Looking Ahead – Tariff Man or Davos Man?

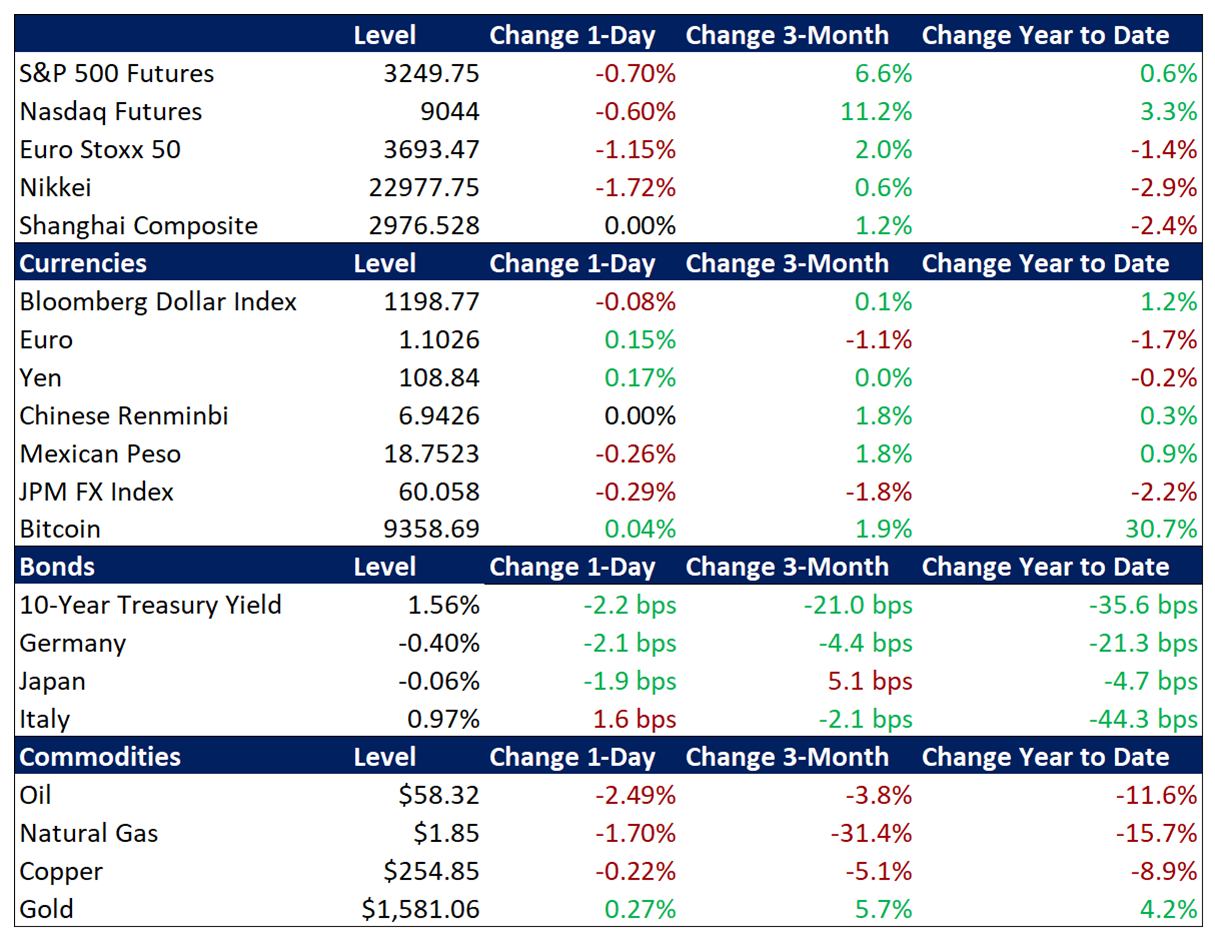

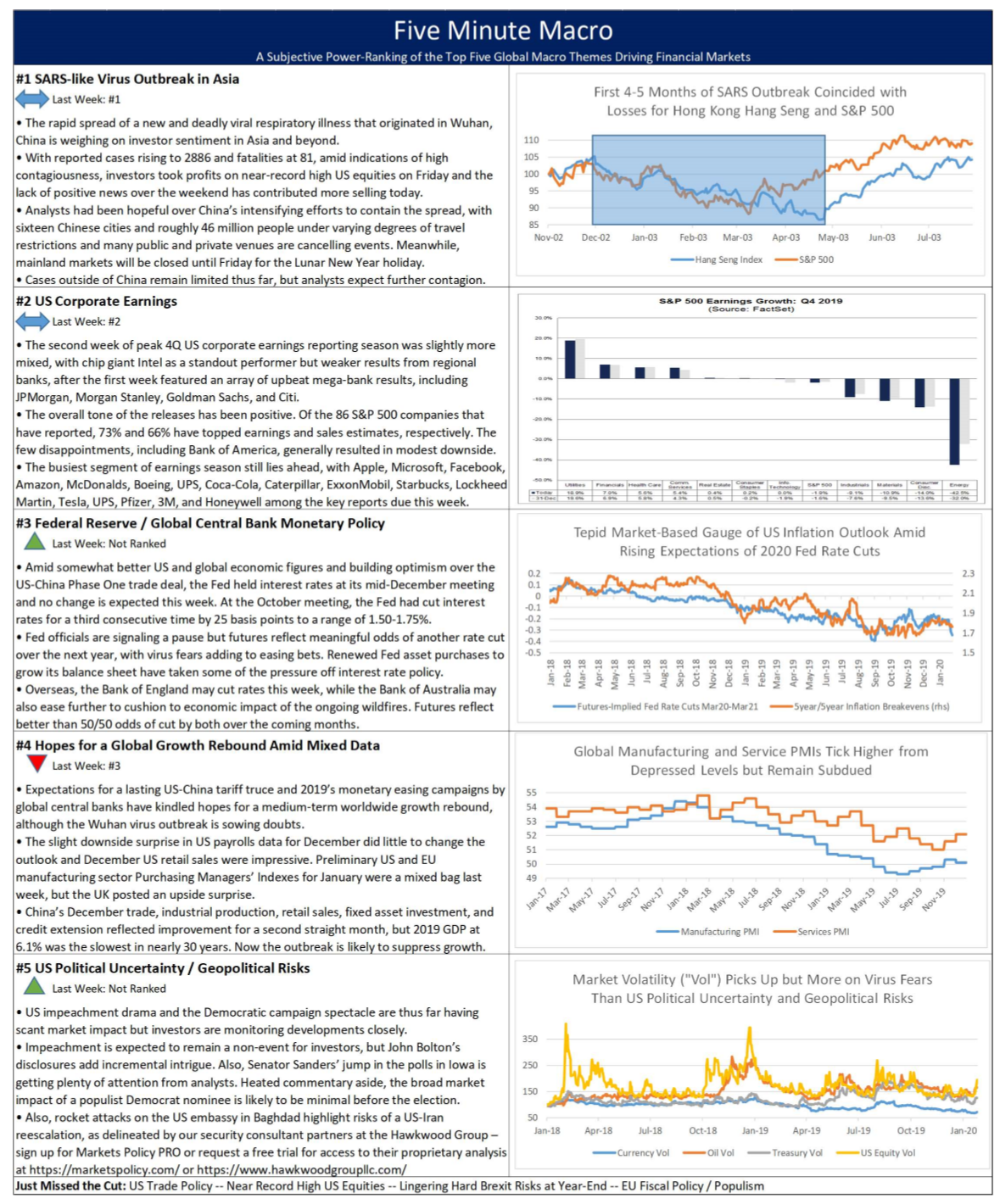

The new year has gotten off to a disquieting and dispiriting start in many ways, although through the lens of financial markets, the view is considerably rosier. Investors have remained quite calm in the face of a potential US-Iran war and now a deadly virus outbreak from China, with the quiet interim between these two worrisome developments featuring big equity gains.

The array of upside catalysts for US equities are well understood: easing global trade tensions, the positive tone of fourth quarter earnings reports, some encouraging global economic readings in recent days, and ultra-easy monetary conditions in the US and abroad.

