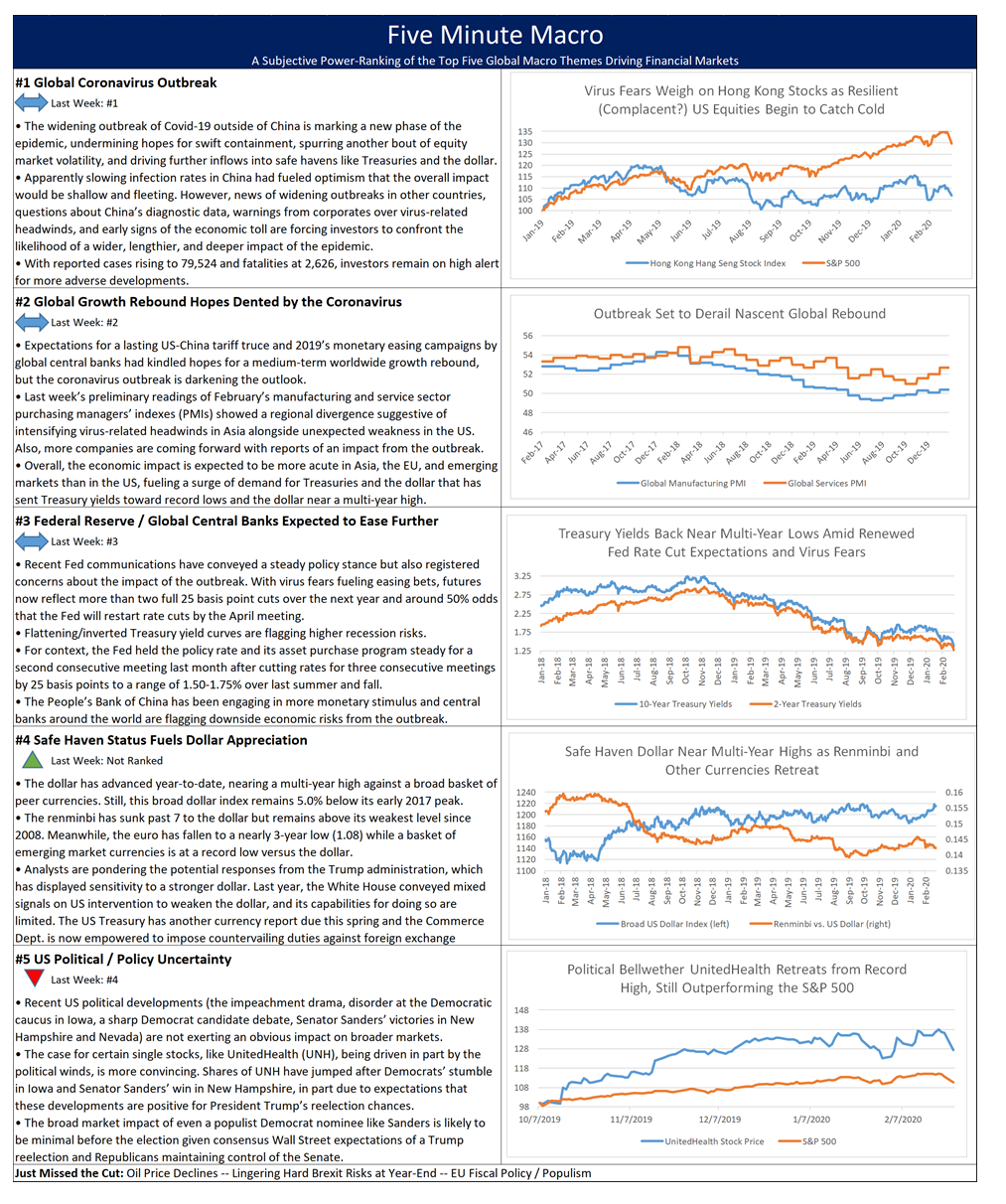

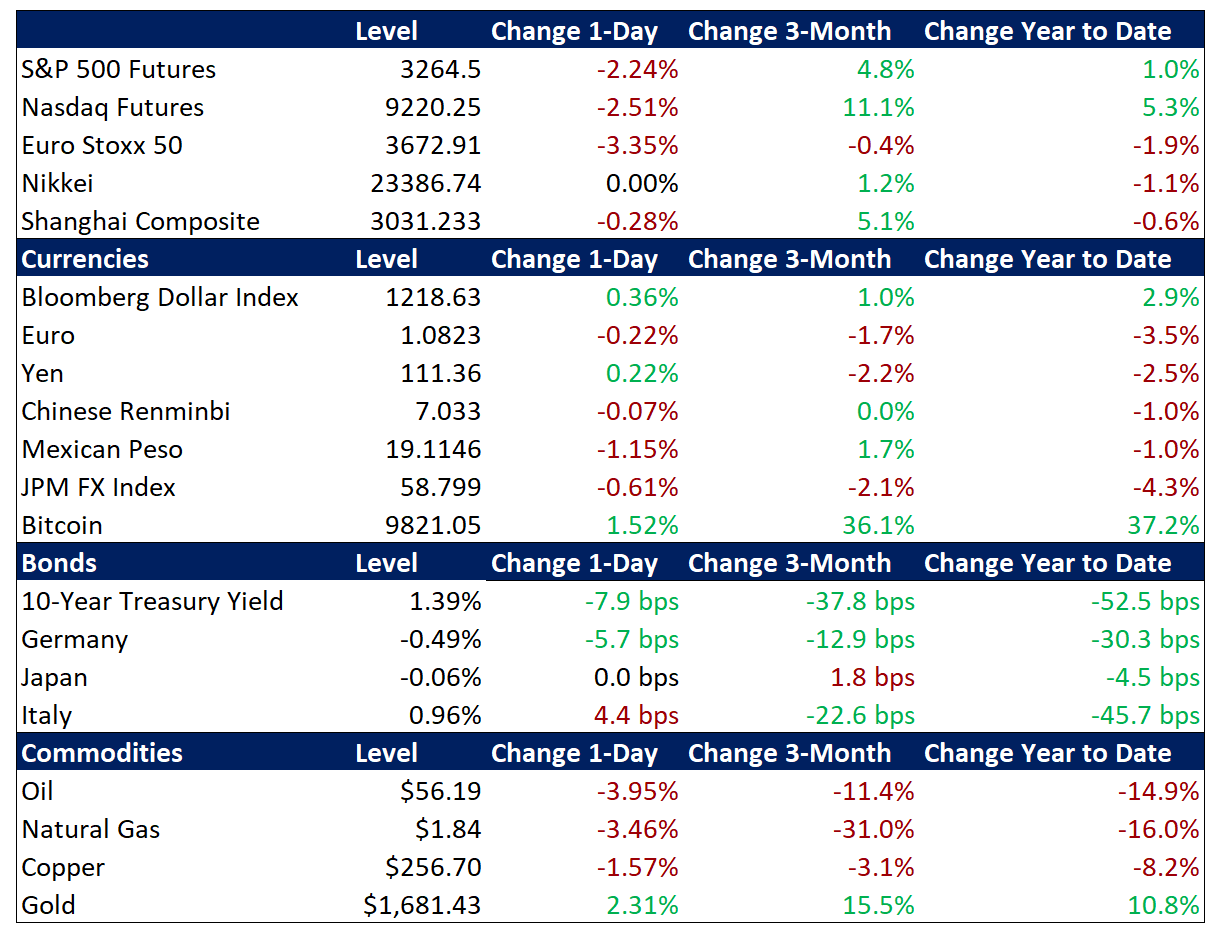

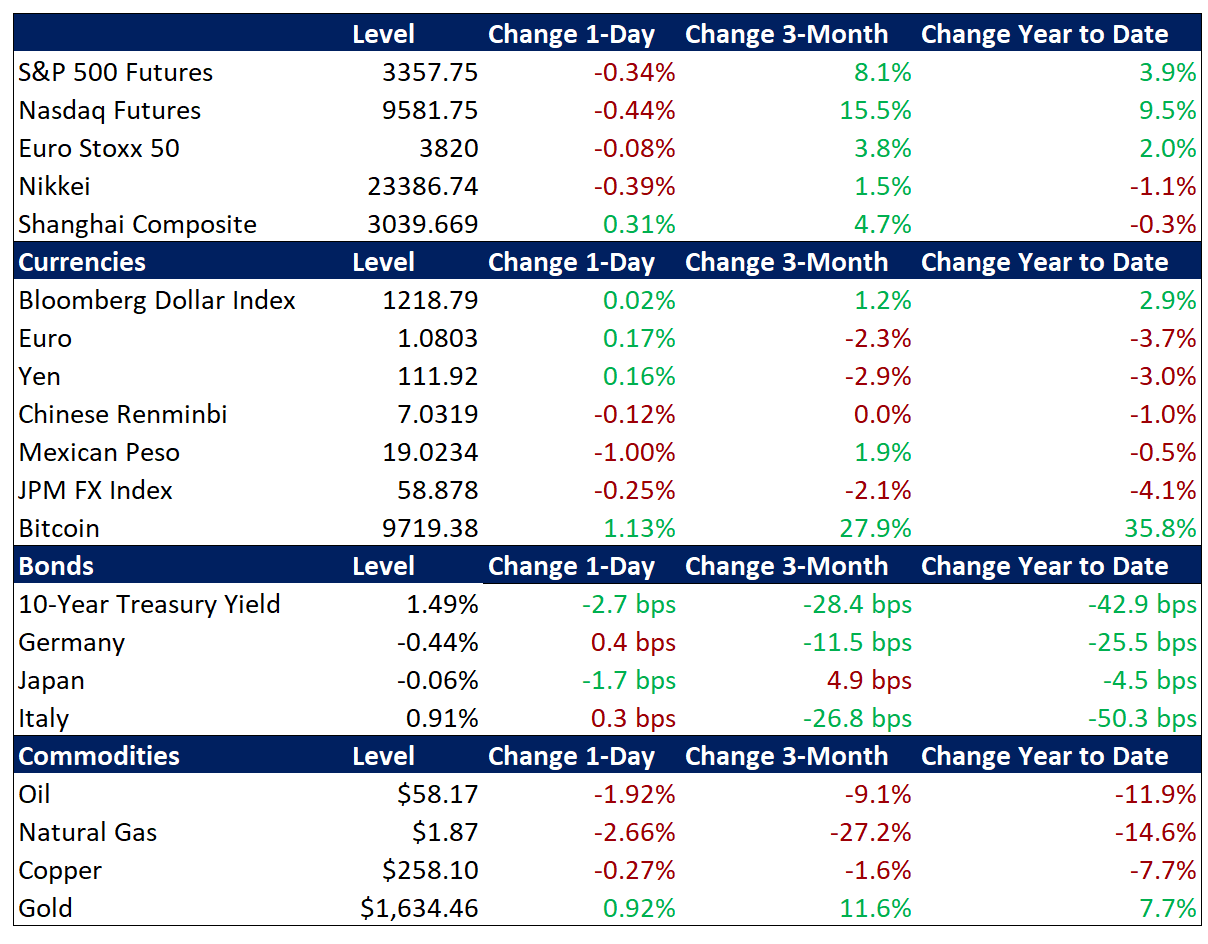

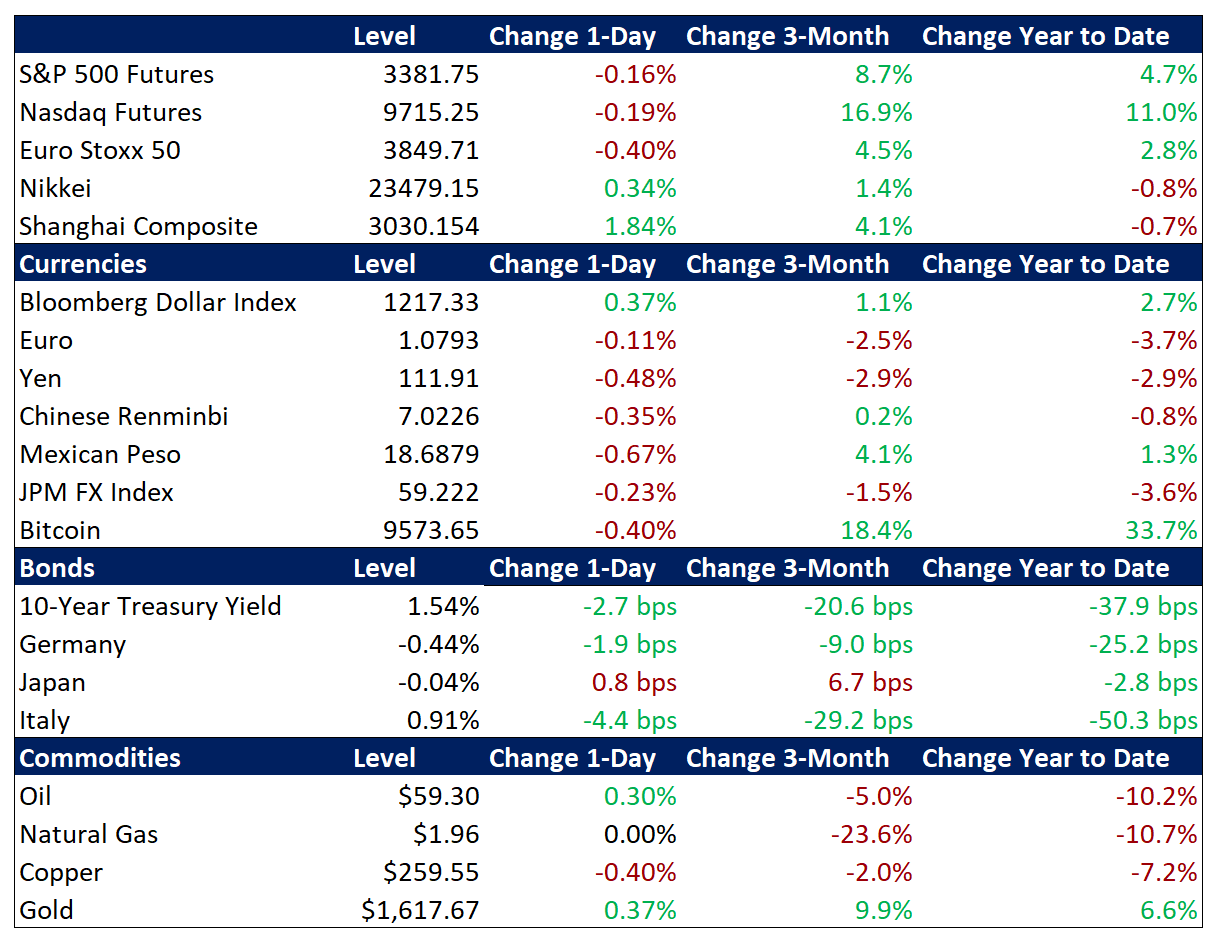

Summary and Price Action Rundown

