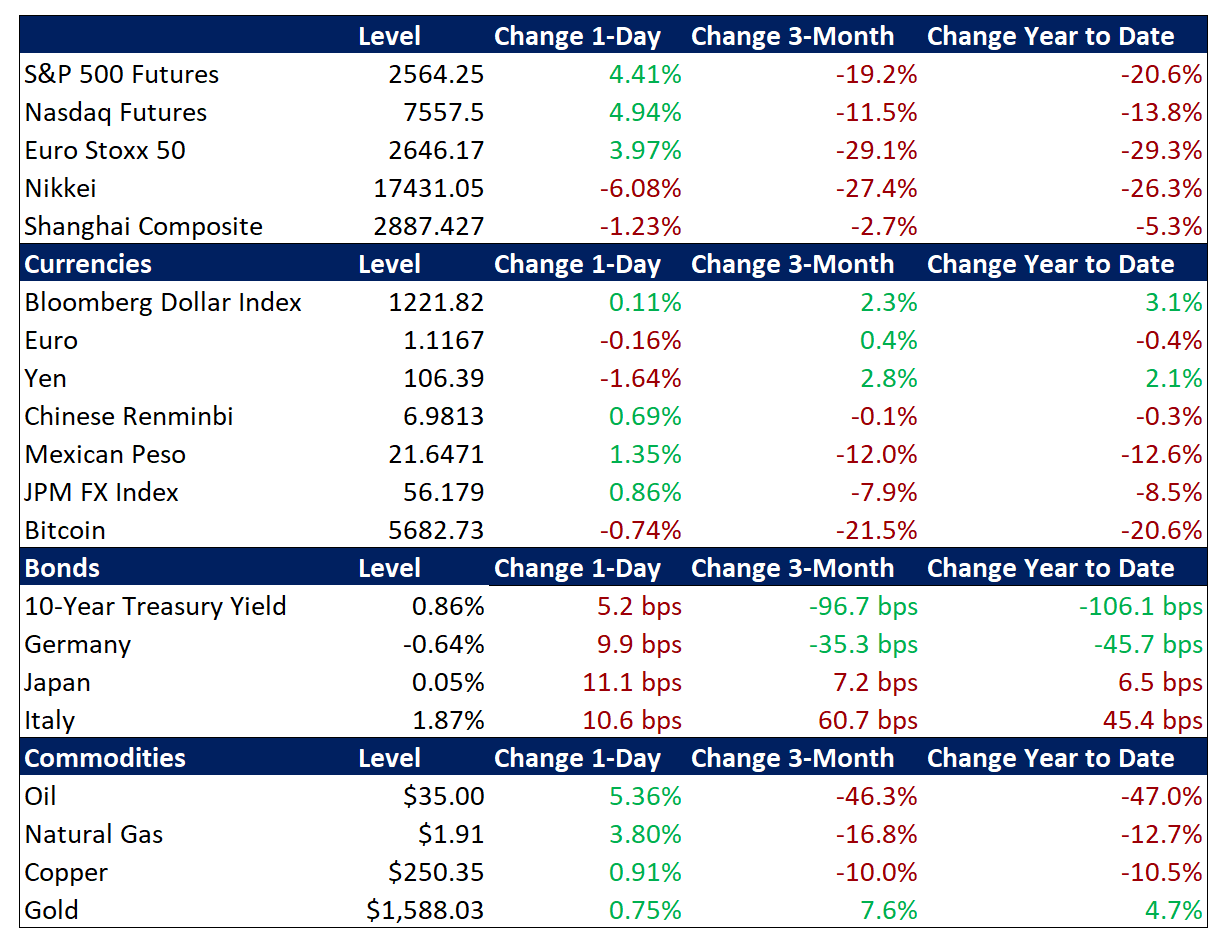

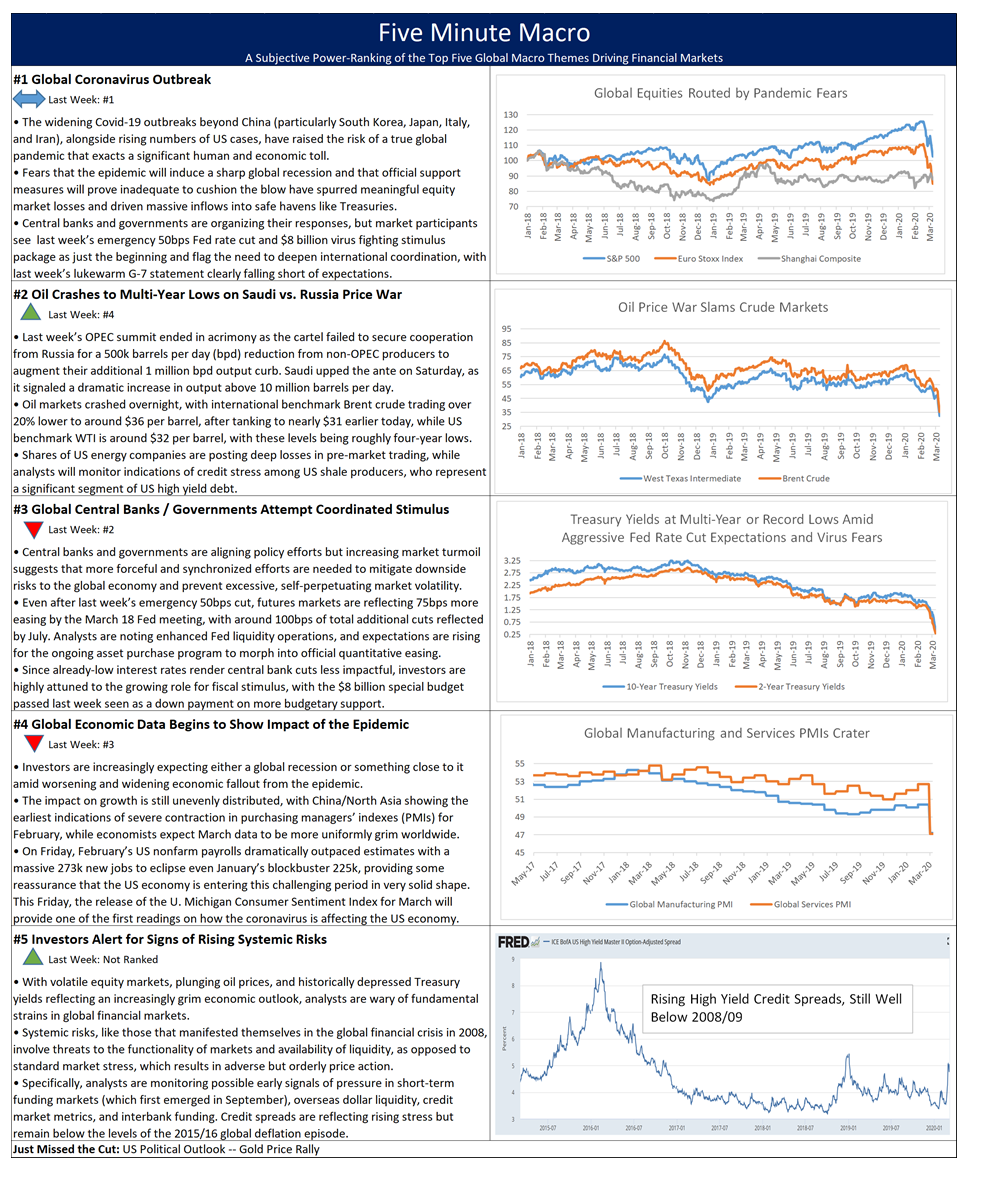

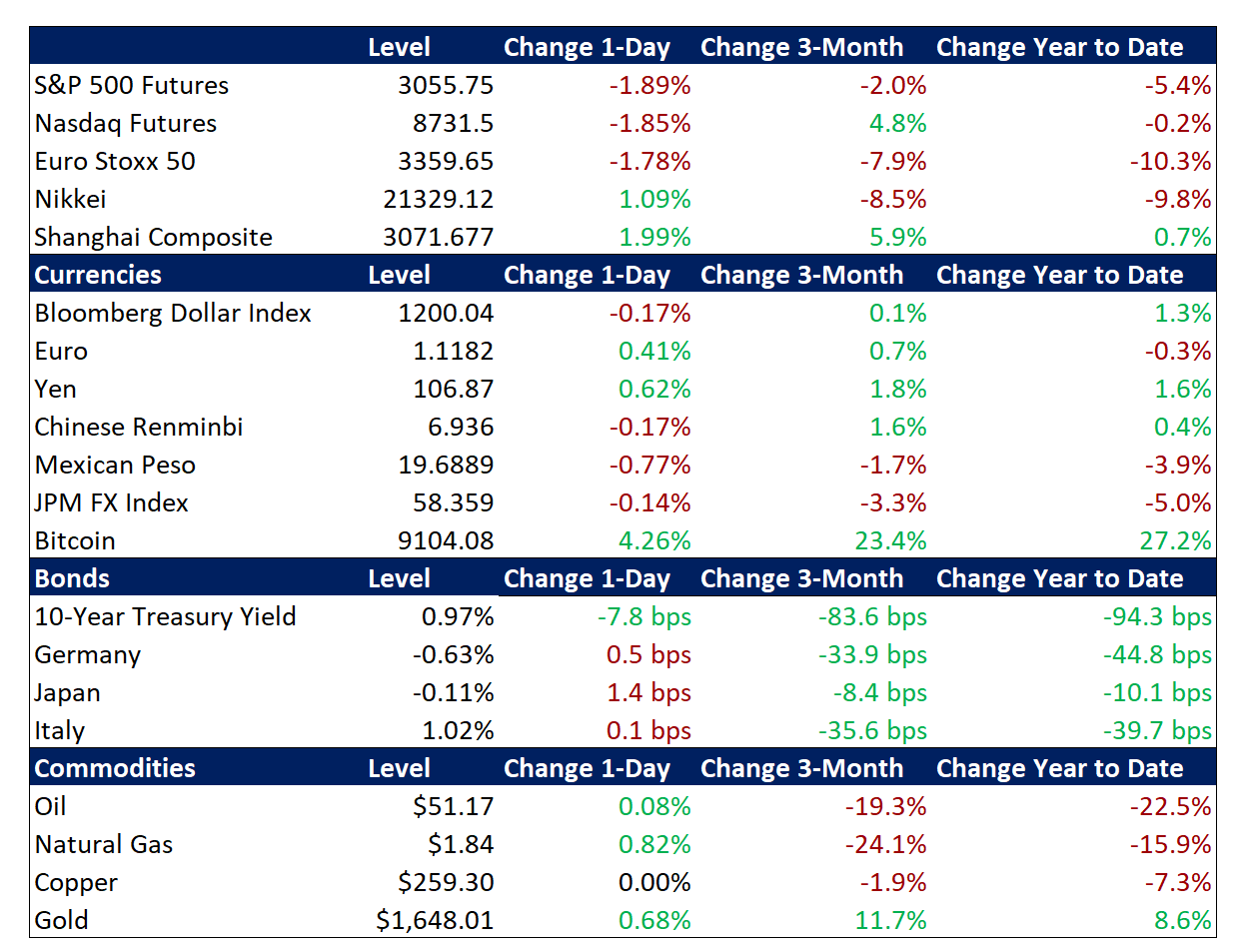

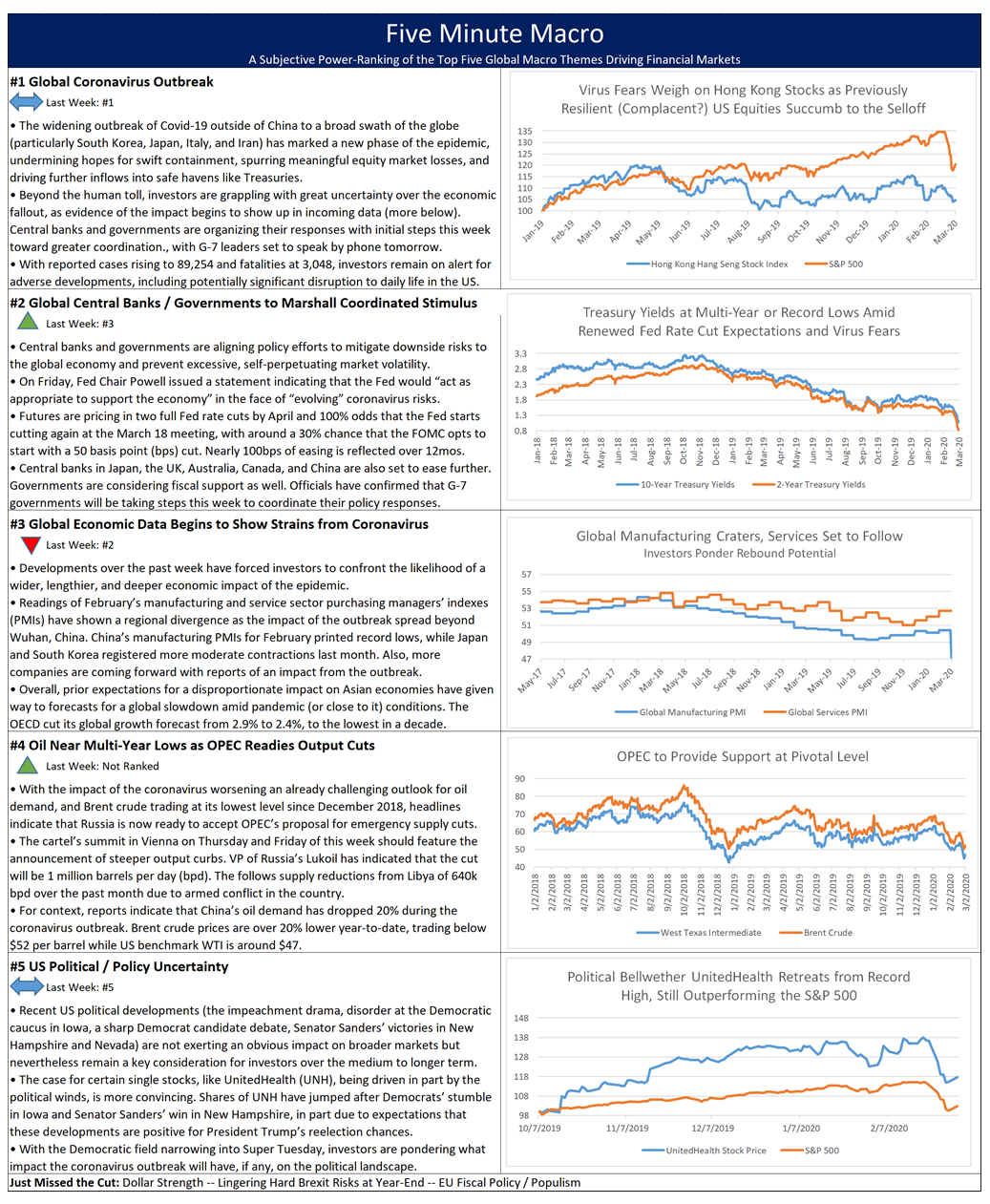

The coronavirus outbreak may not yet fit the scientific definition of a pandemic but it is clearly heading in that direction, according to some leading public health officials. Global financial markets are certainly not waiting for the official notification. Price action this week in Treasury markets is consistent with an exceedingly grim economic outlook and acute risk aversion, while the previously resilient S&P 500 is under increasing pressure.