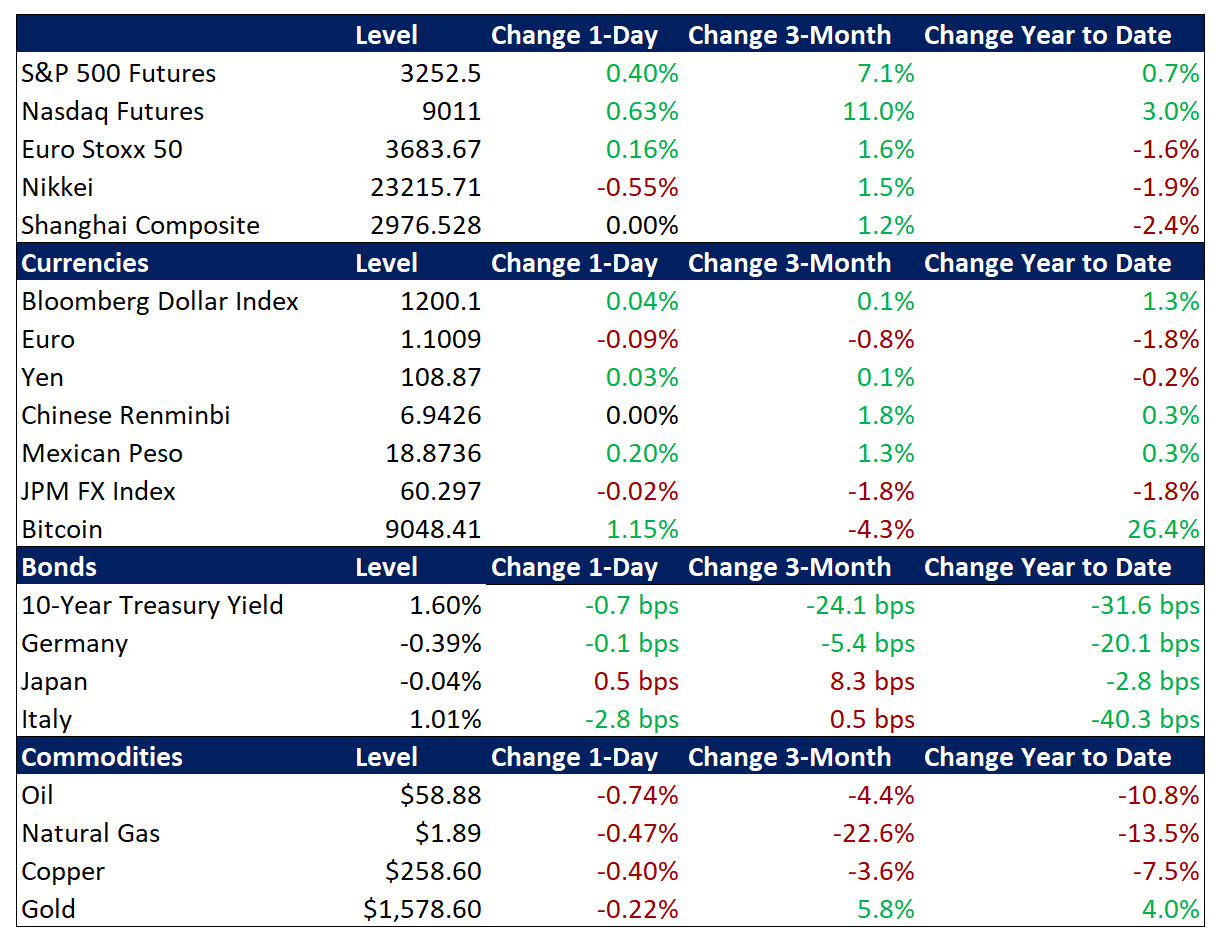

On the last point, some Fed officials have recently sought to refute the idea that their massive asset purchases, which restarted in October and coincide with a ruler-straight uptrend in the S&P 500 since their inception, are anything but a technical tweak to lubricate front-end funding and bank reserve dynamics. But it seems that most market participants roundly disagree with this hair-splitting and see Fed liquidity operations as a key factor in fueling asset price upside.

Given ongoing uncertainty over funding market issues and prevailing belief that the Fed is effectively engaged in quantitative easing (QE4), we believe it is highly unlikely that the Fed will cease or even taper its balance sheet expansion as the program extends into 2Q and beyond. It is inauspicious for the Fed to make consequential policy decisions too close to an election, and that is all the more true now, as the Fed already blundered by overtightening in 2018 and has had President Trump on their case ever since, regularly lambasting them on Twitter.

While President Trump is sure to keep up rhetorical pressure on the Fed, his performance this week in Davos was considerably more balanced than some of his prior appearances. Attendees have told us that his speech was viewed as more of a campaign event than a real statement of global leadership on specific issues, but it was relatively restrained on the subjects of trade and geopolitics. He even put his hand up to join the Trillion Tree initiative.