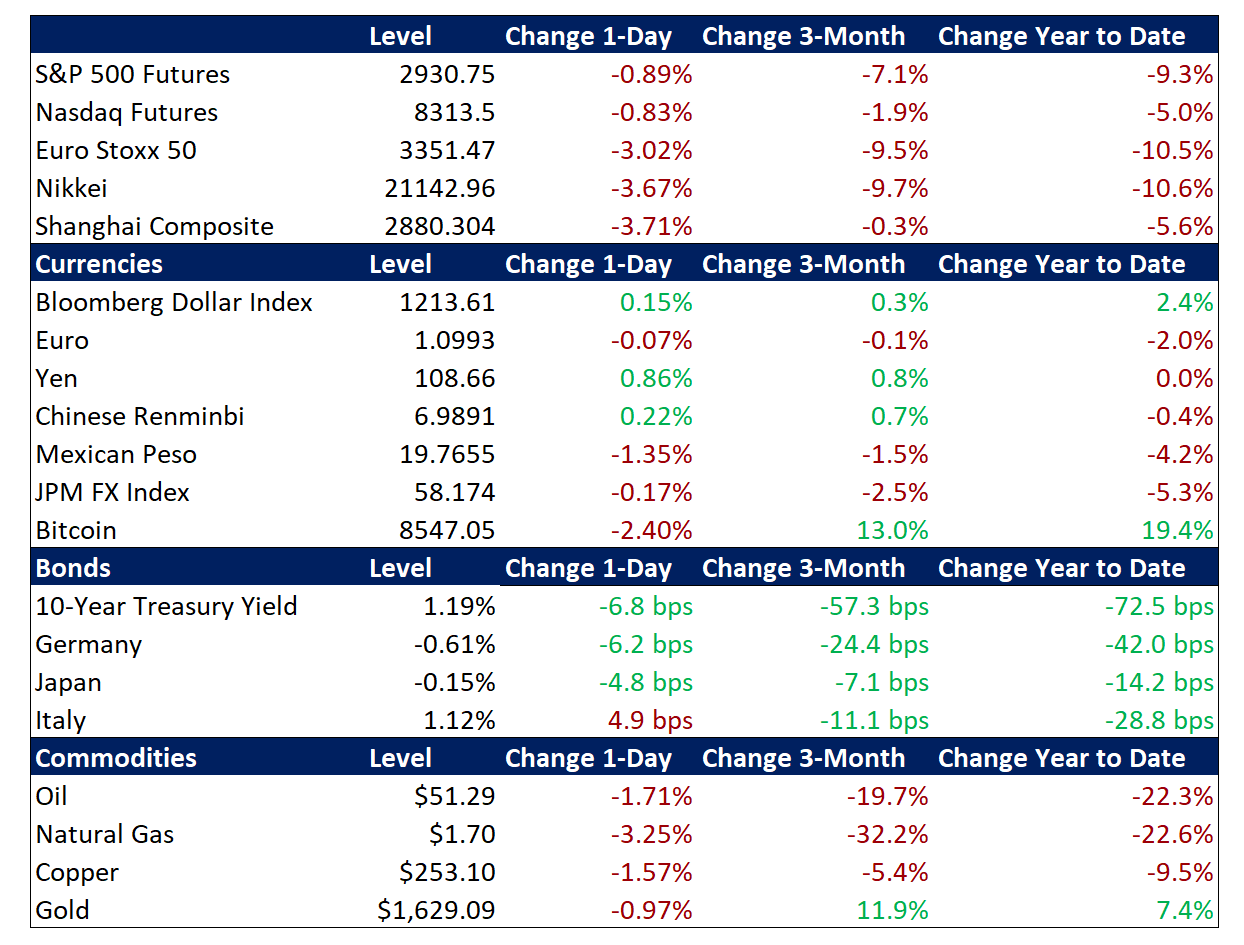

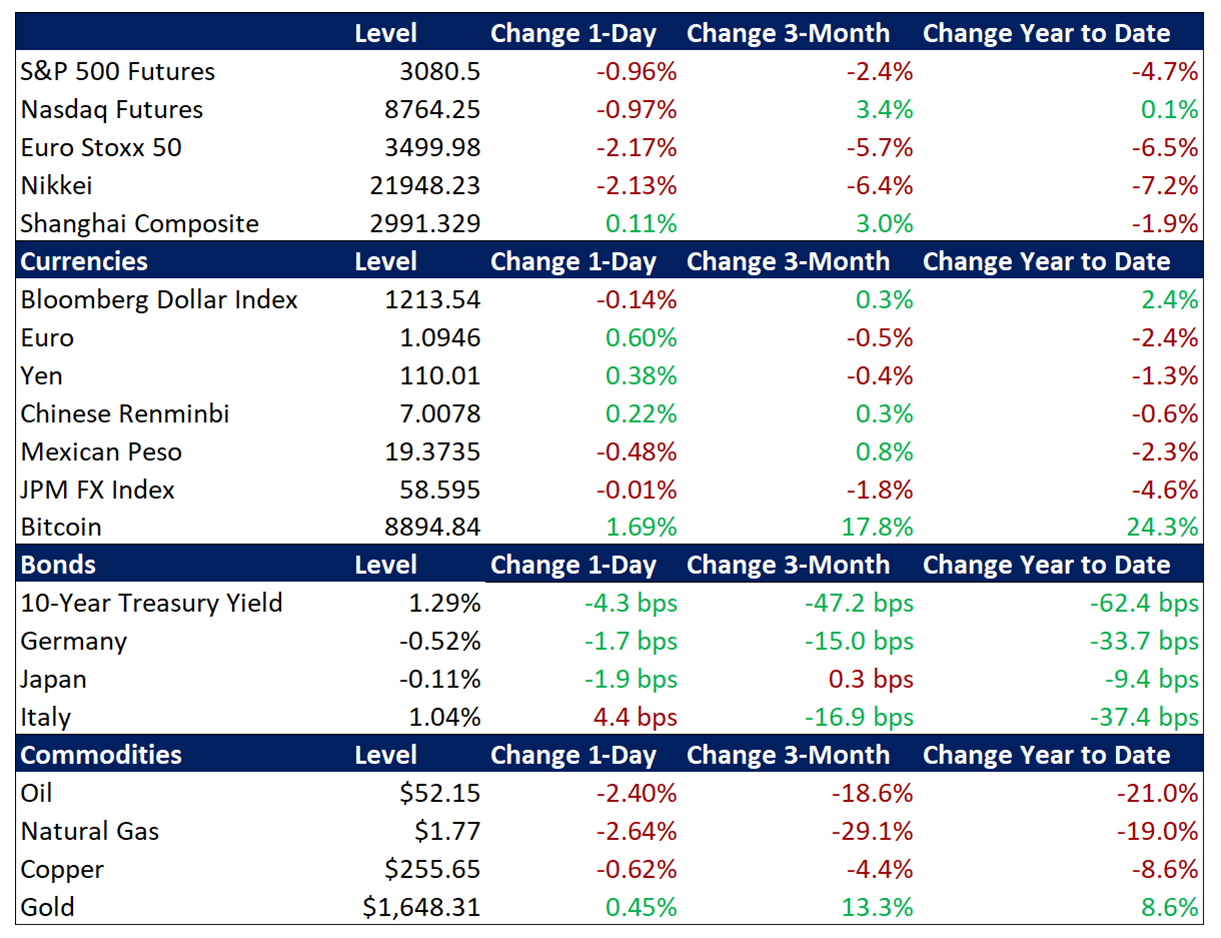

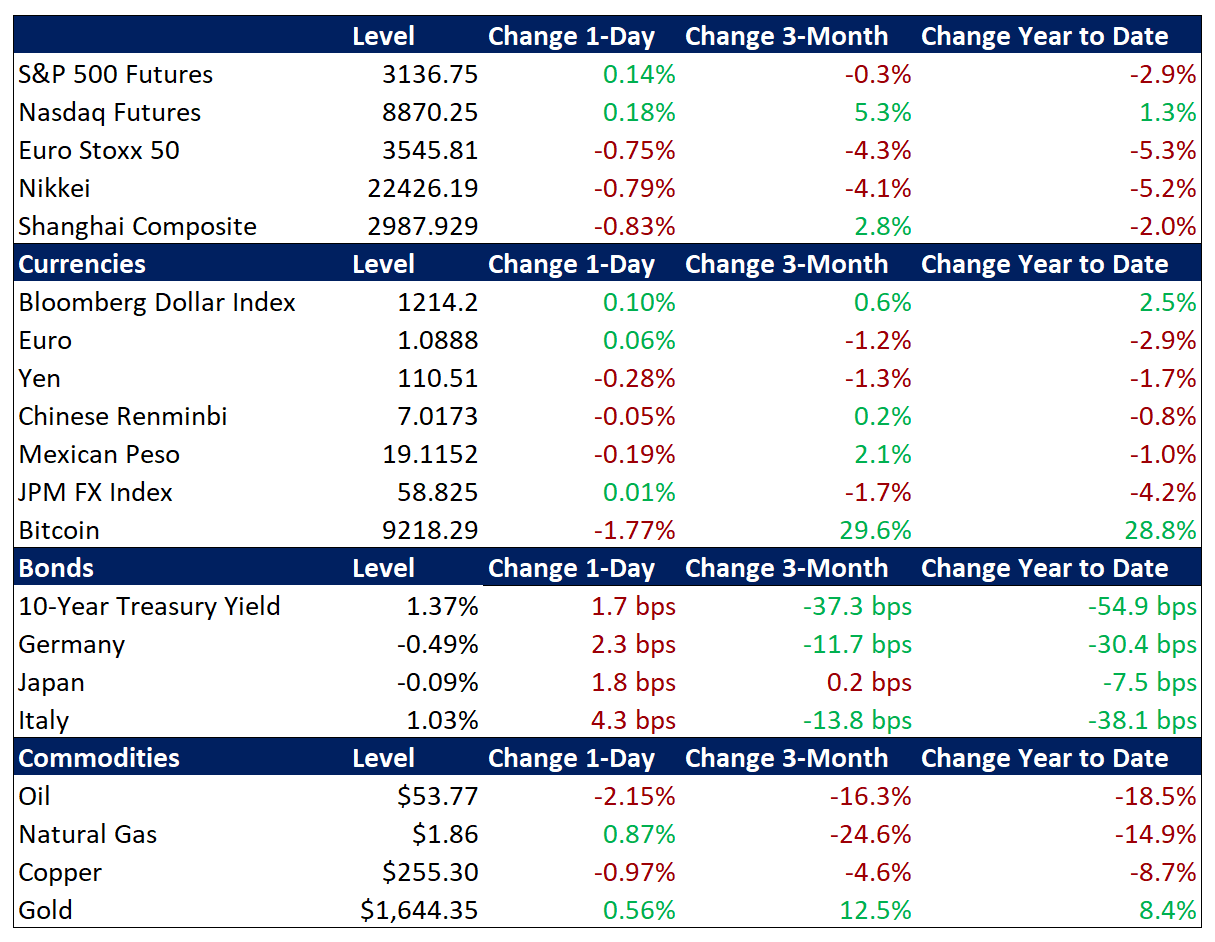

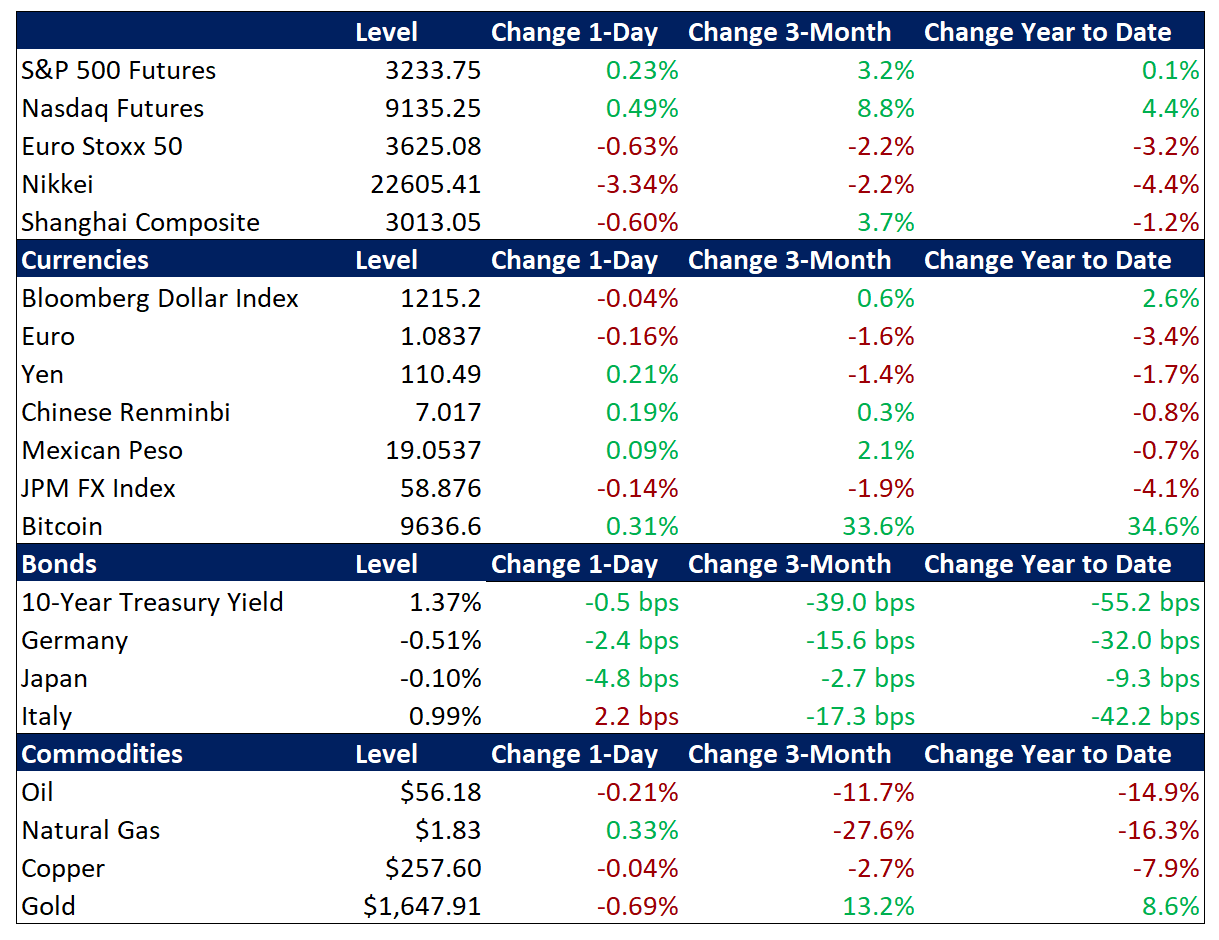

