets this week while earnings season continues. Friday brings the jobs report while Russia and China remain risks to markets.

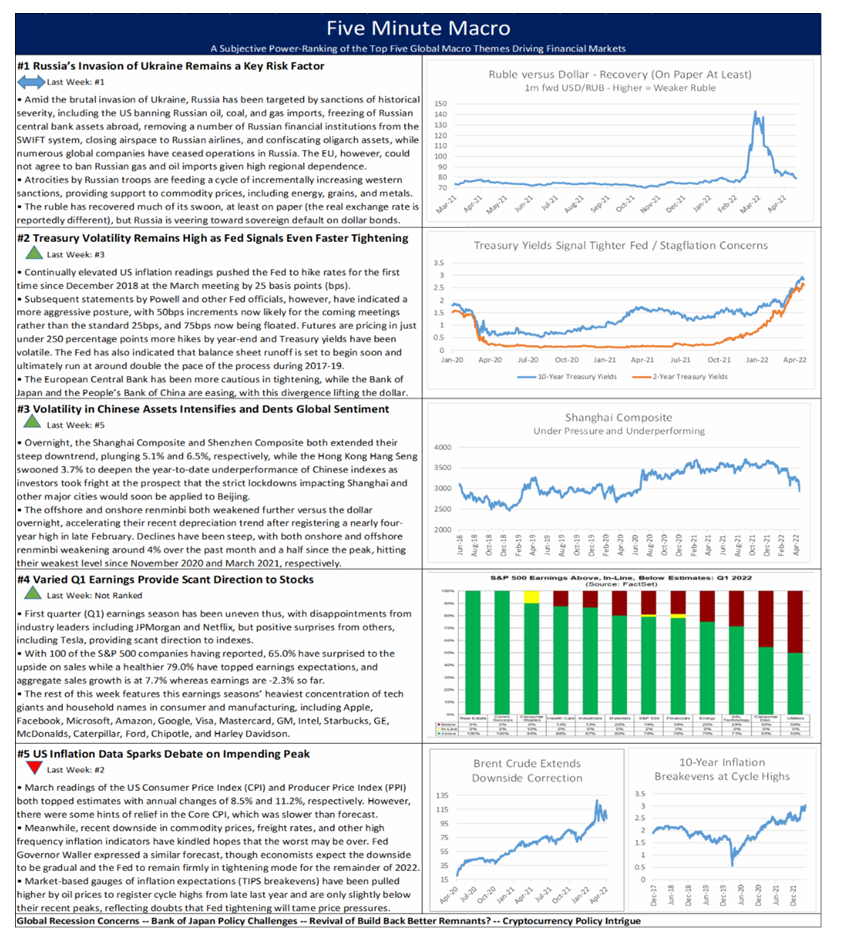

In this week’s Five Minute Macro Russia and Ukraine remain in the top spot, while Fed tightening and Treasury volatility along with Chinese asset sell-off move up the list. First quarter earnings season continues, and finally markets debate future path of inflation.

Summary and Price Action Rundown

Global risk assets are steadying this morning after two days of losses as Treasury market volatility eases in the wake of increasingly hawkish guidance from the Federal Reserve. S&P 500 futures indicate a 0.2% higher open after the index lost 1.0% yesterday, deepening year-to-date downside to 6.0%, while the Nasdaq underperformed to extend 2022 losses to -11.2% thus far. EU equities are retracing a portion of this week’s losses, while Asian stocks were broadly lower overnight. Longer-dated Treasury yields are stabilizing after two days of incrementally hawkish Fed signals, with 10-year Treasury yield wavering below yesterday’s cycle highs at 2.66%, which was the loftiest level since spring of 2019. The broad dollar index is holding slightly below its recent 2022 peak, which was its strongest level since July 2020. Oil prices are rebounding after yesterday’s losses that followed the announcement of further strategic supply releases, with Brent crude rising back above $103 per barrel as EU leader contemplate more action against Russian energy (more below).

Mixed Signals from Chinese Markets Amid Redoubled Pledges of Stimulus from Beijing

Despite the State Council reiterating its intent to counteract downside economic risks, which have been exacerbated by renewed COVID lockdowns, Chinese and Hong Kong stocks are struggling to find support though the renminbi remains solid versus the dollar. The communique from the State Council indicated that an array of monetary policy measures would be enacted at the “appropriate time,” citing the “complexity and uncertainty” of the economic landscape on the mainland and abroad. Similar statements have preceded Reserve Requirement Ratio (RRR) cuts by the People’s Bank of China (PBoC) in July and December. Analysts are also anticipating further reductions in benchmark lending rates in the coming months.