However, Tariff Man was not entirely sublimated to Davos Man, as President Trump reiterated his threat to slap 25% tariffs on EU auto imports absent a trade deal. But he and French President Macron agreed to a tariff truce until year-end, past the US election, over digital taxes that US officials say unfairly single out US tech companies. And with the EU in a scramble to negotiate a post-Brexit trade deal with the UK, it is not clear that the negotiations with the US can be prioritized despite the US auto tariff threat.

Given the amorphous timeline for negotiating an EU trade deal and the lingering uncertainties over the executive authority to impose those particular auto tariffs, a full-blown US-EU trade fight seems unlikely to metastasize into a major market-mover this year, unlike the US-China tariff brawl from 2018 through last December. But that certainly does not mean that this week’s declines in shares of BMW or Daimler represent a great buying opportunity. EU auto stocks are undoubtedly suffering in part from fears that the virus in China will weaken demand in that key market for their vehicles, along with stocks of luxury goods companies and airlines. The evolution of the coronavirus outbreak trumps tariff considerations, and most other global macro factors, for the foreseeable future.

Looking ahead to next week, more 4Q earnings are due alongside US and Chinese economic data and meetings for the Federal Reserve and the Bank of England.

- Corporate Earnings

- US Economic Data

- US Housing Data

- Federal Reserve

- Bank of England

- EU Economic Data

- China Economic Data

Corporate Earnings Reporting: Packed calendar

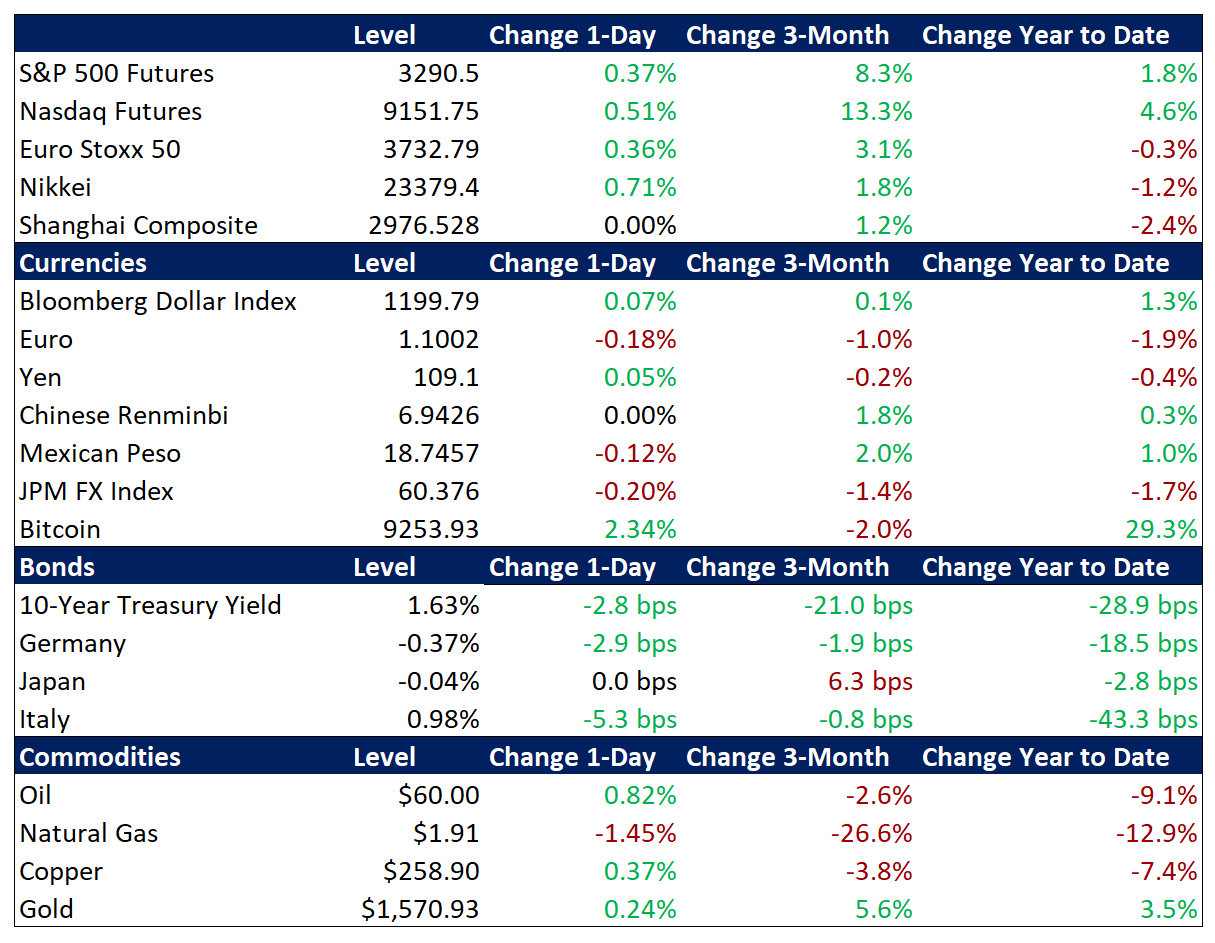

Peak Earnings Season moves into its third week on Monday beginning with D.R Horton and Whirlpool. Tuesday will focus on Apple, AMD, eBay, Harley Davidson, 3M, Pfizer and Starbucks. Wednesday is one of the busiest reporting days of the season with ADP, Boeing, Facebook, General Dynamics, GE, Hess, Mastercard, McDonald’s, Mondelez, Microsoft, Nasdaq, PayPal, AT&T, T. Row Price and Wynn Resorts. Thursday brings Amgen, Amazon, Biogen, DuPont, MSCI, Northrop Grumman, Raytheon, Sherwin-Williams, UPS, Visa and Verizon. Friday closes out the week with Caterpillar, Colgate-Palmolive, Chevron, Honeywell and Exxon Mobil.

Of the 86 S&P 500 companies that have reported 4Q19 results, 73% have topped earnings expectations and 66% have beaten sales estimates.

US Economic Data: Big figures

Tuesday will revolve around US Durable Goods Orders for December. In November new orders unexpectedly fell 2% month-on-month (m/m) while the market was expecting a 1.5% rise. This also followed a weak October where orders only grew 0.2%. Demand for transportation equipment led the fall, while declines were also seen in orders for machinery and primary metals.