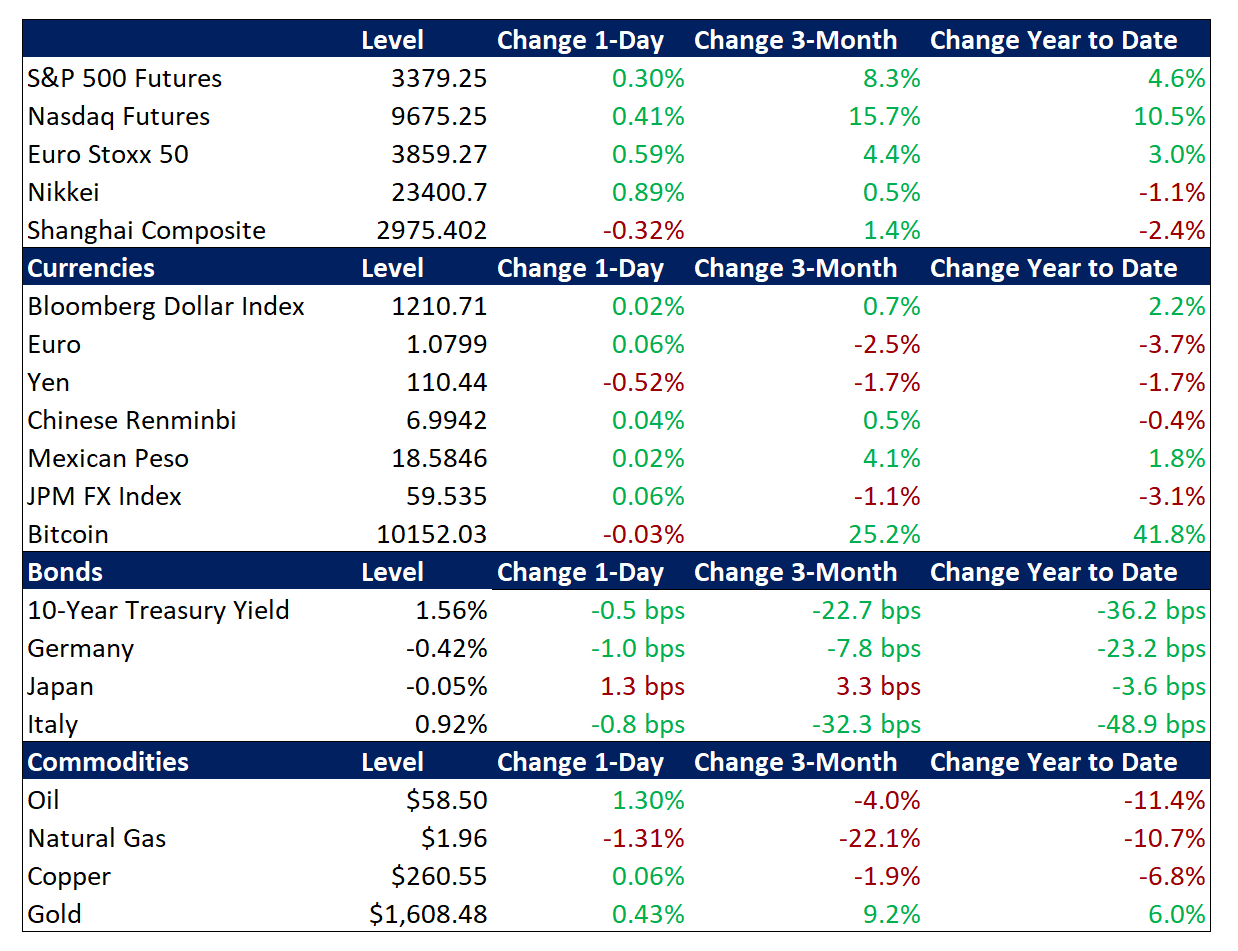

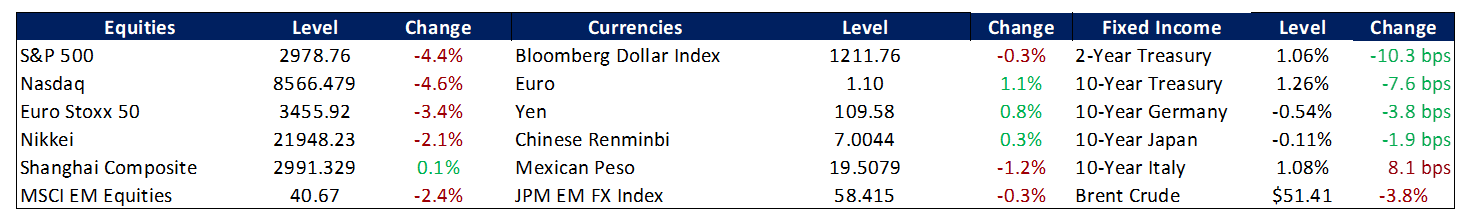

US equities fell precipitously and added to the steep losses on the week as investors confront the risk that the coronavirus outbreak develops into a global pandemic. The S&P 500 fell 4.4% as the first case of the coronavirus in the US raised investor’s fears to the potential fallout from the expanding epidemic. The index is now down 12.0% from last Wednesday’s record high. Overnight, equities in Asia were mostly down again, with the Shanghai Composite outperforming. European stocks closed 3.4% lower and are also now down more than 10% from recent highs. Treasuries are continuing their rally, driven by heightened safe-haven demand and a darkening economic outlook, with the 10-year yield trading at a record low of 1.26%. The dollar is continuing to fluctuate below recent multi-year highs. Brent crude prices fell below $52 per barrel on demand fears.