Policymakers are not standing idly by. This week has seen a raft of rate cuts from global central banks, including an emergency 50 basis point reduction from the Fed on Tuesday. Meanwhile, the Trump administration is deploying an $8 billion spending package, which the President signed this morning after its swift trip to approval in Congress, and National Economic Council Director Kudlow is indicating that more fiscal measures are in the pipeline.

Meanwhile, US politics played out as a side-plot to the main narrative of the unfolding outbreak and the official responses being marshaled against it. There was plenty of debate among market participants over the extent to which US politics played a role in last week’s selloff, as Senator Sanders gained momentum in the Democratic field, and this week’s twin rallies on Monday and Wednesday, of 4.6% and 4.2%, respectively, which bookended a storming Super Tuesday comeback for Joe Biden, who is back as the presumptive frontrunner.

Many market contacts opined that Wednesday’s surge in the S&P 500 was specifically driven by Biden’s big win, and we certainly agree that healthcare stocks in particular received a boost given Biden’s opposition to Medicare-for-all. Shares of UnitedHealth and Anthem, two managed care giants, are up 9.2% and 6.8% this week despite all the chop in broader indexes. The degree of Joe-mentum in broader indexes and financial markets, however, is debatable.

Whether Medicare-for-all and other more radical healthcare reform proposals really are going to disappear with the Sanders campaign is also not so clear. Analysts are noting that a true pandemic has the power to shape societal norms and ideas, supporting (as one put it) “collectivist notions.” Calls from even Republican quarters that coronavirus patients should receive free treatment even if not insured may be just politicking, or it may represent a real shift. Bailouts for the service sector are unworkable, so perhaps direct payments to service sector workers (aka “helicopter money”) might be considered. It is certainly the time for policymakers to try to think creatively about responses to the epidemic, some of which might be difficult to entirely reverse when the coronavirus mercifully abates.

