Summary and Price Action Rundown

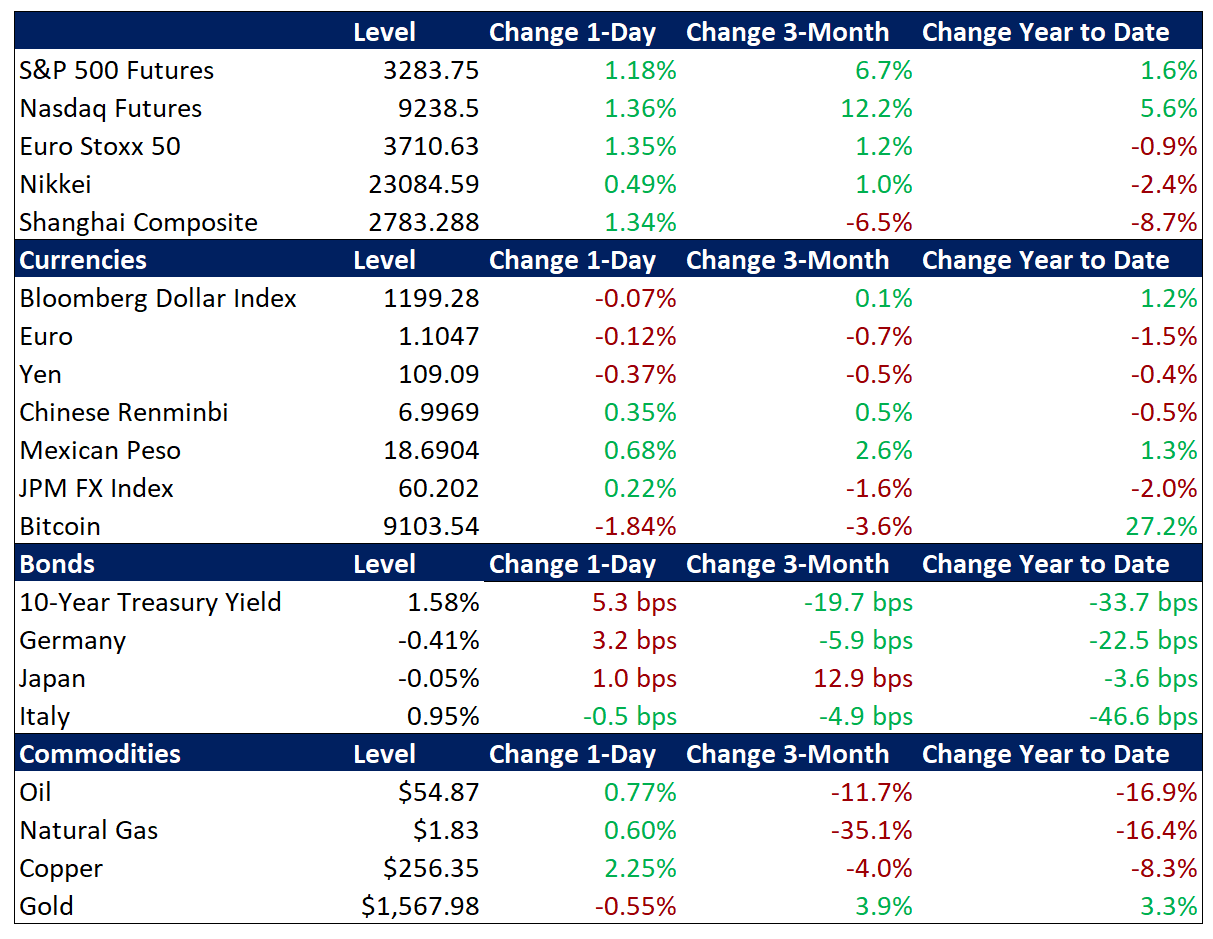

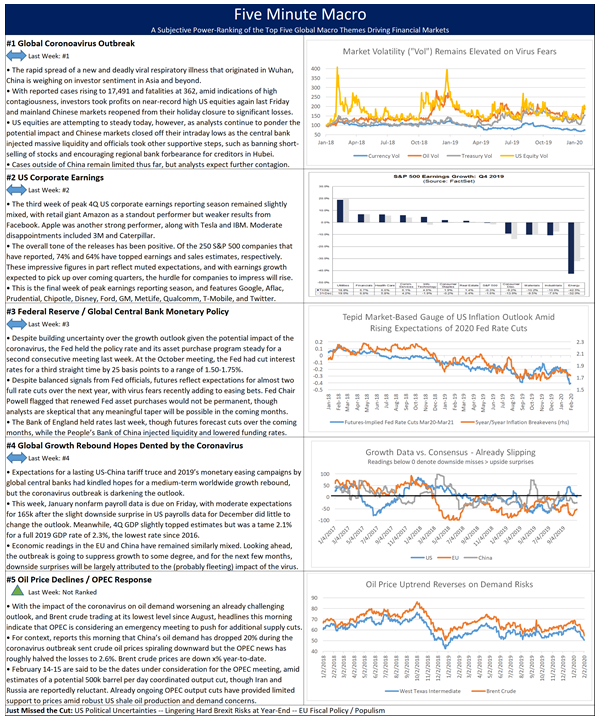

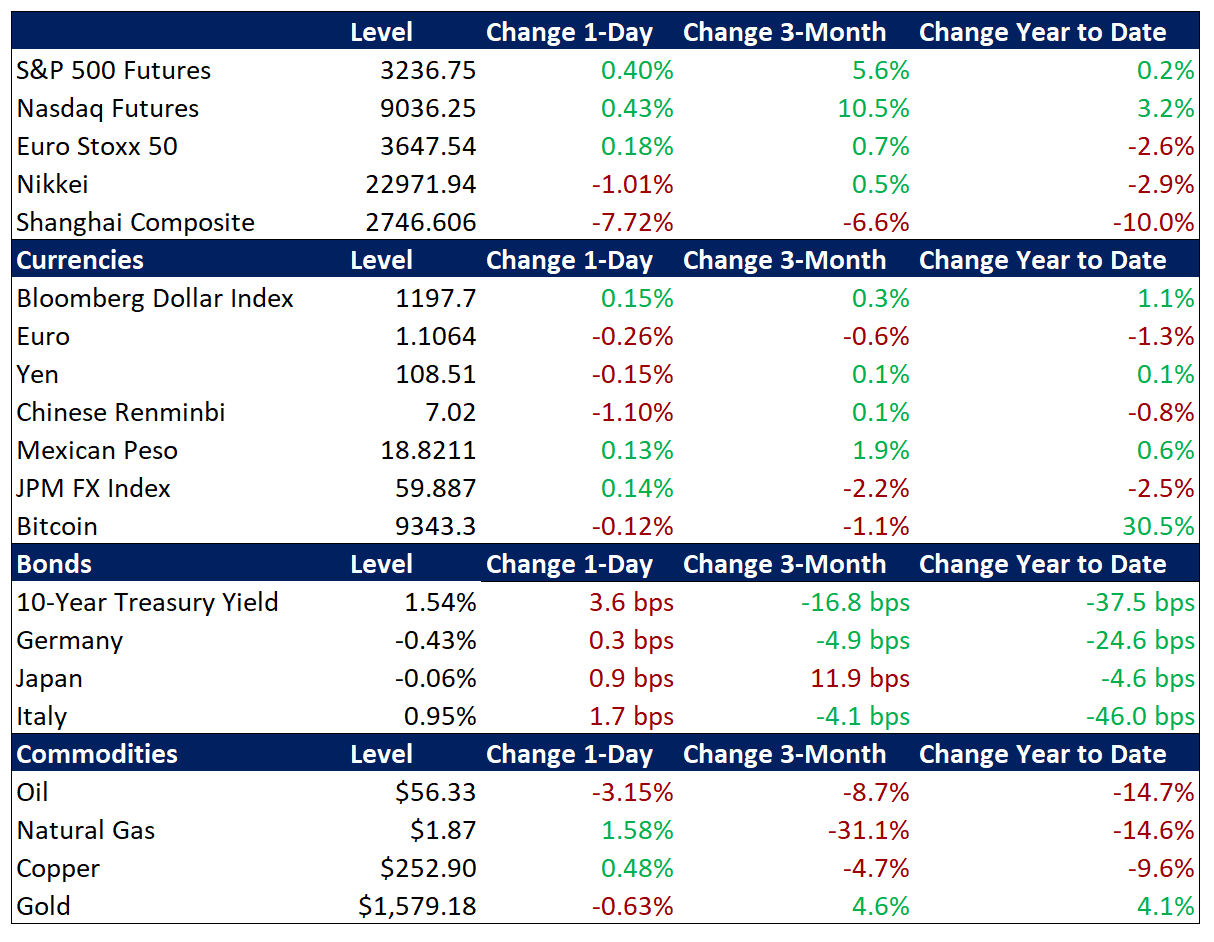

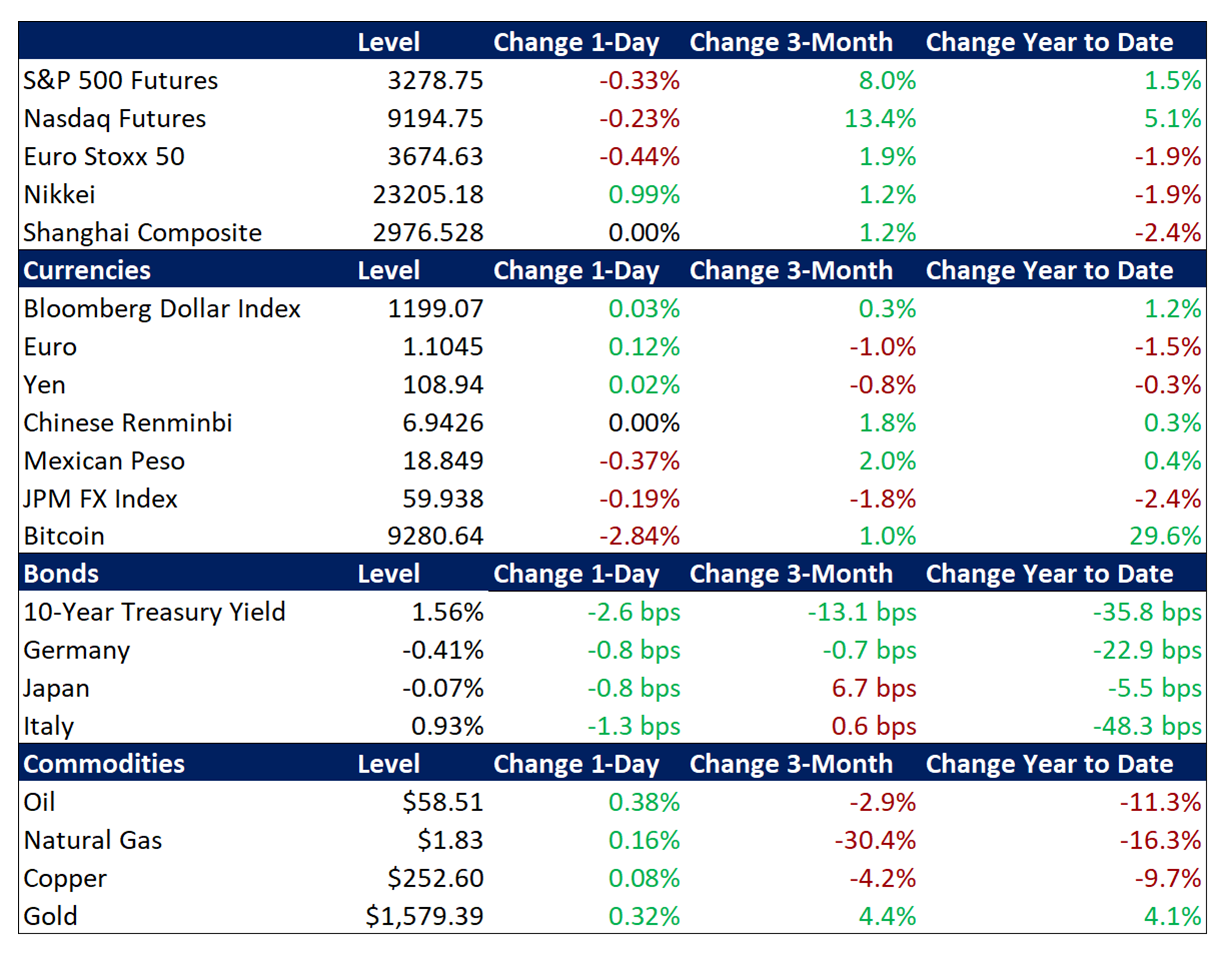

Global risk assets are maintaining this week’s steep uptrend as investors look past the ongoing outbreak to focus on China’s announced tariff cut, generally upbeat corporate earnings, ongoing monetary stimulus from global central banks, and other supportive factors. S&P 500 futures point to a 0.4% gain at the open, which would bring the index above yesterday’s new record high. After two weeks of cautious trading, risk appetite has come roaring back in recent days amid some encouraging reports on slowing infection rates and potential treatment options, which investors have taken to mean that the worst is over for the coronavirus. Overnight, equities in Asia continued to surge for a third straight session, while EU stocks are posting more moderate gains. Though safe haven demand had ebbed over recent days, sending yields slightly higher, Treasuries are steady this morning, with the 10-year yield barely above multi-month lows at 1.64%, after starting the year at 1.92%. The dollar is flat and currency market volatility has remained generally subdued. Crude oil prices staged a rebound yesterday but are struggling to make further headway amid reports that Russia is not on board with proposed OPEC supply cuts, with Brent crude fluctuating above $55 per barrel.

