A Sars-like Virus Outbreak in Asia has taken over the top spot this week, replacing US corporate earnings, which have been solid thus far. Global growth, equity new highs and easing of trade policy round out the top 5.

A Sars-like Virus Outbreak in Asia has taken over the top spot this week, replacing US corporate earnings, which have been solid thus far. Global growth, equity new highs and easing of trade policy round out the top 5.

Summary and Price Action Rundown

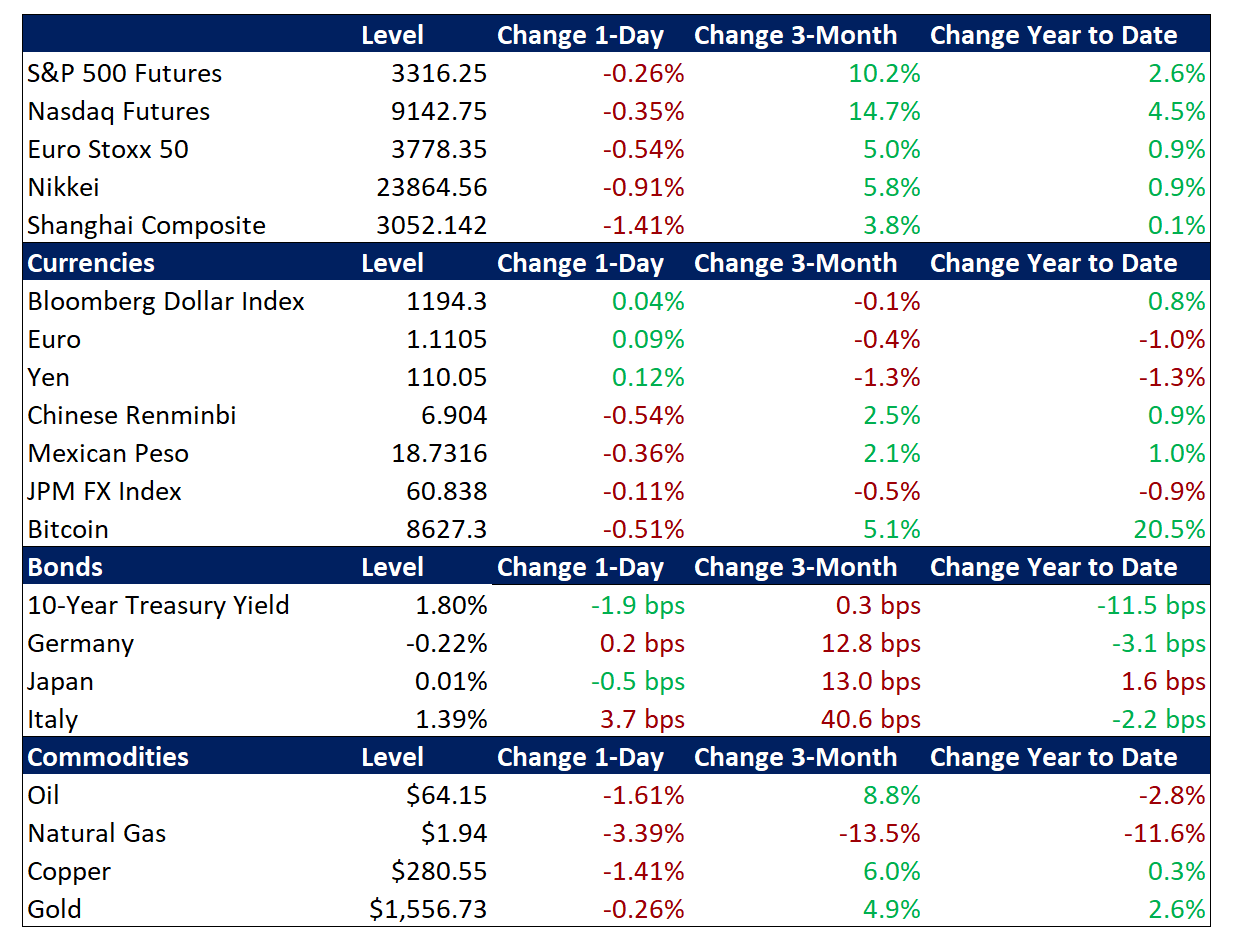

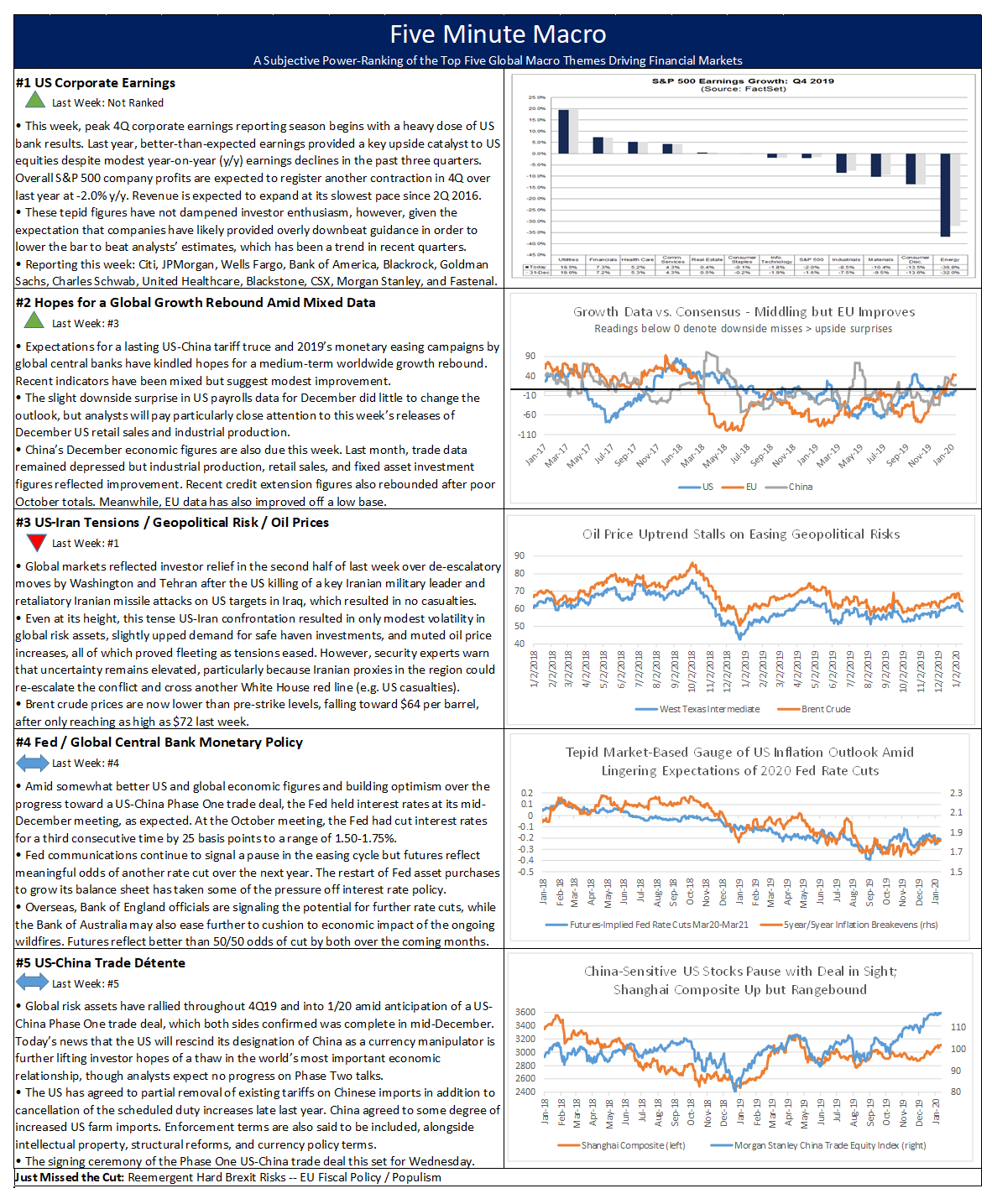

Global risk assets posted moderate losses overnight as concerns over an expanding health crisis emanating from China overshadow prevailing optimism over the nascent global growth rebound and US corporate earnings. S&P 500 futures point to a 0.3% decline at the open, which would take the index just below its third consecutive record high from Friday. US equities have been buoyant this month as investors focus on easing global trade tensions, an increasingly positive tone in fourth quarter earnings reports, and some encouraging global economic readings in recent days. Now, concerns over the spread of a virus from central China are introducing an unanticipated challenge to the upbeat outlook, much as geopolitical factors did to start the year. Overnight, equities in Asia underperformed, given proximity to the outbreak, while EU stocks are further pressured by poor earnings by mega-bank UBS. Treasuries are rallying modestly amid the increased risk aversion, while the dollar is little changed despite a 0.5% decline for the renminbi from recent five-month highs versus the dollar. Renewed doubts over demand growth are weighing on crude oil, which had received a boost from supply disruptions in Libya and fears of similar dynamics brewing in Iraq.