Looking ahead to next week, the European Central Bank is set to ease and global economic data will be scrutinized for any impact from the coronavirus epidemic.

- US Economic Data

- European Central Bank

- EU Economic Data

- China Economic Data

US Economic Data: Focus on consumer sentiment for virus impact

Wednesday’s focus will be on the US Consumer Price Index (CPI) for February. January Headline CPI rose 0.1% m/m, coming in below forecasts of 0.2%. Shelter accounted for the largest increase, with cost of food and medical care services also rising. These increases offset a 1.6% decrease in the gasoline index. On a year-over-year basis CPI climbed to 2.5% from 2.3% in December and is the highest rate since October of 2018, mainly boosted by a 12.8% jump in gasoline cost. Core CPI, which excludes volatile items such as food and energy, increased 0.2% m/m, following a 0.1% gain in December and matching market expectations. Core CPI has risen 2.3% y/y, the same as in December.

The Producer Prices Index (PPI) for February will be released on Thursday. In January the PPI jumped 0.5% m/m, coming is well above market expectations of 0.1% rise. This was the largest monthly gain since October 2018, as services prices rose 0.7% and boosted by apparel, jewelry, footwear, and accessories retailing. On the other side, goods cost only advanced 0.1%. Year-on-year, the PPI rose 2.1%, the largest advance since May 2019. Core PPI also rose 0.5%, also well above the 0.1% forecasted.

On Friday the University of Michigan Consumer Sentiment Index for March will be released and will provide one of the first readings on how the coronavirus is affecting the consumer. February was revised slightly higher to 101 from a preliminary 100.9 and is the highest reading since March of 2018. The gauge for current conditions was higher than expected, while expectations rose less. One-year inflation expectations were 2.4%, while the five-year outlook was 2.3%. The coronavirus was mentioned by 8% of all consumers in February although on the last days of the February survey, 20% mentioned the coronavirus due to the steep drop in equity prices, as well as the CDC warnings about the potential domestic threat of the virus. While too few cases were conducted to attach any statistical significance to the findings, it is nonetheless true that the domestic spread of the virus could have a significant impact on consumer spending.

European Central Bank: No time to waste

On Thursday the ECB will hold their Interest Rate Decision. At its January meeting the ECB left the key interest rate on the main refinancing operations steady at 0%, which was widely expected. The marginal lending facility was also kept at 0.25% and the deposit facility at -0.50%. During the press conference, ECB President Lagarde failed to provide any new information on the monetary policy, economic outlook and strategic review. Lagarde added that incoming data is in line with the ECB baseline scenario and there are some signs of moderate increase in underlying inflation. She added that the governing council stands ready to adjust the instruments if needed. At a subsequent speech in February, Lagarde called for fiscal stimulus measures in the Eurozone, warning that monetary policy isn’t “the only game in town” and the longer the accommodative measures remain in place, the greater the risk that side effects will become more pronounced.