Rising Hopes of Virus Containment Extend the Rally

With price action this week suggesting that investors believe the worst may be over for the outbreak, virology experts still see much uncertainty.

To better understand the key risk factors of the coronavirus, please listen to the podcast we produced in conjunction with our friends at RenMac, featuring virologist Dr. Christopher Mores.

Click here for RenMac Off-Script: Coronavirus Thru Dr. Chris Mores’ Eyes:

Investors are noting that Chinese Premier Li is advising a cautious return to normal economic activity and the reopening of schools on a case-by-case basis. Correspondingly, Taiwanese chipmaker Foxconn has indicated that its mainland production is expected to be fully back online by the end of February. Total reported infections have risen to 28,344 and fatalities to 565. The Shanghai Composite rallied for a third straight day, gaining 1.7% to further retrace Monday’s sharp 7.7% loss. Official and unofficial state support is being credited with helping the index bounce back. The renminbi remained steady after appreciating past the closely-watched 7 to the dollar level earlier this week.

Corporate Earnings Retain a Positive Tone Despite Some Uneven Results

Apart from a few high-profile disappointments, fourth quarter (4Q19) corporate reports remain broadly positive, while shares of Tesla reversed a portion of their dizzying uptrend. GM reported a 4Q loss due to the autoworkers’ strike but otherwise had a solid quarter, driving shares 1.9% higher yesterday. However, its competitor Ford fell 9.5% after management provided a disappointing profit forecast for 2020. The lower projections are due to higher spending on their self-driving and electric car fleets in order to keep pace with competitor Tesla, whose shares fell 17.2% after announcing plans to delay the delivery of its Model 3 to China due to the coronavirus. However, Tesla is still up 12.9% on the week and 77.1% year-to-date. Disney declined modestly after patchy results while social media company Snap fell 14.7% after reporting disappointing sales and usage figures. Chipmaker Qualcomm is down 2.3% in pre-market trading after management indicated that the outbreak in China threatens some mobile phone supply lines. Of the 283 S&P 500 companies that have reported 4Q19 results, 75% have topped earnings expectations and 65% have beaten sales estimates. This final week of peak earnings season concludes with Twitter, Kellogg, T-Mobile, and Tyson Foods.

Additional Themes

China Tariff Cuts – In accordance with the Phase One US-China trade deal, which was signed last month, Beijing indicated today that it would be cutting import tariffs on $75 billion of US goods from 10% to 5% as of February 14th. Regarding China’s commitment to increase purchases of US agricultural and other products, which was the centerpiece of the Phase One deal, National Economic Council Director Kudlow yesterday registered the administration’s understanding that the outbreak might delay the increased buying. For context, analysts have been skeptical that China can hit its US goods purchase targets within the two-year timeframe.

Solid US Economic Data / Soft German Factory Figures – The US ADP Employment number estimated that private businesses in the US hired 291K workers in January, the most since May 2015, handily beating market expectations of 156K. Friday’s nonfarm payroll number is forecast to be a robust 163k. Also, the ISM Non-Manufacturing Purchasing Managers’ Index (PMI) rose to 55.5 in January from 54.9 in December, reaching its highest level since August. German factory orders for December, however, undershot estimates, plunging 8.7% year-on-year. Nevertheless, the euro is holding steady near multi-month lows at the key 1.10 level.