Public Health Concerns in China and Political Unrest in Hong Kong Hit Markets

The rapid spread of an apparently new deadly viral respiratory illness that originated in Wuhan, China is weighing on investor sentiment in Asia and beyond, while resurgent political tensions compounded pressure on Hong Kong markets overnight. Reports of hundreds of cases of the coronavirus, which is being compared to the SARS outbreak from seventeen years ago and is said to have resulted in four deaths thus far, have derailed the upside momentum for global risk assets that has been building over the past few weeks. Cases are being reported in South Korea, Thailand, and Japan, and US authorities are establishing quarantine procedures at major airports for incoming travelers from the region. Experts note that the Chinese Lunar New Year holiday, which begins this Friday, poses a substantial risk of dramatically widening the outbreak given that tens of millions of Chinese travel home or to a vacation destination for the holiday week. The Shanghai Composite fell 1.4% overnight while the renminbi lost 0.5% versus the dollar. For context, Chinese equities and the renminbi had been rallying for the past month, underpinned by improving trade relations with the US, moderately encouraging economic readings, and prospects for more economic stimulus by Beijing. Although China’s fourth quarter GDP was 6.0% year-on-year (y/y), putting the full year growth rate was down to 6.1%, the slowest expansion in nearly thirty years, details from December indicated an uptrend, buoying hopes for an economic reacceleration this year. Meanwhile, equities in Hong Kong fell 2.8% as news of the virus combined with re-intensifying political tensions to deepen the selloff. After a lull in recent weeks, protests resumed on Sunday and China’s main representative in the region urged the Hong Kong government to pass a stricter security law in a state media op-ed. Analysts note that efforts to enact such a security law were met in 2003 with mass protests.

US Corporate Earnings Expected to Remain Supportive of Equities

Investors remain optimistic on fourth quarter (4Q19) corporate results after the S&P 500 powered to a series of record highs last week amid high-profile upside earnings surprises. Last week, shares of JPMorgan, Morgan Stanley, Goldman Sachs, and Citi gained 1.5%, 10.1%, 3.1%, and 2.4%, respectively, after US mega-banks kicked off 4Q19 earnings season on a positive note. Other reporting companies that impressed investors last week include rail giant CSX, financial services mainstay Charles Schwab, and asset management leader BlackRock. Trucker JB Hunt, oilfield services provider Schlumberger, and industrial bellwether Fastenal were among the few disappointments, and shares of each experienced only moderate downside. Of the 47 S&P 500 companies that have reported 4Q19 results, 73% have topped earnings expectations and 63% have beaten sales estimates. Today features reports from Netflix, IBM, Capital One, Haliburton, and United Airlines. Johnson & Johnson, Las Vegas Sands, Northern Trust, Progressive, American Airlines, Freeport McMoRan, Discover, Intel, Southwest, M&T Bank, Proctor & Gamble, Starbucks, Travelers and American Express all report later this week.

Additional Themes

Easing US Trade Offensive – Following last week’s signing of the Phase One US-China trade deal and Senate approval of the US-Mexico-Canada trade deal, the outlook for US trade policy continues to brighten as reports yesterday indicated that President Trump and French President Macron had agreed to a tariff “cease fire” until year-end.

Mixed Global Growth Signals – The Bank of Japan held policy steady but slightly upgraded their economic outlook, although the IMF over the weekend pared their 2019 global growth forecast from 3.4% to 3.3%. Meanwhile, in Germany, the ZEW gauge of economic expectations unexpectedly popped to a four-year high, and in the UK, labor market data bettered estimates.