Coronavirus Fears Continue to Drive Market Volatility

News of the first likely case of community spread of the coronavirus in the US, alongside widening outbreaks in numerous other countries, are weighing further on market sentiment. The latest developments are forcing investors to confront the likelihood of a wider, lengthier, and deeper impact of the epidemic, or even its expansion into a global pandemic. Goldman Sachs is now estimating that US companies will have zero earnings growth this year due to the coronavirus and Japan is closing schools nationwide (more below). CDC officials are counseling preparedness for a pandemic, meaning “community spread” of the coronavirus and a “significant disruption to our lives” in the US, but note that the trajectory of the outbreak remains “very uncertain.” Last evening, President Trump gave a press conference focusing on the coronavirus and placing Vice President Pence in charge of the response, who added National Economic Council Director Larry Kudlow and Treasury Secretary Steven Mnuchin to the team. Rising infection figures and expanding quarantines in Italy, Japan, South Korea, and other countries have dispelled prior optimism over the prospects for quick containment, which had lifted global equity markets over the past few weeks. News out of China, however, has taken a more positive tone, with various provinces reducing their threat levels and reports of increasing factory activity. Today, Starbucks announced it is reopening cafes across China after the virus forced widespread closures last month. Currently 85% of its 4,292 locations are open. Nationwide, total infections are reported to be 82,446 while fatalities have reached 2,808. Regarding the economic costs, rating agency Moody’s has noted that a worldwide recession is likely in the event of a pandemic and some prominent Wall Street strategists are calling for more downside for US equity markets in the near-term. Meanwhile, the list of companies downgrading their 2020 profit forecasts due the epidemic continues to grow. –MPP note: We are arranging a call for our clients with noted epidemiologist Dr. Christopher Mores on Tuesday next week. Please send any advance questions in a reply to john.fagan@marketspolicy.com and stand by for details of the call.

Investors Monitor Overseas Stimulus Efforts and Fed Easing Prospects

Recent Fed communications have conveyed a steady policy stance despite concerns about the impact of the outbreak, while markets see rate cuts restarting in the coming months as stimulus measures also ramp up overseas. Analysts are noting a Wall Street Journal op-ed this morning from former Fed Board Member Kevin Warsh advocating for front-loaded Fed easing in coordination with other major central banks to cushion the economic impact of the outbreak. However, Vice Chair Clarida’s remarks earlier this week gave little indication that the bias of the FOMC is shifting toward more easing in the coming weeks and months, noting that it is “too soon” to estimate the possible fallout. Several regional Fed Presidents have echoed that position this week. Price action in Treasury markets is aligned with Warsh’s viewpoint, reflecting a prompt return to easing by the Fed.

Today, Chicago Fed President Charles Evans said that the Fed may need to let inflation overshoot its 2% target in the future in order to ensure inflation is not so weak that policy rates get stuck near zero. The 10-year Treasury yield is now trading at 1.26% after yesterday breaking below the prior all-time intraday low of 1.32% registered during the global deflation scare of 2016. Treasury yield curves (the yield spread between Treasuries of differing maturities) remain flat, and in some cases inverted, which is considered a warning of impending recession.

Meanwhile, futures markets are pricing in more than two Fed rate cuts by June and nearly 90% odds that the Fed starts lowering rates again at the March 18 meeting. Overseas, stimulus measures are being marshalled but the responses remain disparate. Germany is set to loosen its self-imposed fiscal straightjacket, China’s central bank is adding accommodation, and Hong Kong’s government is giving cash directly to its citizens in an attempt to cushion the economic impact of the virus. However, the Bank of Korea held rates steady overnight at 1.25% and a European Central Bank official stated that “more clarity” is needed before policymakers can confront “hard to understand implications” of the outbreak. – MPP view: We expect the Fed to be responsive to the yield curve, deploying cuts to counter a 2/10 inversion, as well as to futures markets that demand rate cuts, but there may be a critical lag in their response due to general policy inertia and specific concerns about making major monetary policy moves in an election year.

Additional Themes

Japan Cancels School to Fight Coronavirus – Japanese PM Shinzo Abe announced that the entire Japanese school system will be asked to close from Monday until spring break in late March to help contain the coronavirus outbreak. The number of cases in Japan rose to more than 200 as 15 new cases were identified on the northern island of Hokkaido.

US Economic Data in Focus – The second estimate of US GDP showed the economy grew 2.1% in Q419, the same as in Q3 and matching consensus expectations. The contribution from net trade was revised higher and the drag from inventories was smaller, while PCE rose less than initially estimated and nonresidential investment shrank faster. For full year 2019, the economy grew 2.3%, the least since 2016 and below the Trump administration’s 3% target.

January Durable Goods Orders dropped 0.2% month-on-month (m/m) in January, following a 2.9% advance in December, but well above market expectations of a 1.5% fall. Demand for transport equipment shrank 2.2% due to decreases in orders for motor vehicles and parts and defense aircraft and parts. Demand for civilian aircraft jumped 346.2%, reversing a 66.7% fall in December.

January Pending Home Sales jumped 5.2% m/m, rebounding from a 4.3% drop in December and beating forecasts of a 2.2% gain. Only the West region reported a drop in monthly sales, while the Northeast, Midwest and South all saw pending home sales growth. Exceptionally low mortgage rates are helping support the housing market, but the existing home market is struggling with a record low supply of homes for sale, currently the lowest since 1999. – MPP View-With the spread of the Coronavirus spreading across the globe, all data pre-virus will be overlooked, and all data post will be blamed on the virus, lessening the usual market significance. However, the virus is raising the odds of preemptive Fed rate cuts but the bar is still high in an election year.