For context, statements from key officials with the State Council, PBoC, Financial Stability and Development Committee in the middle of last month promising to “actively introduce policies that benefit [Chinese] markets” spurred a steep rally in mainland and Hong Kong stock markets. These communications suggested that the campaign against Chinese IT companies would be concluded, support for beleaguered property developers would be forthcoming, and additional monetary stimulus would be enacted. Since that bounce, however, greater Chinese share prices have struggled to make further headway, as the rhetoric does not appear to have been matched by policy action. – MPP view: We have retained our longstanding negative posture on Chinese assets as we suspect that Beijing’s expressions of market/economic support are more rhetorical than substantive and China’s backing of Russia opens it to higher risk of being caught up in the sanctions. There was also no indication that PCAOB or the Biden administration in general would be favorably disposed to compromise with China on this audit disclosure / delisting issue, or do Beijing a favor on any other count either. After such steep losses, there is always a temptation to buy the dip but we continue to think that Chinese stocks are, from an index perspective, dead money at best over the medium term, despite the likelihood of tactical bounces this year ahead of the Party Congress in the fall at which President Xi will assume an unprecedented third term.

Sanctions in Focus as Russia’s Invasion Strategy Shifts

With Russian troops reportedly massing in eastern Ukraine for a renewed offensive, western leaders are evaluating the impact of sanctions and ability of Russia to skirt them. Reports this morning indicate that Russia has sold the full complement of its Sokol crude in the east of the country for next month and that Chinese buyers are using renminbi for coal transactions. Meanwhile, ongoing gas and oil exports to the EU and elsewhere are helping support the ruble, which is trading back to pre-invasion levels, though US officials, including Treasury Secretary Yellen, have warned that capital controls and other measures taken by the Kremlin have artificially supported the currency, suggesting an outlook for renewed depreciation. This comes as the US expanded sanctions yesterday on Russian financial institutions and individuals and EU leaders are meeting today to discuss the potential to ban Russian coal, with consensus remaining elusive to take similarly strict measures on Russian gas imports. The benchmark price of EU natural gas remains historically elevated but roughly half the level of the super-spike peak early last month. – MPP view: Our base case is that the US administration policy is to force Russia into sovereign default, if possible. Meanwhile, the EU has come further and faster than many had expected on Russia sanctions, but a full embargo on Russian energy is still a bridge too far. But this is a case of mutual dependence – therefore, we do not think Russia will cut off EU gas if the EU doesn’t pay in rubles, as keeping this flow is probably almost as import to the Kremlin as it is to the EU. But with the conflict grinding on and potentially turning even more grim (chemical weapons, further atrocities), the embargo will be revisited repeatedly and there is a significant chance that the Kremlin’s brutality in Ukraine will leave the EU with little option, with this upside risk skew keeping a floor under energy prices.

Additional Themes

German Industrial Production Holds Up in February but Signs of Weakness Mount – Though yesterday’s more forward-looking factory orders data for February reflected significant deterioration and a darkening economic outlook, this morning’s release of February industrial production data for German was only slightly weaker than anticipated. The 0.2% month-on-month (m/m) pace matched estimates but the downwardly revised January reading, to 1.4% m/m from the previous 2.7%, dragged the annualized rate to 3.2% for February and 1.1% in January versus a forecast and preliminary reading of 3.7% and 1.8%, respectively. The Bundesbank has been issuing increasingly dire warnings of downside growth risks over the coming months in the face of a commodity supply shock and stagflationary dynamics.

Summary and Price Action Rundown

Global risk assets are moderately lower this morning as the US and EU add to their sanctions regimes against Russia and more central banks pivot to a tighter stance. S&P 500 futures indicate a 0.3% lower open after the index advanced 0.8% yesterday, paring year-to-date losses to 3.9%, while the Nasdaq outperformed on notable tech stock news to improve 2022 performance to -7.1% thus far. EU equities are retracting some recent gains, while Asian stocks were mixed overnight. Longer-dated Treasury yields are moving higher after their recent slide, which has featured an inversion of the closely-watched 2-year/10-year segment of the yield curve, a traditional signal of impending recession. The 10-year Treasury yield is climbing back to 2.47%, which is slightly below the 2-year yield. The broad dollar index is holding steady below its recent 2022 peak, which was its strongest level since July 2020. Oil prices are extending yesterday’s rebound, with Brent crude climbing back above $108 per barrel amid tightening US and EU sanctions on Russia.