Summary and Price Action Rundown

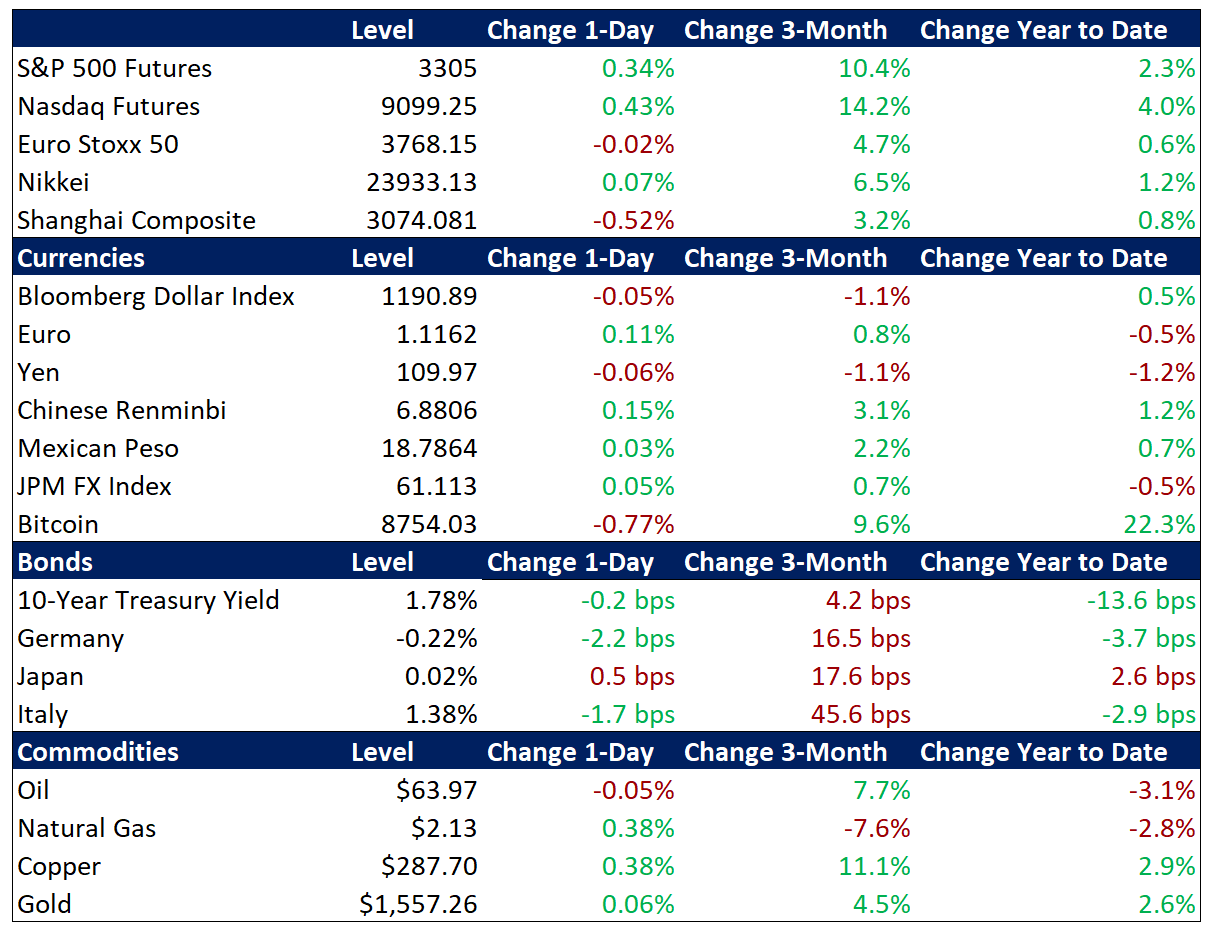

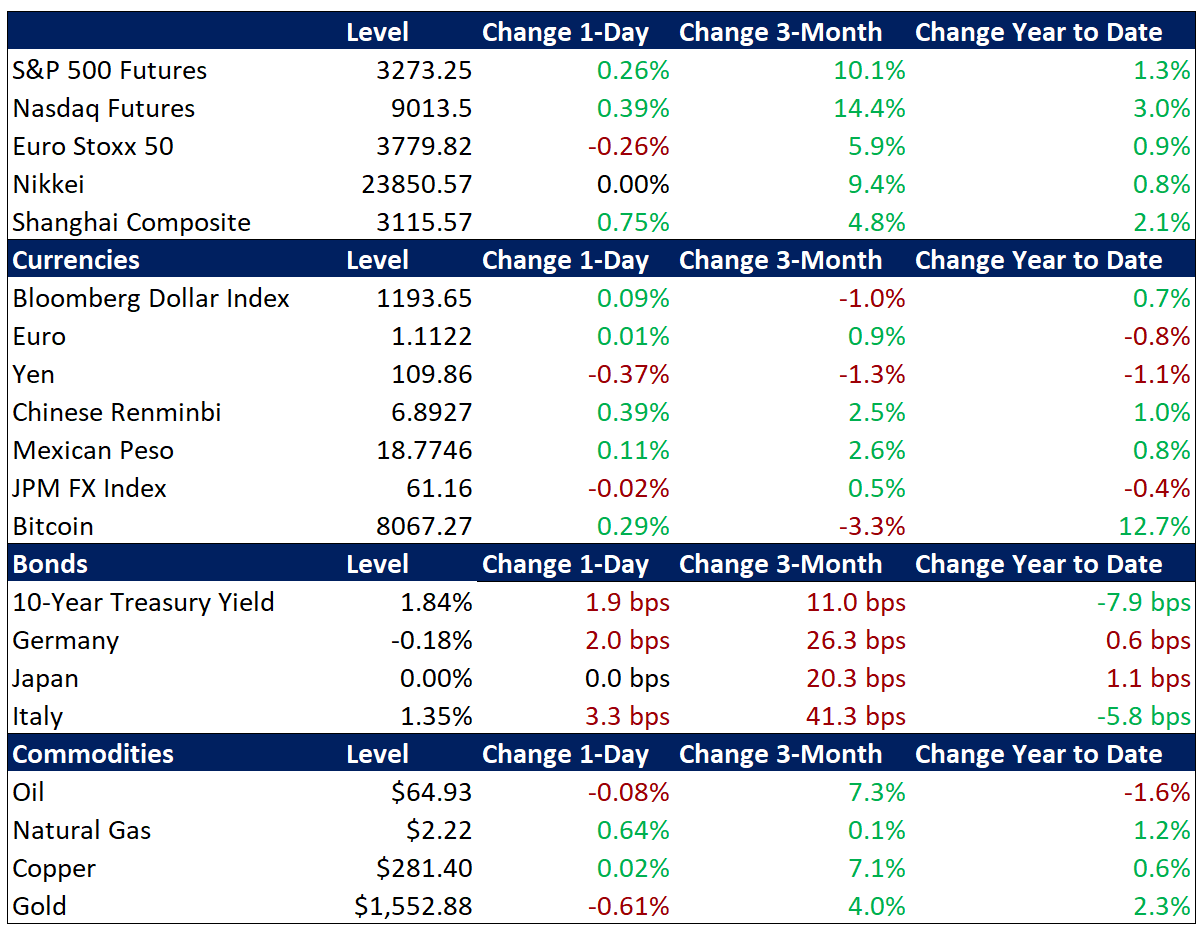

Global risk assets are extending their upside this morning as Chinese economic data suggested a burgeoning rebound while US corporate earnings remain positive. S&P 500 futures indicate a 0.2% gain at the open, which would send the index to a fresh record high for the third consecutive session. US equities have been buoyant this month as investors focus on easing global trade tensions, an increasingly positive tone in fourth quarter earnings reports, and some encouraging global economic readings in recent days. Geopolitical risks, which roiled markets to start the year, have receded into the background for now. Overnight, equities in Asia and the EU resumed their uptrend after struggling to find direction earlier this week. Treasury yields are flat this morning, as analysts note the announcement that 20-year Treasuries will be issued in the first half of this year. Meanwhile, the dollar is slightly higher as dismal UK retail sales figures and weak EU inflation data weighs on the pound and euro, respectively. Crude oil is continuing to rise from one-month lows, with Brent topping $65.

Improving Chinese Economic Data Strengthens Growth Optimism

After yesterday’s array of uniformly strong US economic data, upside surprises for China’s December activity readings added further support for expectations of a global growth rebound in 2020. Although China’s fourth quarter GDP was in-line with expectations at 6.0% year-on-year (y/y) and the full year growth rate was down to 6.1% from 6.6% last year, representing the slowest expansion in nearly thirty years, details from December indicated an uptrend, buoying hopes for an economic reacceleration this year. Industrial production evidenced the most significant improvement last month, jumping to 6.9% y/y to easily top the consensus expectation of 5.9% and the prior month’s 6.2%. Fixed asset investment, which is published on a year-to-date basis, was 5.4%, beating the estimate of 5.2%, which would have matched November’s pace. Lastly, retail sales were slightly better than expected at 8.0% y/y, which is level with the November reading. This comes after China’s total aggregate financing for December, which is its most comprehensive measure of credit extension, posted a significant upside surprise yesterday, signaling Beijing’s intent to stimulate the economy. Recent US data has also been supportive of the consensus among investors for a moderate 2020 growth rebound. In December, retail sales in the US rose 5.8% y/y, which is the biggest annual increase since August of 2018. For context, retail sales increased 3.6% for the full year 2019, down from a 4.9% gain in 2018, which was the largest in six years on the boost from tax cuts. UK retail sales, however, posted a dramatic downside surprise in December, boosting rate cuts odds.

Increasingly Upbeat Corporate Earnings Lift Equities

The S&P 500 powered to another record yesterday as high-profile upside surprises continued in fourth quarter (4Q19) corporate results. Shares of Morgan Stanley jumped 6.7% after strong 4Q19 earnings that came in well above analyst expectations. Profits rose 46% to $1.30 per share versus expectations of 99 cents. Revenue climbed 27% to $10.86 billion on the back of strong fixed income trading, following the trend set by JPMorgan and Goldman Sachs earlier this week. The large wealth management division and investment management also produced strong results for the quarter. Meanwhile, financial service bellwether Charles Schwab missed earnings estimates but its shares rallied 4.1% nonetheless as its shift to zero trading fees attracted a wave of new account openings. Rail giant CSX, which released its results after the closing bell, topped earnings forecasts despite missing sales projections, sending its stock 2.3% higher in pre-market trading. This first busy week of 4Q earnings season closes today with Citizens Bank, Fastenal, and State Street among the major companies reporting. Next week features reports from Capital One, Haliburton, Netflix, United Airlines, Johnson & Johnson, Las Vegas Sands, Northern Trust, Progressive, American Airlines, Freeport McMoRan, Discover, Intel, Southwest, M&T Bank, Proctor & Gamble, Starbucks, Travelers and American Express.

Additional Themes

US Trade Resolutions – A day after President Trump and Vice Premier Liu signed the Phase One US-China trade deal, the Senate yesterday approved the US-Mexico-Canada trade deal, the successor agreement to NAFTA. President Trump is expected to sign the bill shortly. After nearly two years of drama and brinksmanship around US trade policy, investors expect this issue to be on the backburner until the election. Specifically, the US-China Phase Two trade deal negotiations are deemed unlikely to show meaningful progress and no major imposition of tariffs on Chinese goods, EU autos, or other market-impactful products are anticipated.

Looking Ahead – In addition to continuing corporate earnings reports, next week’s calendar will include January manufacturing sector purchasing managers’ indexes in the US and EU as well as a closely-followed economic sentiment gauge for Germany. The European Central Bank and Bank of Canada both have meetings next week but neither is expected to make policy changes.