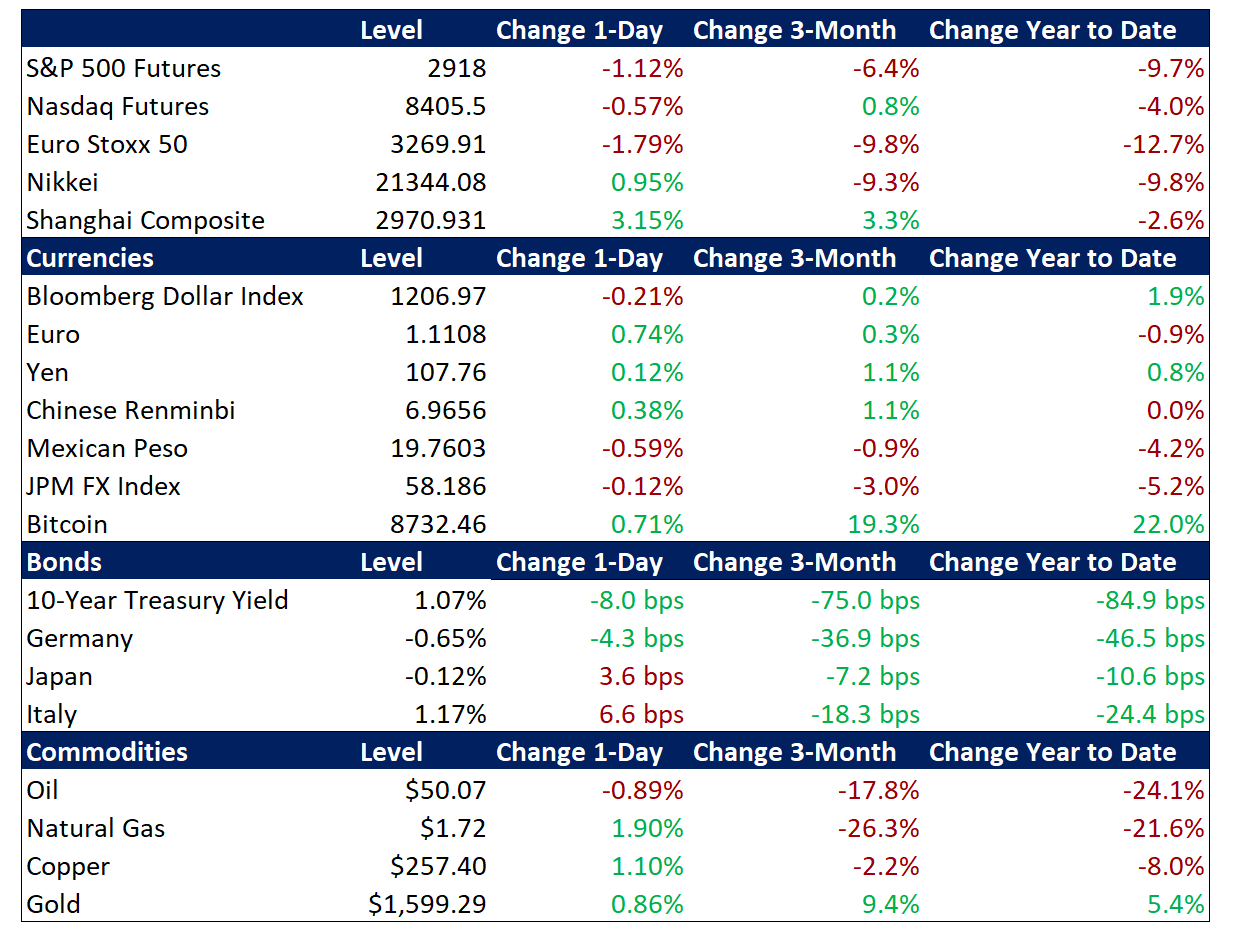

EU Economic Data: Feeling contractions

Thursday begins with Eurozone Industrial Production (IP) for January. December IP plunged 4.1% y/y, following a 1.7% contraction and compared to market forecasts of a 2.3% decline. The latest figure matched the December 2018 drop, which was the biggest since November 2009. Capital goods output led the fall, followed by intermediate goods, energy and durable consumer goods. Among the bloc’s largest economies, there was a contraction in Germany, Italy and France, while Spain’s output was little changed. For full year 2019, IP shrank 1.7%, the steepest contraction since 2012.

Chinese Economic Data: Price check

The week begins with China’s Consumer Price Index (CPI) for February. January CPI jumped to 5.4% y/y from 4.5% in December and above market consensus of 4.9%. This is the highest inflation rate since October 2011 due to rising pork prices, stronger demand during the Lunar New Year holiday and the ongoing coronavirus outbreak. Food prices went up 20.6% y/y, the most since April 2008, with pork prices rising for the 11th month in a row and at a steeper rate. Pork prices have been rising during the last year amid a prolonged African swine fever epidemic and in January 2020, several lockdowns and transport restrictions due to the coronavirus outbreak weighed on the pork cost even more.

Friday begins with Chinese Foreign Direct Investment (FDI) for February. In January FDI into China rose 4% y/y to CNY 87.57 bil, or 2.2% to $12.68 bil. In yuan terms, foreign investment in high-tech industries went up 27.9 percent and accounted for 35.8 percent of the total FDI, with investment in high-tech service increasing 45.5 percent. Among the main sources of investment, FDI into China rose mainly from Singapore (40.6 percent), South Korea (157.1 percent), and Japan (50.2 percent); while FDI from the countries along the “Belt and Road” and ASEAN advanced by 31.3 percent and 44.8 percent, respectively.