With the signing of the Phase 1 trade deal with China last week, the US Trade Deficit has become a little less market-moving, but still important. In November the deficit narrowed to $43.1 bil from $46.9 bil. The trade gap shrank for the third straight month to the lowest since October 2016. Imports dropped 1% to the lowest level in 2 years due to falling purchases of aircraft, computers and cell phones. Exports increased 0.7% to $209 bil, boosted by sales of drilling and oilfield equipment, jewelry, autos and aircraft engines. The goods trade deficit with China narrowed 15.7% to $26.4 bil, with imports dropping 9.2% and exports jumping 13.7%. Year-to-date, the total deficit has narrowed $3.9 bil.

On Thursday in the US we will get the first estimate of US 4th Quarter 2019 GDP. In 3Q19 the US economy grew by an annualized rate of 2.1%, following a 2% expansion in 2Q19. The increase reflected positive contributions from PCE, federal government spending, residential investment, exports, and state and local government spending that were partly offset by negative contributions from nonresidential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased. Consensus estimates are looking for GDP growth of 2.1%.

Friday’s focus will be on US Personal Income and Spending for December. In November Personal Income rose 0.5% m/m, following a 0.1% advance in October. Consumer Spending rose 0.4% m/m, following a 0.3% rise, as purchases of motor vehicles increased, as well as spending on healthcare. The Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) Price Index, is also included in the same report. November PCE rose 0.2% m/m, the same pace as in October. Services prices advanced 0.2%, while goods prices were flat, after rising 0.3% in the prior month. Prices slowed for non-durable goods along with fell for durable goods. Year-on-year, the PCE price index advanced 1.5%, above the 1.4% rise in October. Core PCE, which excludes prices of food and energy, increased 0.1% m/m, the same pace as in October. Core PCE is the Fed’s preferred measure of inflation and they target a 2% level. Year-on-year, Core PCE went up 1.6%, easing from a 1.7% increase.

The week closes with the MNI Chicago Business Barometer. In December the PMI rose to 48.9 from 46.3 in November. The index remained in contraction territory for the fourth straight month. Production, new orders, order backlogs, employment and inventories indexes continued in negative territory. Supplier delivery times was the only component among the main five remaining above the 50-mark, which denoted expansion. Prices at the factory gate jumped 9.2% to 58.4, hitting the highest level since August. Business sentiment dropped by 1.2 points to 46.2 in the fourth quarter, marking the lowest quarterly reading since 2Q09.