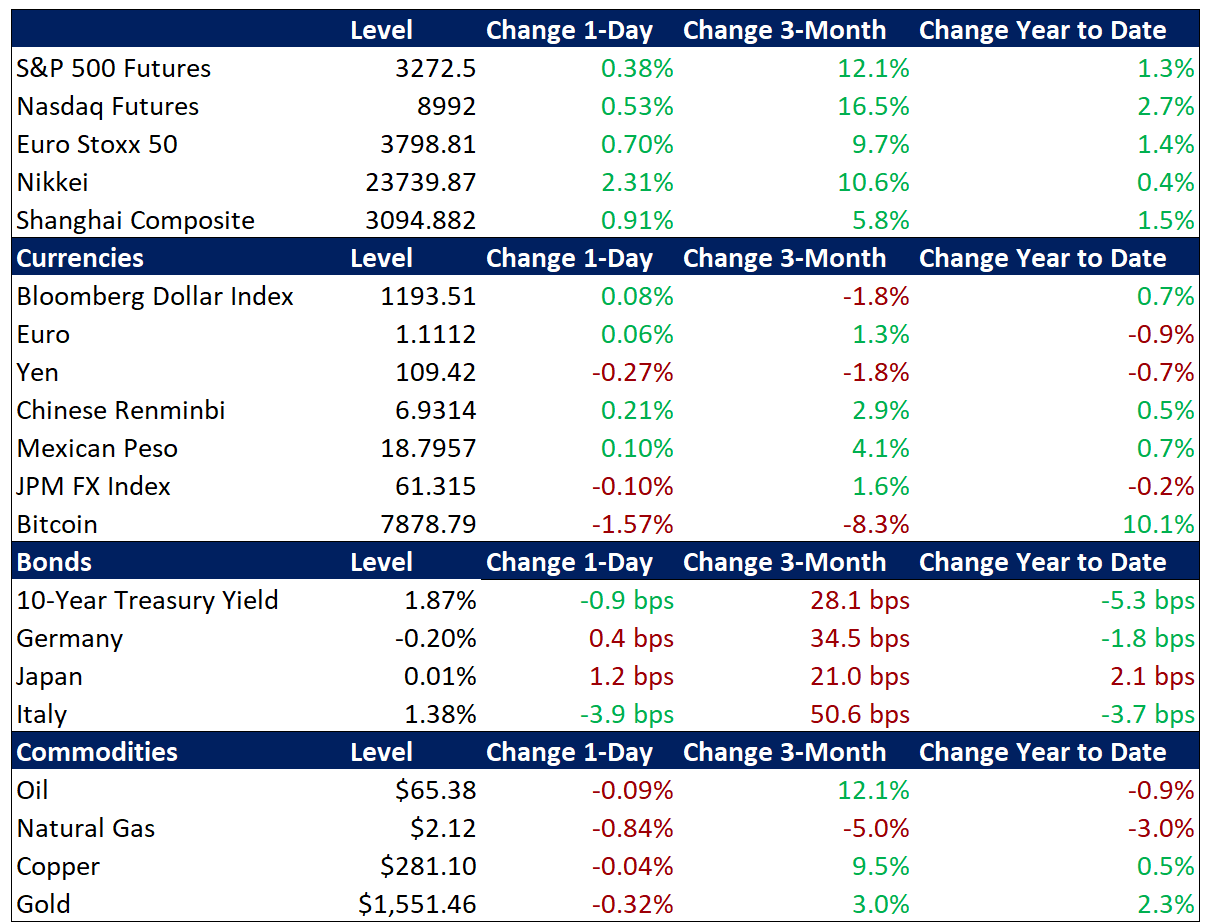

Summary and Price Action Rundown

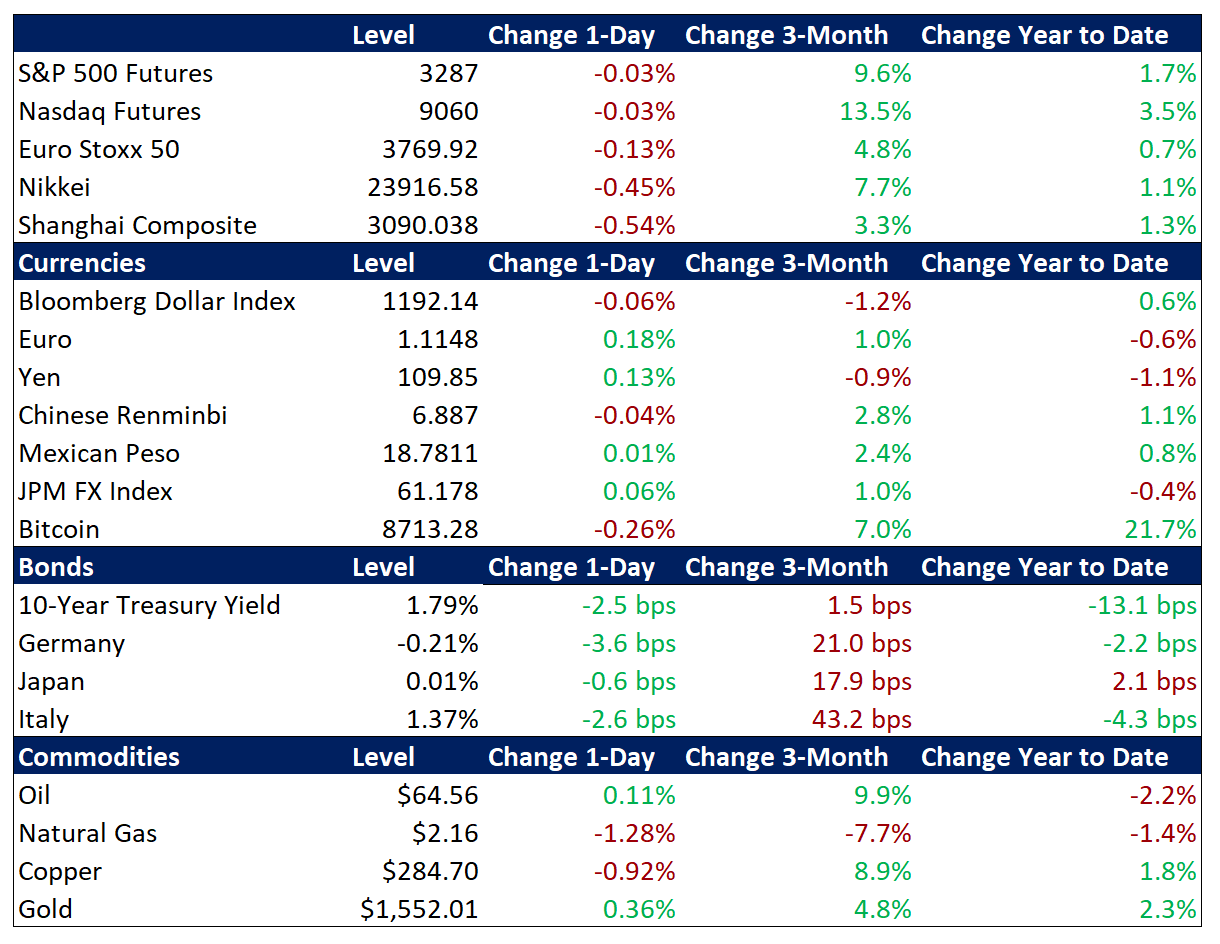

Global risk assets are rallying this morning amid positive atmospherics surrounding the completed Phase One US-China trade deal, while investors parse key economic data and US corporate earnings reports. S&P 500 futures point to a 0.3% gain at the open, which would send the index to a fresh record high for the second consecutive session. US equities have been buoyant this month even as analysts note a lack of positive surprises in the Phase One US-China trade deal terms, some mixed earnings reports, elevated geopolitical tensions, and uneven global economic readings. Overnight, equities in Asia and the EU were directionless despite better-than-anticipated Chinese credit figures (more below). Treasury yields and the dollar are flat, hovering within their recent ranges, as traders await key US retail sales data later this morning. Crude oil is flat as prices continue to fluctuate near one-month lows.