Central Banks Tilt More Hawkish in the Face of Persistent Price Pressures

The Reserve Bank of Australia (RBA) held policy steady but signaled a pivot toward interest rate hikes at upcoming meetings, while the Bank of Japan (BoJ) is reportedly set to jawbone against yen weakness. Though the RBA maintained its policy rate at 0.10%, it dropped language in the accompanying statement suggesting a wait-and-see posture and indicated that rate hikes could begin over the summer. Analysts are focused on the June meeting as the timing for liftoff, but May could be on the table. Governor Lowe noted that “additional evidence will be available… on both inflation and the evolution of labor costs” in the coming months, implying that no decision has been made, but flagged that there are already “some areas where larger wage increases are occurring.” This represents a pivot from the determinedly dovish policy stance of the RBA, and brings it closer to alignment with the Fed, as futures markets are pricing in seven to eight 25 basis point rate increases for the RBA though year end versus eight to nine more for the Fed after liftoff last month. The Australian dollar is 1.2% stronger versus its US counterpart this morning, extending the comeback of the currency to its strongest point since June of last year. Rising commodity prices have helped bolster the Australian dollar versus its developed market peers, with its 5.1% year-to-date appreciation the strongest by far in the G-10.

Meanwhile, BoJ Governor Kuroda overnight remarked that recent moves in the yen had been “somewhat rapid,” though this gentle jawboning did little to hoist Japan’s flagging currency overnight. For context, the yen has weakened 6.4% versus the dollar this year amid a widening monetary policy divergence as the BoJ has maintained its ultra-dovish settings and even augmented its bond buying in recent weeks to tame the upside in the 10-year Japanese government bond yield. These bond market interventions, in particular, have exerted significant pressure on the yen versus the dollar. – MPP view: We expect that increasingly hawkish and urgent rate hikes by the Fed will keep the divergence from the RBA, ECB, and BoJ relatively wide, keeping the dollar supported and tightening global financial conditions.

Prospect of Tighter Sanctions Amid Russian Atrocities in Ukraine

With the news conveying evidence of war crimes discovered in the wake of retreating Russian forces in Ukraine, western leaders are preparing to expand their sanctions against Russia. Specifically, the White House is now blocking use of US banks to make dollar payments on Russian bonds, a move that is intended to force the Kremlin to drain domestically-held dollar reserves. Additional sanctions are reportedly in the works. For its part, the EU is reportedly debating imposition of a ban on coal, wood, chemicals and other imports from Russia, semiconductor and other high-tech exports to Russia, prohibitions on Russian use of EU transportation infrastructure, and further measures against Russian oligarchs, politicians, and military members and their families. Tighter prohibitions against transactions with Russian banks are also said to be on the table. – MPP view: Our base case is that the US administration policy is to force Russia into sovereign default, if possible. Meanwhile, the EU has come further and faster than many had expected on Russia sanctions, and we had not anticipated that a full oil embargo would yet be in the cards, nor do we think Russia will cut off EU gas if they don’t pay in rubles. But with the conflict grinding on and potentially turning even more grim (chemical weapons, further atrocities), the embargo will probably be revisited.

Additional Themes

Supply Chain Pressures in Focus – The latest reading of the Logistics Managers’ Index, which is compiled by five US universities and published by Colorado State, registered a record degree of pressure, hitting 76.2 for March after posting 75.2 in February. The New York Fed’s newly created supply chain showed a modest improvement in February but is also expected to reflect re-intensifying frictions in March amid reverberations from China’s COVID containment lockdown and Russia’s invasion of Ukraine. – MPP view: For additional color on the state of logistics bottlenecks, please see Sunday’s latest edition of the Skyline Supply Chain Risk Radar