US Housing Data: Safe as houses

New Home Sales for December will be released on Monday. In November sales rose 1.3% m/m to a seasonally adjusted annual rate (SAAR) of 719K, recovering from a 2.7% drop in October and handily beating market expectations of a 0.3% fall. Analysts are crediting low mortgage rates supporting the housing market.

Wednesday will see Pending Home Sales for December. November sales climbed 7.4% year-on-year (y/y), the largest annual increase in pending home sales since June 2015. Contracts rose in all 4 regions, with the West up 14.0%, the South 7.7%, the Midwest 5.0% and the Northeast 2.6%. On a monthly basis, pending home sales rose 1.2%, rebounding from a 1.3% fall in October.

Federal Reserve: How easy is too easy?

Wednesday’s focus will be on the Federal Reserve’s first Interest Rate Meeting of the new year. At its meeting in December the FOMC left the target range for the federal funds rate unchanged at 1.5-1.75%, as was widely expected and following a 25bps cut at the October meeting. Policymakers consider the current stance of monetary policy appropriate to support sustained growth, strong labor market conditions, and inflation near the 2% target. They also kept their growth forecasts unchanged for this year at 2.2%; 2% for 2020; 1.9% for 2021 and 1.8% for 2022. Inflation is projected at 1.5% in 2019; 1.9% in 2020; 2% in 2021 and 2% in 2022, same as the September projection. Regarding the future path of the fed funds rate, most participants expect no changes in 2020, although a hike is still seen in 2021, while the market is currently pricing in one cut in the back half of 2020. At next week’s meeting the market is pricing in 86% odds that the Fed keeps rates at the current levels and 14% chance that they hike 25bps. Investors will be attuned to any discussion by Chair Powell of financial conditions or, more specifically, asset price inflation. Expressions of concern on either of these points are unlikely but would have a material impact on investor sentiment.

Bank of England: Coin flip

On Thursday the Bank of England (BoE) holds their own Policy Meeting. At their December meeting the BoE’s Monetary Policy Committee (MPC) voted by a majority of 7-2 to hold the Bank Rate at 0.75%, as policymakers took a wait-and-see approach following Prime Minister Boris Johnson’s election victory and its possible implications on Brexit. Two members voted for a second month in a row for a rate cut amid concerns about the job market. With the House of Lords dropping their opposition to Prime Minister Johnson’s bill this week and the Queen signing it into law, the UK is now set to formally leave the EU at the end of the month. However, the agreement needs to be formally ratified by the European Parliament on Jan. 29, following which Britain will enter a transition period, scheduled to last until the end of the year, during which it will continue to be bound by EU laws until it negotiates a new trade deal with the remaining 27 member states. On the back of these recent developments the market is pricing in 46% odds that the MPC votes to cut rates by 25bps next week and 54% odds they hold steady.

EU Economic Data: Winter thaw?

On Monday in Germany the focus will be on the Ifo Business Climate Index. December rose to 96.3 from 95.1 in November and easily beating market expectations of 95.5. This is the highest reading since June and was boosted by an improvement in companies’ assessment of the current situation, as well as their expectations of the future. Across sectors, sentiment improved among manufacturers and service providers, but deteriorated among traders and constructors.

Wednesday brings a glimpse into the state of the German Consumer with the GfK Consumer Sentiment Indicator. January edged down to 9.6, which is the lowest level since November 2016. Economic expectations dropped 6.1 points to -4.4, far below the long-term average of 0, as Germans were less optimistic about the growth outlook. Furthermore, income expectations fell 10.5 points to 35.0, the lowest since October 2013, amid fears of more job cuts in some industrial sectors, mainly in the car industry and its suppliers. However, the willingness to buy went up 2.2 points to 52.2.

Thursday will show how the European business sector is feeling about the economy with the Business Climate Indicator for the Euro area for January. December fell by 0.04 points to -0.25, the lowest level since August 2013, as managers’ assessments of past production and stocks of finished products declined sharply. Also, their assessments of overall order books and export order books deteriorated, while production expectations improved firmly.

Chinese Economic Data: Pre-outbreak reading

Also, on Thursday is the Official NBS Manufacturing PMI in China. In December the PMI was unchanged at 50.2. The latest reading pointed to the second straight month of expansion in factory activity, supported by government stimulus measures and optimism surrounding a trade war truce with the US. Output growth accelerated and new orders continued to rise, boosted by a rebound in exports. However, employment fell further. Future expectations softened slightly from November’s seven-month high. January’s readings are expected to settle slightly lower and manufacturing is forecast to barely avoid dipping back into contraction.