Nuanced Market Reaction to Phase One US-China Trade Deal Completion

Global risk assets have been mixed as the positive atmospherics of the Phase One trade deal signing were offset by a lower-than-expected degree of tariff relief and some lingering ambiguities in the agreement. The long-awaited Phase One US-China trade deal was signed yesterday at the White House by President Trump, who called it a “monster” deal, and Chinese Vice Premier Liu, who stated that Beijing is “full of confidence” in the positive impact of the accord. Notwithstanding these optimistic official assessments, analysts are noting few positive or negative surprises. China’s pledge to import more US goods, which was Beijing’s central concession for this stage of the trade deal, was roughly as expected, but soybean, corn, and cotton futures are retreating for a second day amid less clarity than anticipated on purchase quotas. Analysts are also focused on the target of $50 billion in US energy purchases over two years. Commitments to avoid competitive currency devaluation were noted, with some verbiage on enforcement that suggests scant difference from the status quo. The renminbi was up 0.2% versus the dollar overnight, extending its gains from September’s low to 4.2% and reaching a five-month high. Meanwhile, the language on intellectual property protections and tech transfer lacked specifics and the continuation of US tariffs of 25% on $250 billion and 7.5% on $120 billion of Chinese imports for a 10-month window was viewed as a disappointment. Although President Trump indicated that these tariffs would be removed as part of the next stage of negotiations, which Vice President Pence said have already begun, analysts expect no progress toward a Phase Two deal before the US election in November.

Equities Remain Upbeat Amid Mixed Corporate Earnings and News

Although the S&P 500 climbed to another record yesterday, price action at the sectoral level was disparate after some uneven fourth quarter (4Q19) corporate results. Shares of UnitedHealth Group jumped 2.5% after the health care coverage company reported 4Q19 profit that beat expectations although revenue missed estimates. Goldman Sachs’ stock price fluctuated but closed slightly lower after handily beating consensus earnings expectations but posting a litigation charge of $1.1 billion. Bank of America, meanwhile, fell 1.8% despite better than expected earnings as investors focused on lower expected net interest margins in 2020 due to 2019 Fed rate cuts. Finally, shares of Blackrock, the largest asset manager in the world, closed 2.3% higher after reporting strong results and robust flows into its exchange-traded funds (ETFs). Shares of big box retailer Target fell 6.6% after the company reported disappointing holiday sales numbers, which also weighed on shares of its retailing peers. This downbeat disclosure precedes today’s US December retail sales figures (more below). Today’s high-profile earnings releases include Blackstone, CSX, and Morgan Stanley. And the week closes tomorrow with Citizens Bank, Fastenal, and State Street.

Additional Themes

Solid Chinese Credit Data – China’s total aggregate financing for December, which is the most comprehensive measure of credit extension that Beijing publishes, posted a significant upside surprise, suggesting that authorities are seeking to facilitate another credit-fueled growth rebound for the stuttering mainland economy. However, the more important subsector of new bank loans was slightly below estimates. This comes ahead of tonight’s release of 4Q GDP, which is expected to be steady at 6.0%, and retail sales, industrial production, and fixed asset investment figures for December, which are expected to show broad stability.

US Retail Sales Data Due – December’s retail sales figures are forecast to feature a reacceleration of the headline rate to 0.3% month-on-month (m/m) from 0.2% in November, while the core metric, which strips out auto and gasoline sales, is projected to rebound to 0.4% m/m from 0% in November. Although Target’s downgraded holiday sales numbers could bode ill for retail, analysts note that this disappointment could reflect the shift to online purchasing rather than overall consumer weakness.