SEC Chief Discusses Crypto Regulation – SEC Chair Gary Gensler said in a speech at the Penn Law Capital Markets Association’s annual conference that the SEC is pursuing several initiatives to better regulate cryptocurrency markets and protect investors, signaling a new era of oversight in what is now a $2 trillion market that has been riddled with scams and extreme volatility. “Any token that is a security must play by the same market integrity rulebook as other securities under our laws,” Gensler said. “There’s no reason to treat the crypto market differently just because different technology is used… We already have robust ways to protect investors trading on platforms. We ought to apply these same protections in the crypto markets.” Specifically, Gensler said the SEC will work to make sure “issuers of crypto tokens that are securities… register their offers and sales of these assets with the SEC and comply with [its] disclosure requirements,” and will explore whether crypto platforms should be treated like traditional retail exchanges. Additionally, Gensler said the SEC will collaborate with the Commodity Futures Trading Commission to oversee platforms that trade both crypto-based security tokens and commodity tokens and will take steps to regulate the $183 billion stablecoin market, which he said has raised concerns over potential conflicts of interest within crypto platforms that own large quantities of stablecoins and the potential use of stablecoins to facilitate illegal activity. – MPP view: Consumer protection in crypto is a key policy goal of this administration, but the fragmented interplay between agencies and Congress means a patchwork approach will remain in place. We continue to think that the US legislative process has little chance of producing a comprehensive bill that meaningfully confronts this issue, but we are watching the potential for stablecoin regulation more closely – this is still likely to be a post-midterm agenda item.

Looking Ahead – The March of Folly

Prior to this week’s full-scale Russian invasion of Ukraine, plenty of global security experts (and many less erudite commentators) had predicted that the massive buildup of Russian troops and material on the border would serve as a show of might and warning to NATO, but the actual objectives of President Putin’s offensive would be limited to prying away the two regions in the east, Luhansk and Donetsk. Such a conclusion tended to hinge on the expectation that a massive, unprovoked invasion of Ukraine by Russia would be a brazen war crime, particularly given the effectiveness of the Biden administration and others in exposing the Kremlin’s clumsy false flag fumbling, and almost certainly a monumental strategic blunder. Successfully capturing and then durably holding a large and populous independent country like Ukraine without incredible cost of lives and treasure simply does not seem feasible in this day and age.

As reasonable as this prediction may have been at the time, it was incorrect. Though there are still some who think that Putin is playing geopolitical chess while the Western world plays checkers, capturing Kyiv and installing a Vichy government may well prove to be the easy part. But amoral global markets don’t pick right and wrong, just what makes money or doesn’t, and the prospect of an end to the hostilities in Ukraine, no matter the shoddiness of the puppets put in place to run the country as a vassal state of Russia, are enticing opportunistic buyers back into the stock market.

They say March comes in like a lion and out like a lamb, and that may well be the forecast for financial markets over the coming month as well. If Kyiv falls over the coming weeks and Russia “negotiates” for a nominally neutral government amid a cessation of outright hostilities, financial markets are likely to experience a degree of relief (yesterday’s rally was an early flicker of these hopes). Meanwhile, we expect that the Fed will raise interest rates by 25 basis points, not 50, at the March meeting, alleviating some concerns of a maximally aggressive tightening trajectory. These factors taken together have the potential to drive a period of countertrend “risk on” price dynamics next month.

Despite the prospects of a respite in March, we retain our longstanding base case that market volatility will remain elevated into the late spring/early summer, and that concerns about Federal Reserve and global central bank overtightening into a supply shock and cyclical global slowdown will continue to drive a flattening trend of the Treasury yield curve, a firmer dollar, and reflation-in-reverse dynamics prevailing in global risk assets (with the notable exception of commodities driven by supply shocks).

Looking ahead to next week, developments in the Russia/Ukraine war will be in the spotlight, alongside what will surely be a heavily scrutinized State of the Union address by President Biden. Chair Powell’s testimony before Congress also has the potential shift market expectations about the Fed’s reaction function to the current inflationary environment, in the face of a geopolitically-driven oil price shock. It will be a big week for crude, as OPEC+ holds their monthly meeting to decide production levels for April and the Iran nuclear deal negotiations reach a critical juncture. On the data front, US February nonfarm payrolls are on the calendar on Friday, while additional US and global Purchasing Managers’ Indexes (PMIs) and EU inflation and retail sales metrics are also due. The Reserve Bank of Australia and Bank of Canada have policy decisions.