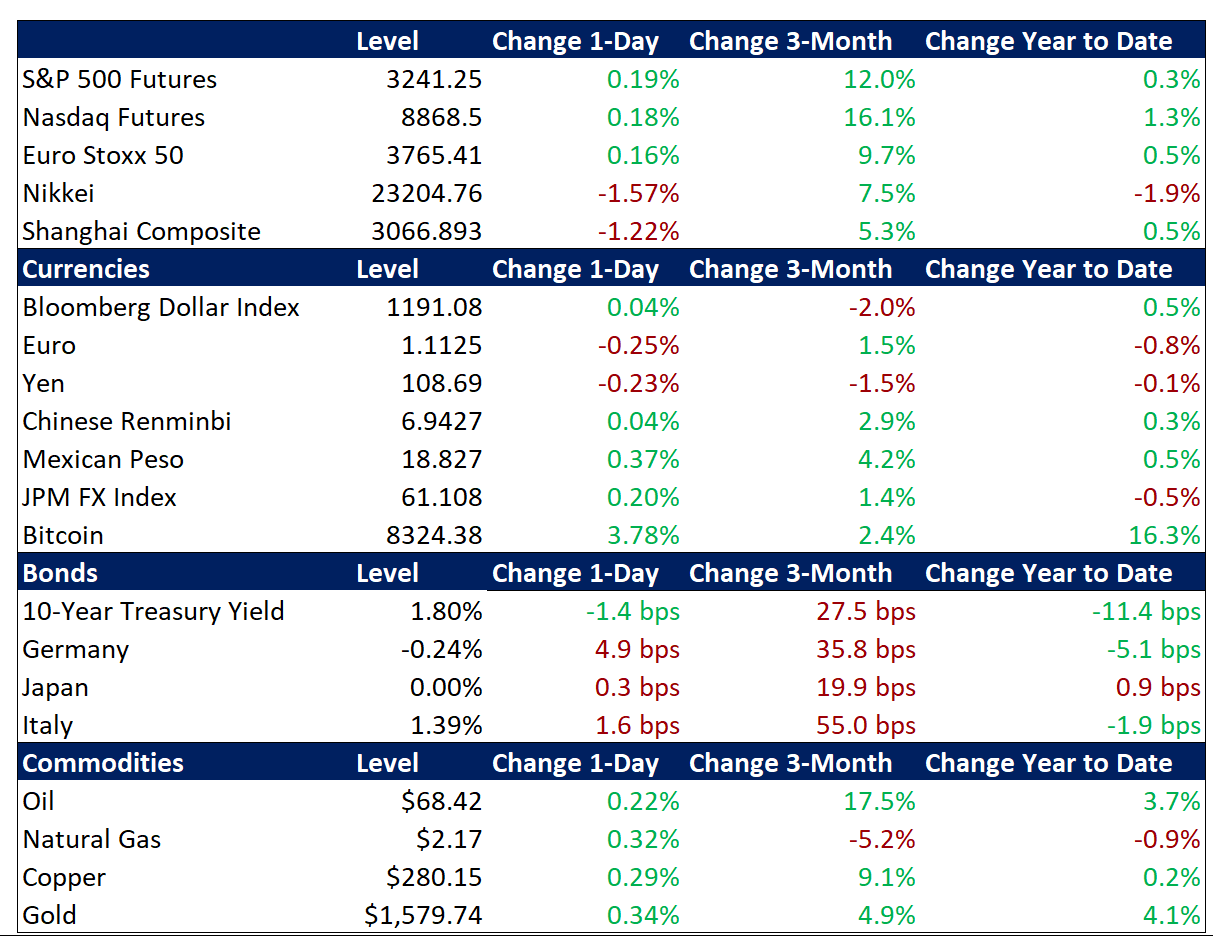

Summary and Price Action Rundown

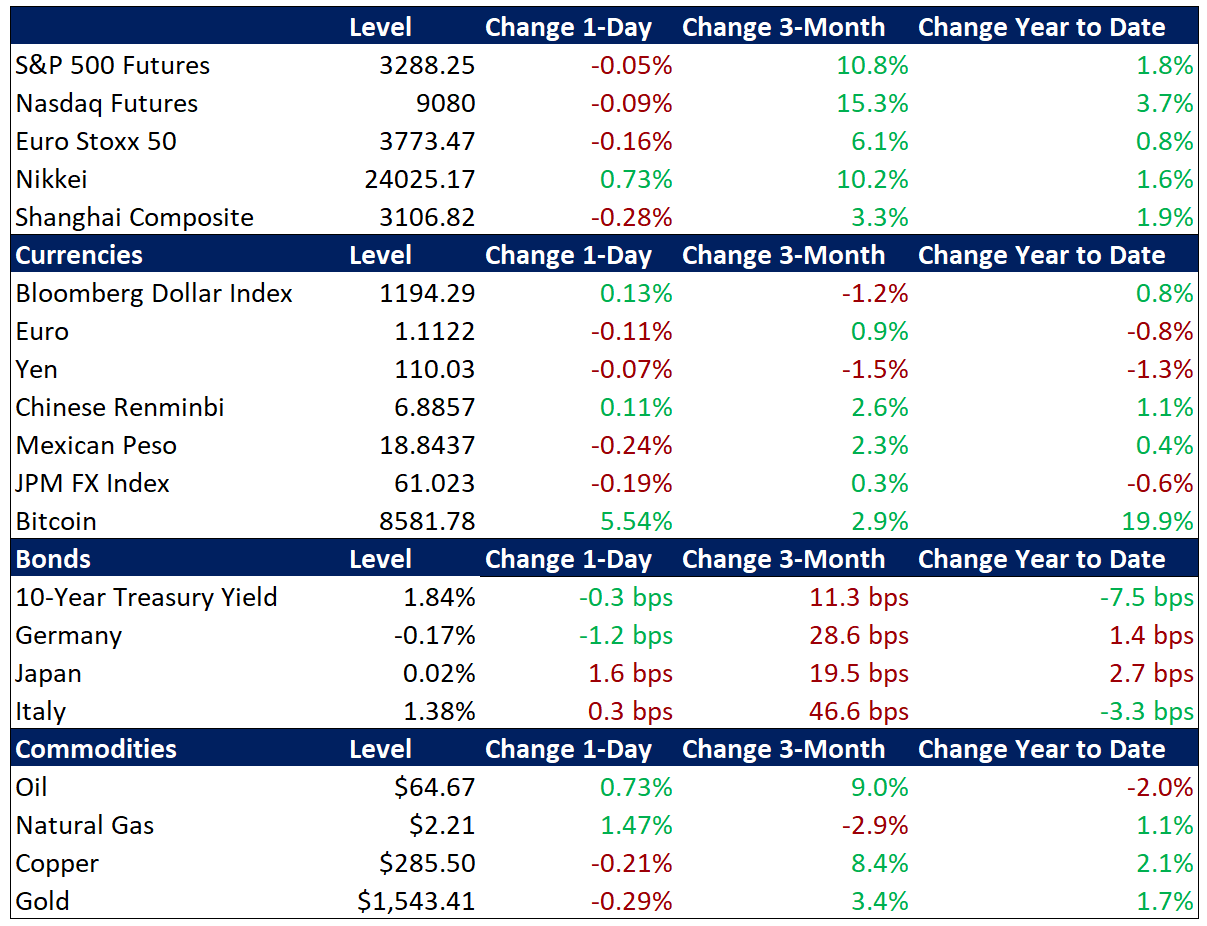

Global risk assets were mostly lower overnight after yesterday’s headlines dampened enthusiasm over the Phase One US-China trade deal, while investors continue to monitor US corporate earnings reports. S&P 500 futures indicate a flat open, which would retain the index’s modest decline yesterday from Monday’s record high. Overnight, equities in Asia and the EU were broadly subdued amid shifting expectations for US tariff reduction (more below). Treasury yields are lower but remain in their recent range ahead of tomorrow’s key US retail sales data, while the dollar is flat. Oil prices are slightly higher this morning as investors follow headlines from the ongoing conflict in Libya and await US inventory data. For context, crude prices are now trading below the levels that preceded the rising US-Iran tensions.

Earning Reporting Off to a Positive Start

Yesterday, US stocks rallied prior to the US-China tariff headlines as mostly solid corporate reports kicked off a potentially consequential set of fourth quarter (4Q) corporate results. Shares of JPMorgan Chase closed 1.0% higher after the bank reported fourth quarter (4Q19) profits and revenue that handily beat markets expectations on the back of strong trading revenue. Profits rose 21% to $8.52 billion, which equates to $2.57 per share, while analysts were expecting $2.35. Citigroup shares also rallied, climbing 1.6% after reporting earnings of $1.90 per share compared to $1.84 expected. The bank earned $18.38 billion on the back of strong fixed income trading that was almost double what analysts expected and 49% higher than 4Q18. However, shares of Wells Fargo traded down 5.4% after the bank reported disappointing earnings after newly appointed CEO Charles Scharf set aside another $1.5 billion for ongoing legal costs related to the bank’s fake-account sales scandal while also promising “fundamental changes”. Revenue of $2.87 billion came in well below the $6.06 billion earned a year earlier, while earnings per share of 60 cents missed analysts’ expectations of $1.12. Today’s packed earnings calendar features reports from Bank of America, Blackrock, Goldman Sachs, Charles Schwab, and United Healthcare. Thursday’s focus will be on Blackstone, CSX, and Morgan Stanley. And the week closes with Citizens Bank, Fastenal, and State Street. Last year, better-than-expected earnings provided a key upside catalyst to US equities despite modest year-on-year (y/y) earnings declines in the past three quarters and consensus expectations for another contraction in 4Q at a rate of -2.0% y/y.

US-China Trade News Dampens Deal Optimism

US stocks surrendered gains in midday trading yesterday and remain subdued following headlines indicating that the Phase One trade deal will provide less tariff relief than investors had hoped. News that US tariffs of 25% on $250 billion and 7.5% on $120 billion of Chinese imports will be kept in place for a 10-month window for commitment enforcement knocked US equities from their highs of the day into negative territory and continue to exert a headwind on sentiment this morning. The final terms of the US-China Phase One trade deal have not been made public even though the signing ceremony is set for today. Despite the diminished expectations for the US and China to further unwind their tariffs, the renminbi is steady versus the dollar this morning, holding its recent gains at its strongest level since last August after having gained 4.0% over four months. Going forward, analysts expect no progress on a Phase Two deal before the US election in November. Meanwhile, China’s December trade figures picked up, with exports and imports rising to 7.6% y/y and 16.3% y/y, respectively, from -1.3% and 0.8% the prior month. Other key Chinese December data is due this week, including credit extension figures, retail sales, industrial production, and fixed asset investment.

Additional Themes

Weak Economic Data Overseas – German bonds are rallying but the euro is stable versus the dollar after Germany’s 2019 GDP reading matched estimates of a dismal 0.6% y/y rate, down from 1.5% the prior year. This is the slowest pace since 2013 and the consensus outlook is for only a slight improvement in 2020 to 0.7% GDP growth. Meanwhile, UK consumer price inflation unexpectedly stagnated in December. This data has further lifted futures-implied odds of a Bank of England rate cut at the next meeting on January 30th to nearly 65%. However, the pound is steady versus the dollar, having already lost 2.4% over the past month.

Softening US Inflation Data – The Consumer Price Index (CPI), a key gauge of US inflation, increased 0.2% month-on-month (m/m) in December, slightly below market forecasts of 0.3%. This puts the CPI up 2.3% year-on-year (y/y), up from 2.1% in November and in line with consensus. Core CPI, which excludes volatile items such as food and energy, increased 0.1% m/m, missing market expectations of a 0.2% rise. On an annual basis, Core CPI was up 2.3%, in line with market forecasts. These slight downside surprises depressed Treasury yields. Producer price inflation figures for December are due today, with expectations for muted pressures.

Summary and Price Action Rundown

Global risk assets were mixed overnight with investors closely monitoring today’s unofficial start to US corporate earnings reporting season. S&P 500 futures point to a 0.1% decline at the open, which would keep the index close to yesterday’s latest record high. Overnight, equities in Asia and the EU lacked direction, as analysts will look to today’s results from major US banks and other companies for positive or negative cues. Treasury yields are hovering in their recent range ahead of today’s US inflation data, while the dollar is edging to the stronger side. Oil prices are turning higher this morning as investors follow headlines from the ongoing conflict in Libya, which has maintained relatively steady production levels despite the unfolding civil war. Nevertheless, international benchmark Brent crude and US benchmark WTI remain below the levels that preceded the intensification of US-Iran tensions earlier this month.

Equities Fluctuate Ahead of Key Earnings Reports

US stocks turned higher again yesterday but are pausing this morning as analysts await a potentially consequential set of fourth quarter (4Q) corporate results. This morning, peak 4Q corporate earnings reporting season begins with a heavy dose of US bank results. Today, analysts will see how the year ended for Citi, JPMorgan and Wells Fargo. Wednesday’s packed calendar features reports from Bank of America, Blackrock, Goldman Sachs, Charles Schwab, and United Healthcare. Thursday’s focus will be on Blackstone, CSX, and Morgan Stanley. And the week closes with Citizens Bank, Fastenal, and State Street. Last year, better-than-expected earnings provided a key upside catalyst to US equities despite modest year-on-year (y/y) earnings declines in the past three quarters. Overall S&P 500 company profits are expected to register another contraction in 4Q over last year at -2.0% y/y. Meanwhile, top-line revenue is forecast to expand 2.6% y/y last quarter, which would be the slowest pace of expansion since 2Q 2016. These tepid figures have not dampened investor enthusiasm for US stocks, however, given the expectation that companies have likely provided overly downbeat guidance in a repeat of recent quarters that featured high rates of upside surprises. Also, earnings growth is expected to rebound to around 4.5-6.5% y/y in the first half of 2020, and then improve even further thereafter, which suggests that the bar will be raised for companies to impress analysts.

More US-China Conciliation in Advance of the Phase One Deal Signing

Yesterday’s news that the US Treasury rescinded its designation of China as a currency manipulator further boosted investor hopes of a thaw in the world’s most important economic relationship. The long-awaited Treasury foreign exchange report, which was delayed beyond its usual fourth quarter publishing timeframe presumably due to ongoing negotiations with China, was released yesterday and labeled no countries as currency manipulators. For context, China’s brief designation as a currency manipulator was announced in August, not as part of the official report but in response to abrupt renminbi weakness after President Trump announced a new round of tariff threats. In the press release accompanying the Treasury’s report, Secretary Mnuchin is quoted as stating that “China has made enforceable commitments to refrain from competitive devaluation, while promoting transparency and accountability,” though official terms of the Phase One trade deal have not yet been made public. This came ahead of the arrival of a Chinese delegation led by Vice Premier Liu in Washington for the scheduled signing ceremony of the Phase One trade deal tomorrow. The renminbi has gained 0.5% versus the dollar since the news of this move by the Treasury and is at its strongest level since last August, having appreciated 4.0% over four months. Going forward, analysts expect that no progress will be made on a Phase Two deal before the US election in November. Meanwhile, China’s December trade figures picked up, with exports and imports rising to 7.6% y/y and 16.3% y/y, respectively, from -1.3% and 0.8% the prior month.

Additional Themes

US Inflation Data – Today’s reading of December consumer prices (CPI) is expected to accelerate to 2.4% y/y from 2.1%, with a steady 2.3% y/y for core CPI. The Fed targets 2% inflation, but it prefers to use a different metric than CPI, instead focusing on the core personal consumption expenditure (PCE) price index. Core PCE is currently 1.6% and in the past five years has only topped 2% for a few months in the middle of 2018 and in early 2012. Futures markets continue to reflect a meaningful likelihood of another rate cut over the coming year.

BlackRock Focuses on Climate Change – CEO Fink of the mega-asset manager has stated in his annual letter to US corporate executives that his firm will be increasingly focused on climate-related issues in its investment decisions and engagement with companies. He characterizes this initiative as a “fundamental reshaping of finance” as the industry struggles to factor in the uncertain but potentially dramatic medium to longer-term impact of climate issues and sustainability into their traditional valuation metrics.

This week’s top 5 are US Corporate Earnings, Hopes for Global Growth, US-Iran tensions, Central Banks and US-China détente.

Summary and Price Action Rundown

Global risk assets were mixed overnight but US equity futures are higher as investors shift their attention from Friday’s decent jobs report to US corporate earnings and retail sales data this week. S&P 500 futures indicate a 0.3% gain at the open, which would retrace Friday’s moderate losses to send the index back toward Thursday’s record high. Overnight, equities in Asia were generally higher but EU stocks are turning mixed as investors search for positive cues. Treasury yields and the dollar are both retracing most of their post-nonfarm payroll downside and continue to trade within recent multi-month ranges (more below). Oil prices are pausing after having been whipsawed by the waxing and waning geopolitical risks this month, with Brent crude dipping below $65 per barrel after spiking to nearly $72 during the initial reports of Iranian missile attacks on US targets in Iraq last Tuesday night.

Markets Look Past Mixed US Jobs Report

The gentle declines in US Treasury yields, equities, and the dollar that followed Friday’s modest downside surprise in December nonfarm payrolls have reversed as investors shift their focus to retail sales and other key US data this week. Nonfarm payrolls increased 145k in December, missing market expectations of 164k and descending from a downwardly revised 256k gain in November. Notable job gains occurred in retail trade, which added 41k jobs, though this could be due to a later-than-normal Thanksgiving in 2019. The unemployment rate held steady at 3.5%, the lowest level since 1969, and the labor force participation rate was unchanged at 63.2. Average hourly earnings (AHE) rose 0.1%, to $28.32, after an upwardly revised 0.3% gain in November, missing market estimates of a 0.3% gain. Year-on-year, AHE increased 2.9%, easing from a 3.1% gain in November and below market expectations of a 3.1% gain. While Friday’s market reaction was consistent with the slightly softer tone of the report, the moves have proven fleeting as Treasury yields, the dollar, and S&P 500 futures are moving higher again this morning ahead of more economic data this week, with December retail sales in the spotlight. The strength of the US consumer is expected to be on display in last month’s retail figures, with the core figure (excluding autos and gasoline) forecast to rise 0.5% month-on-month versus a flat reading for November.

Corporate Earnings Reports Awaited

US equities are rising ahead of a potentially consequential set of fourth quarter (4Q) corporate results, with reporting beginning in earnest tomorrow. This week, peak 4Q corporate earnings reporting season begins with a heavy dose of US bank results. On Tuesday analysts will see how the year ended for Citi, JPMorgan and Wells Fargo. Wednesday’s packed calendar features reports from Bank of America, Blackrock, Goldman Sachs, PNC, Charles Schwab, United Healthcare, and US Bank. The focus on Thursday will be on Blackstone, CSX, and Morgan Stanley. And the week closes with Citizens Bank, Fastenal, Regions Financial, and State Street. Last year, better-than-expected earnings provided a key upside catalyst to US equities despite modest year-on-year (y/y) earnings declines in the past three quarters. Overall S&P 500 company profits are expected to register another contraction in 4Q over last year at -2.0% y/y. Meanwhile, top-line revenue is expected to expand 2.6% y/y last quarter, which would be the slowest pace of expansion since 2Q 2016. These tepid figures have not dampened investor enthusiasm, however, given the expectation that companies have likely provided overly downbeat guidance in order to lower the bar to beat analysts’ estimates. Additionally, earnings growth is expected to rebound to around a 4.5-6.5% year-on-year rate in the first half of 2020.

Additional Themes

Bank of England (BoE) Rate Cut Expectations Rise – The ongoing trend of monetary easing by major global central banks may soon include another rate cut by the BoE. Futures markets have moved sharply today to price in greater-than-50% odds of a 25 basis point reduction in the policy rate at the January 30th meeting from 0.75% to 0.50%. This shift of the policy outlook is weighing on the pound, which is down 0.8% versus the dollar, extending its losses from its December peak to 2.7%. As the catalyst for the move, analysts are citing remarks by a key member of the BoE monetary policy committee to the Financial Times indicating that the bar for further easing is low and implying that action could be taken over the coming meetings.

This Week – In addition to this week’s corporate earnings figures, analysts will monitor the ongoing geopolitical tensions in the Middle East as well as the expected culmination of months of US and Chinese trade negotiations. Chinese Vice Premier Liu has confirmed that he will be coming to Washington ahead of a signing ceremony of the Phase One trade deal on Wednesday, January 15th. Regarding economic data, the calendar is heavy with December’s US retail sales, industrial production, and wholesale and consumer price inflation figures, as well as China’s 4Q GDP reading and key growth data for December.

Summary and Price Action Rundown

Global risk assets advanced overnight, reflecting investor relief over easing tensions between the US and Iran. S&P 500 futures indicate a 0.4% gain at the open, which would build on yesterday’s strong gain and put the index above last Thursday’s record high. Overnight, equities in Asia and the EU posted similarly robust upside as risk appetite was buoyed by the de-escalatory actions by the US and Iran. Correspondingly, demand for safe haven assets like Treasuries and gold has ebbed, although the latter is retaining much of its gains over the past week. Yields on 10-year Treasuries have popped to 1.87% but remain within their multi-month range between 1.45% and 1.95%, while the dollar is continuing to climb above recent multi-month lows ahead of key US economic data (more below). Oil prices have reversed sharply amid the easing geopolitical tensions, with Brent crude between $65 and $66 per barrel after spiking to nearly $72 during the initial reports of Iranian missile attacks on Tuesday night.

Global Stocks Rally as Washington and Tehran Step Back

After Iran’s reprisal attacks on US troops in Iraq on Tuesday evening resulted in no American casualties and were accompanied by balanced rhetoric on both sides, President Trump affirmed a cessation of hostilities yesterday, boosting investor sentiment. The past week’s events have induced moderate volatility across global markets but even at its peak, the degree of risk aversion was moderate relative to the scale of the geopolitical threat. Tuesday evening, global financial markets were roiled by reports of missile attacks on a number of Iraqi military installations housing US troops. Iran quickly took credit for the attacks, characterizing them specifically as a response to the US killing of Iranian General Soleimani late last week. S&P 500 futures were down nearly 2% and oil prices had spiked almost 5%, with Brent nearing $72 per barrel. Sentiment began to recover swiftly amid reports of no American casualties and Iran’s measured rhetoric regarding the attacks, which called them proportionate and promised no further action absent a US counterstrike. Later, President Trump tweeted “All is well” and Iraq’s Prime Minister stated that Iran provided advance warning of the strikes. Yesterday morning, President Trump stated that Iran was “standing down” and announced tighter sanctions but no new military action, thereby alleviating investor fears of all-out war. Among the safe haven asset classes that saw their demand spike in response to the heightened tensions, Treasuries, the yen, and oil have largely reverted to pre-strike levels, although gold prices are retaining a portion of their gains. The S&P 500 is set to vault to another record at the open. This investor equanimity in the face of still-elevated risks is supported by recent history, in which geostrategic flare-ups have mostly proven fleeting and immaterial to global financial markets.

More Downbeat EU Data Contrasts with Solid US Labor Market Figures

Following yesterday’s disappointing reading of factory orders, Germany’s trade data relapsed to the downside this morning, as the euro nurses year-to-date losses. Data in Europe remains spotty as German exports and imports fell 2.3% month-on-month (m/m) and 0.5% m/m, respectively, in November, undershooting expectations of -0.9% and 0.1% as well as the prior month’s 1.5% and 0.5%. This comports with November’s weak German factory orders, which fell 1.3% m/m in November, well below estimates of a 0.3% rise. Meanwhile, the Euro area Business Climate Indicator fell by 0.04 points in December to -0.25, the lowest level since August 2013, and below market expectations of -0.16. This recent string of downbeat EU economic data has sent the euro 1.0% lower versus the dollar over the past week, with Friday’s US nonfarm payroll number potentially offering further support to the greenback in the event of an upside surprise, Yesterday, the ADP Employment Report showed that private businesses in the US added 202K workers in December, the most since April and well above expectations of 160K. The service sector added 173K jobs while the goods-producing sector added 29K jobs, as a 37K gain in construction jobs was enough to offset continued declines in manufacturing. Nonfarm Payrolls will be released on Friday and consensus estimates are for a 160K increase.

Additional Themes

Fed Speakers on the Calendar – As analysts await Friday’s nonfarm payroll number, a bevy of Fed officials will weigh in on the economic outlook. Vice Chair Clarida, and regional Fed presidents Kashkari, Evans, Bullard, Williams, and Barkin will all deliver remarks today. Analysts expect little change in the prevailing “wait-and-see” policy posture, cautious optimism on US growth, and focus on soft inflation. Futures markets still reflect meaningful odds of another rate cut over the coming year but the Fed’s ongoing asset purchase program has taken some of the pressure off interest rate policy. A gauge of US financial conditions compiled by Goldman Sachs suggests that the monetary environment is near its loosest level in five years.

US-China Trade Deal in Sight – Chinese Vice Premier Liu has confirmed that he will be coming to Washington next week for a signing ceremony of the Phase One trade deal on January 15th.

Summary and Price Action Rundown

Global risk assets were mixed overnight as investors grappled with risks of an escalating US-Iran conflict following last evening’s missile attacks on Iraqi military sites housing US troops, but risk appetite is steadying this morning on measured rhetoric from Washington and Tehran. S&P 500 futures point to a 0.2% gain at the open, which would nearly retrace yesterday’s moderate loss and keep the index within 0.5% of last Thursday’s record high. Overnight, equities in Asia underperformed amid the uncertainty while stocks in the EU are rebounding ahead of President Trump’s statement on the attacks, which is expected later this morning. The market mood remains cautious, however, with safe haven assets like Treasuries and gold retaining some gains while oil prices, which have been reflecting an increasing geopolitical risk premium, continue to move higher as well. Yields on 10-year Treasuries are hovering at 1.80%, within their multi-month range between 1.45% and 1.95%, while the dollar is edging above multi-month lows ahead of key US economic data (more below). Oil prices are fluctuating near multi-month highs, with Brent crude between $68 and $69 per barrel.

US Response to Iranian Missile Strike Awaited

Investor sentiment remains cautious after Iran’s reprisal attacks targeting US troops in Iraq last evening but the lack of American casualties, limited nature of the strikes, and hints of de-escalatory intent on both sides are supporting optimism for cessation of hostilities. Last evening, global financial markets were roiled by reports of missile attacks on a number of Iraqi military installations housing US troops. Iran quickly took credit for the direct attacks, characterizing them specifically as a response to the US killing of Iranian General Soleimani late last week. Amid conflicting reports about US casualties and additional hostilities, S&P 500 futures were down nearly 2% and oil prices had spiked almost 5%, with Brent nearing $72 per barrel. For context, this price action was significant but far from extreme, and trading conditions remained orderly throughout. Sentiment began to recover later in the evening on reports of no American casualties and Iran’s measured rhetoric regarding the attacks, which characterized them as proportionate and implied that no further action would be taken in the absence of a US counterstrike. President Trump further shored up investor sentiment last evening by tweeting “All is well” and “So far, so good” regarding the damage assessment and refraining from threats of any further escalation. This morning, analysts are noting that Iraq’s Prime Minister stated that Iran pre-warned of the strikes, presumably in an effort to limit casualties. President Trump is set to make a statement this morning and investors will be highly sensitive to any indication that the White House is declining the opportunity to de-escalate and preparing a military response to last evening’s strikes, which would rekindle fears of all-out war.

Muddled Global Growth Figures Ahead of Key US Jobs Report

Yesterday’s upside surprise in US service sector activity and a narrowing trade deficit are helping support the dollar versus the euro following weak German factory data. Last month, the ISM non-manufacturing purchasing managers’ index (PMI) for the US increased to a four-month high of 55 from 53.9 in November and slightly beat market forecasts of 54.5. However, new orders, new export orders and employment slowed. Companies are positive about the potential Phase One resolution with China and reduction of tariffs, while noting that capacity constraints have eased, although a tight labor market remains a headwind. Meanwhile, the US trade deficit narrowed to $43.1 billion in November 2019 from a downwardly revised $46.9 billion gap in October and market expectations of a $43.8 billion shortfall. This is third straight month of narrowing, bringing the trade deficit to its lowest level since October 2016. This latest data put the US economy on track to grow around 2% in the 4th quarter, well above estimates over the summer of little to no growth. The dollar is advancing from roughly multi-month lows following the data, while Treasury yields bounced moderately as well. Meanwhile, German factory orders for November significantly undershot expectations, weighing on the euro.

Additional Themes

Boeing Shares Fall After Crash – In what may be a disquieting coincidence, a Boeing 737 crashed shortly after taking off from Tehran last evening for Ukraine leaving no survivors. For context, this plane is the predecessor to the troubled 737 Max. Shares of the beleaguered US airline giant are down 1.7% in pre-market trading and are languishing near a two-year low.

EU Pessimism on Brexit Hits the Pound – The pound is descending further below its recent one-year highs versus the dollar after a key EU official downplayed the likelihood of a comprehensive UK-EU trade deal in the timeframe targeted by Prime Minister Johnson. Newly-minted European Commission President von der Leyen stated that a full deal is impossible before the December 31, 2020 deadline that Johnson is imposing on the process, suggesting instead that a limited accord on key issues would be the more optimal approach.